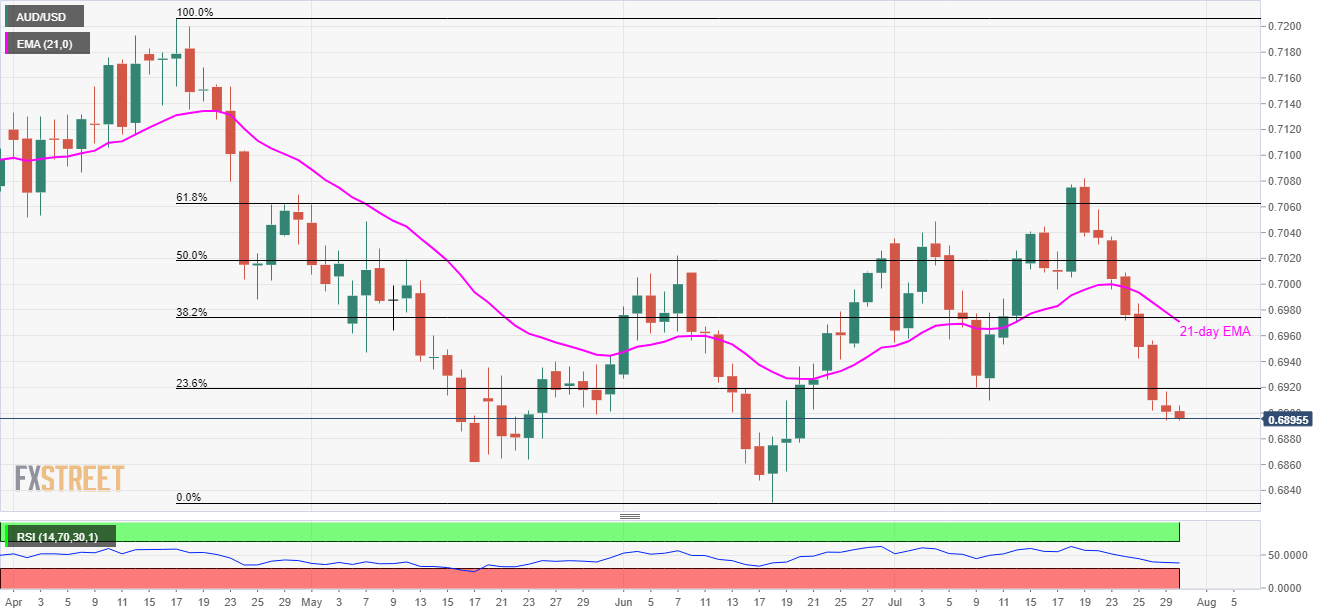

- AUD/USD remains below 23.6% Fibonacci retracement on sluggish Aussie housing data.

- Mid-June low and the yearly bottom flash on bears’ watch-list.

With the June month Aussie housing data declining below forecasts, the AUD/USD pair drops to the intra-day low of 0.6896 during early Tuesday.

Australian Building Permits slip beneath -1.0% and -24.3% respective forecasts for MoM and YoY by registering -1.2% and -25.6% figures.

As a result, June 17/18 highs around 0.6885/80 remains on sellers’ radar with the June month low of 0.6831 being the next target.

However, depleting conditions of 14-day relative strength index (RSI) might disturb further declines. If not, then January bottom surrounding 0.6684 will become bears’ favorite.

Alternatively, an upside clearance of 23.6% Fibonacci retracement of April – June downpour, at 0.6920, can trigger the pair’s fresh recovery towards July 25 low near 0.6942 and then to 21-day exponential moving average (EMA) level near 0.6970.

AUD/USD daily chart

Trend: Bearish