- AUD/USD drops to 2-week low after mixed NAB data.

- Oversold RSI and 4H 200MA can question further downside.

Having witnessed mixed numbers from the National Australia Bank’s (NAB) Business Confidence and Business Conditions data, AUD/USD slumped to a fortnight low while taking the rounds to 0.6960 during early Tuesday.

Australia’s Business Confidence lagged behind 7 prior to 2 whereas Business Conditions grew to 3 from 1 as per NAB survey data for June.

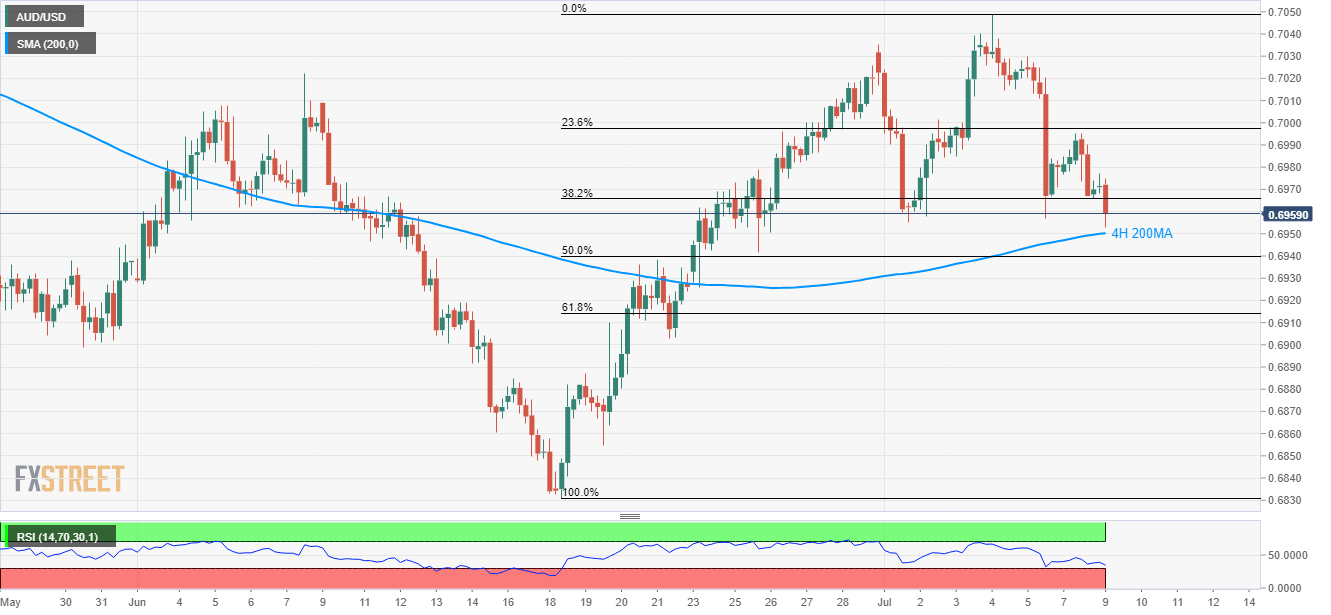

A 200-bar moving average (4H 200MA) at 0.6950 acts as immediate support for the pair amid oversold levels of 14-bar relative strength index (RSI).

Should bears refrain from respecting 0.6950 rest-point, 50% and 61.8% Fibonacci retracements of late-June to early-July increase, at 0.6940 and 0.6914 respectively, can flash on their radar ahead of highlighting June 21 low around 0.6900.

On the upside, 0.6980 and 23.6% Fibonacci retracement level close to 0.7000 can question the pair’s pullback whereas current month high around 0.7050 could please buyers afterward.

AUD/USD 4-hour chart

Trend: Pullback expected