- AUD/USD is resing up at a key Fibonacci support level and prior daily lows.

- AUD/USD is pressured below falling moving averages.

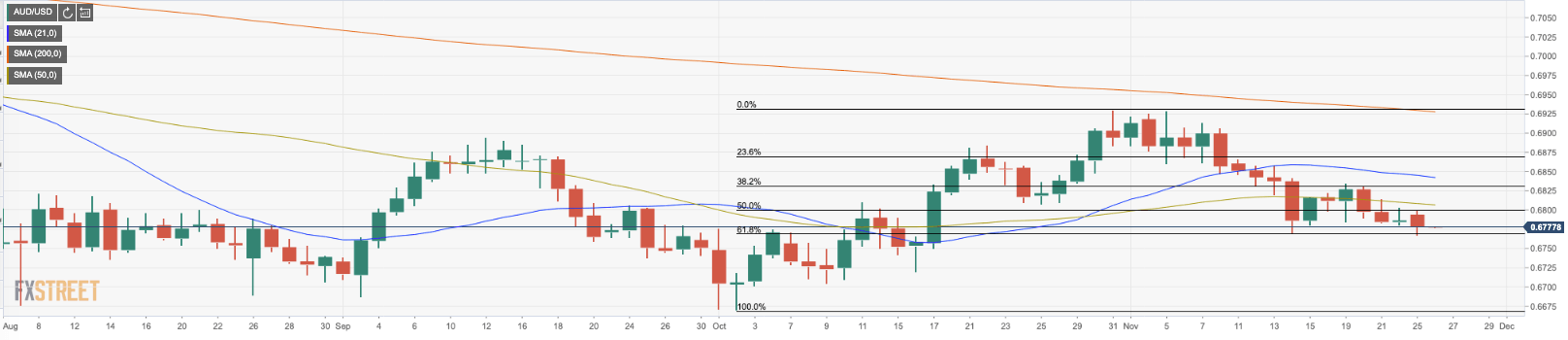

AUD/USD is trading around the 61.8%% Fibonacci retracement of the Oct swing lows to Nov swing highs around 0.6770. The pair has been falling from the vicinity of the 200-Day moving average and fell through the 21-DMA mid-month to open the flood gates for a low of 0.6769.

Falling RSI on a daily and short term basis are laving a bearish picture for the pair and bears eye a break to the 78.65 Fibo of the aforementioned range that meets the 16th October lows. This area guards the double bottom target of the Oct lows at 0.6670.

On the flip-side, bulls need to get back above the 21-DMA and then the 23.6% Fibonacci level that meets the 15th and 16th double tp highs as a resistance around 0.6875.

AUD/USD daily chart