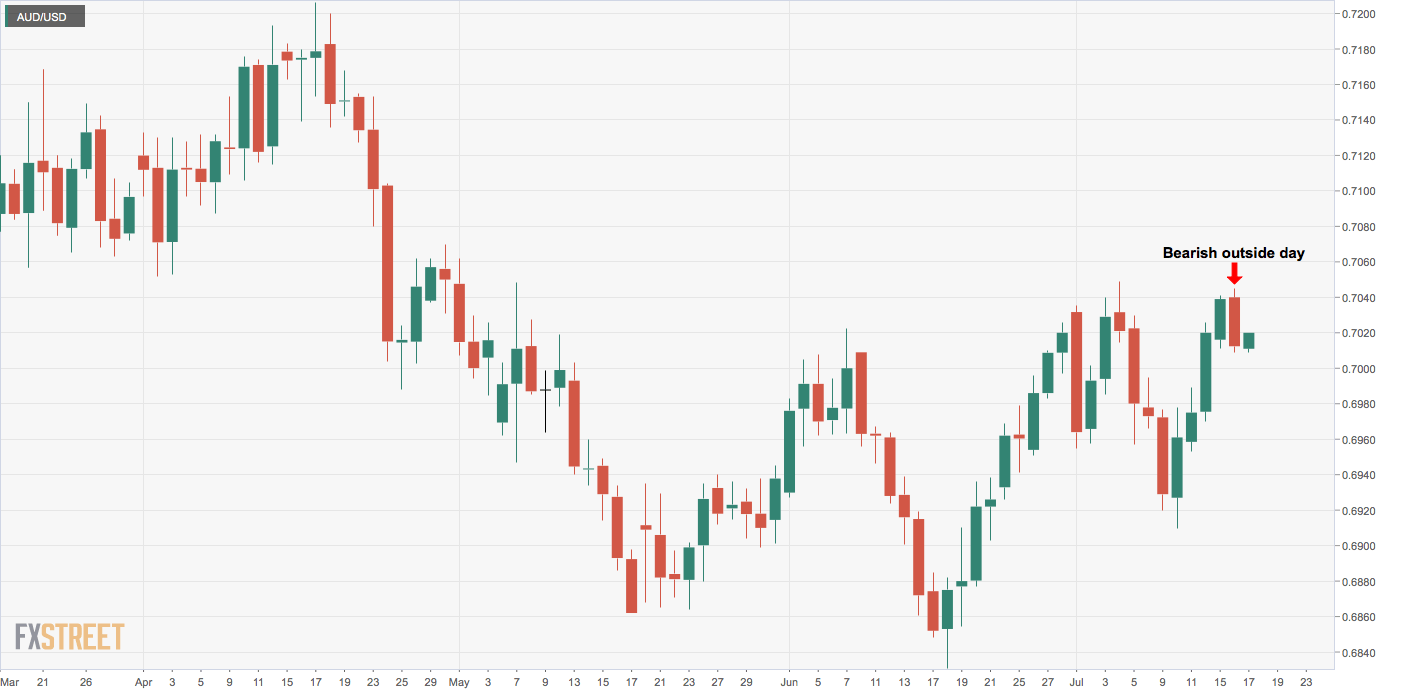

- AUD/USD created bearish outside day on Tuesday.

- A close below 0.7010 needed to validate Monday’s bearish outside day.

AUD/USD snapped a four-day winning streak on Tuesday with a bearish outside day candle.

A bearish outside day is created when the day begins with optimism but ended on a pessimistic note, engulfing the preceding day’s high and low.

It is widely considered an early sign of bearish reversal and its success rate is high when it appears following after a notable rally.

In AUD’s case, the candlestick patter has appeared following a four-day rally from 0.6910 to 0.7040.

A trend change, however, would be confirmed only if the spot closes today below the outside day’s low of 0.7010. That would open the doors for retest of 0.6910.

On the other hand, a close above 0.7045 (outside day’s high) would signal a continuation of the rally from the recent low of 0.6910 and allow a test of the 200-day moving average, currently at 0.7091.

As of writing, the pair is trading at 0.7018.

Daily chart

Trend: Bearish below 0.7010

Pivot points