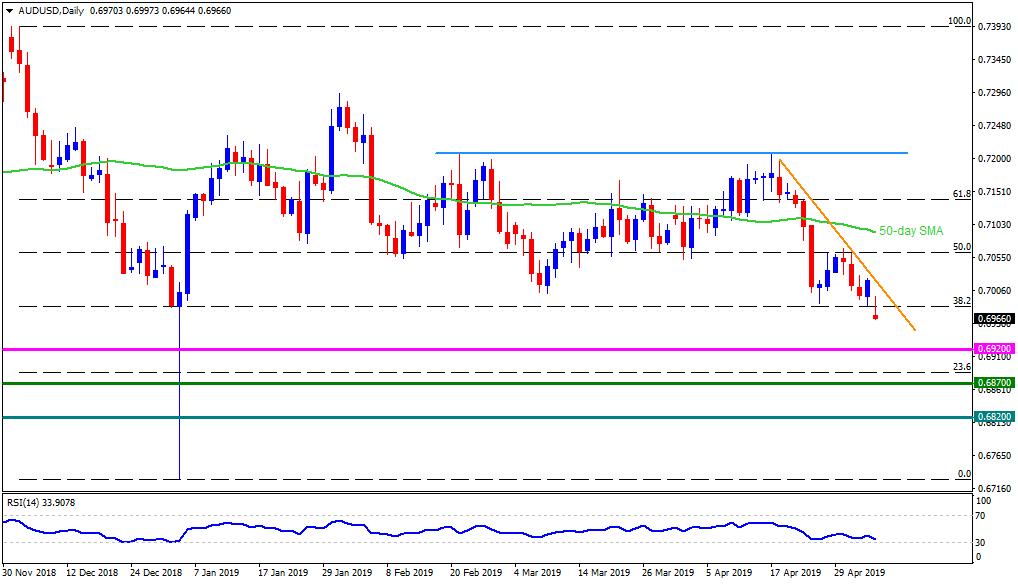

- A break of 0.6980 triggers fresh selling towards early 2016 levels.

- The pullback moves might be challenged by immediate trend-line resistance.

The dimmed prospects of the US-China trade deal drags the AUD/USD pair to the intra-day low of 0.6965 during the early Asian session on Monday.

The pair trades below 0.6980 confluence comprising 38.2% Fibonacci retracement of December – January plunge and the low of the candle just ahead of the mentioned drop.

With the fundamentals and technicals both supporting the downturn, chances of the quote’s slip to late-January 2016 lows near 0.6970 and 0.6920 can’t be denied.

However, the year 2016 bottom near 0.6820, followed by the January month’s flash crash low of 0.6730, can appear on the bears’ radar afterward.

In a case prices take a U-turn, a break of 0.6980 can recall 0.7000 on the chart whereas three-week-old descending trend-line at 0.7030 might question the pullback then after.

Should there be additional upside past-0.7030, 0.7055 and April 30 high around 0.7070 might please buyers.

AUD/USD daily chart

Trend: Bearish