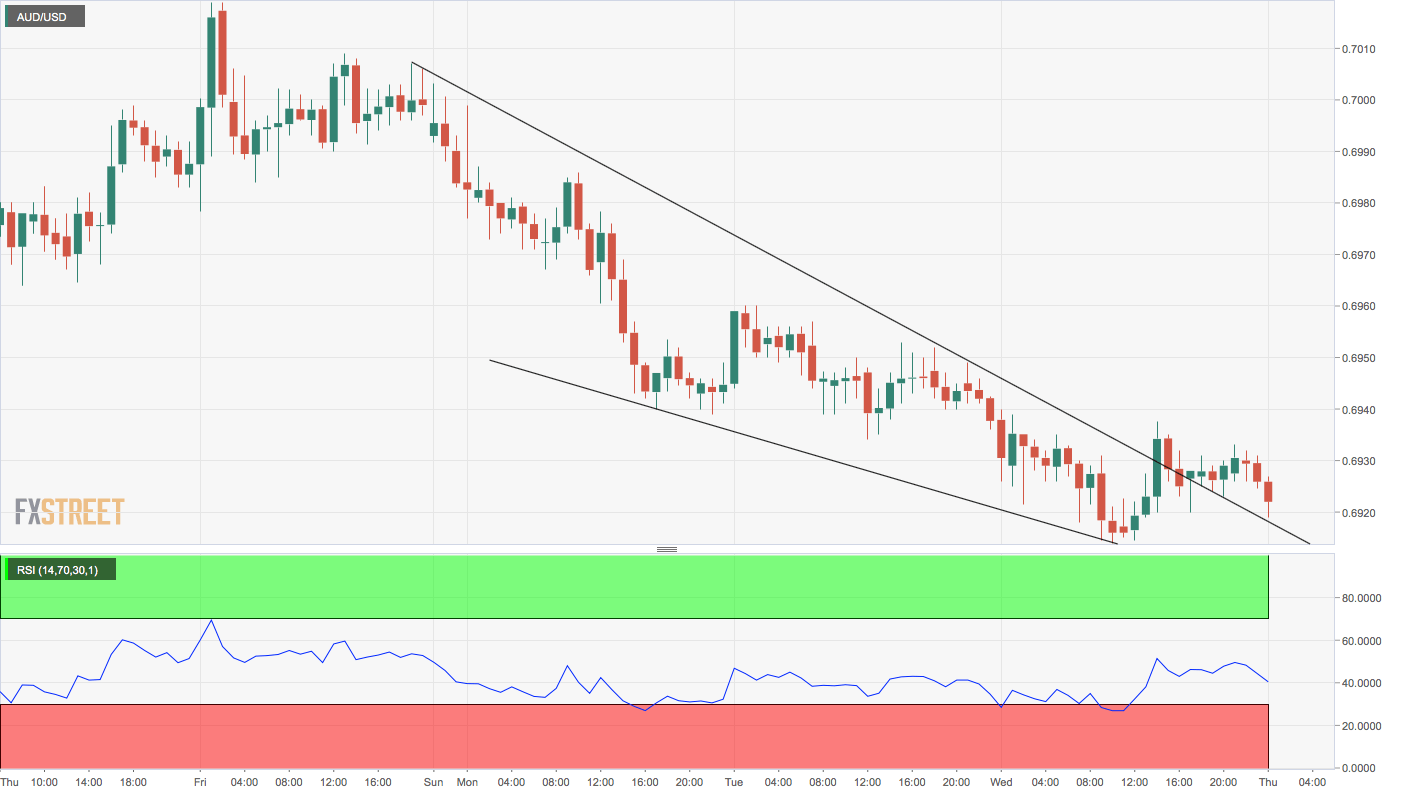

- AUD/USD’s failure to capitalize on the falling wedge breakout is a cause for concern for the bulls.

- A break below 0.69 looks likely.

- An above-forecast Aussie labor data may lift the pair into bullish territory above 0.6937.

AUD/USD is on the defensive ahead of the Aussie jobs data, having failed to capitalize on the falling wedge breakout in the US trading hours.

The currency pair is currently trading in the red at 0.6920, representing 0.11% drop on the day, having found offers at 0.6933 earlier today.

The failed breakout despite the optimistic trade headlines and weak US retail sales data, coupled with the bearish hourly chart RSI indicates the path of least resistance is to the downside.

The pair risks hitting fresh 4.5-month low below 0.69. The intraday outlook, however, would turn bullish if the Aussie data, due at 01:30 GMT, shows a surge in full time employment in April.

The seasonally adjusted employment change is forecasted to print at 14.0K, having registered a growth of 25.7K in March. The jobless rate is seen ticking higher to 5.1% from 5%.

Hourly chart

Trend: Bullish above 0.6937

Pivot points