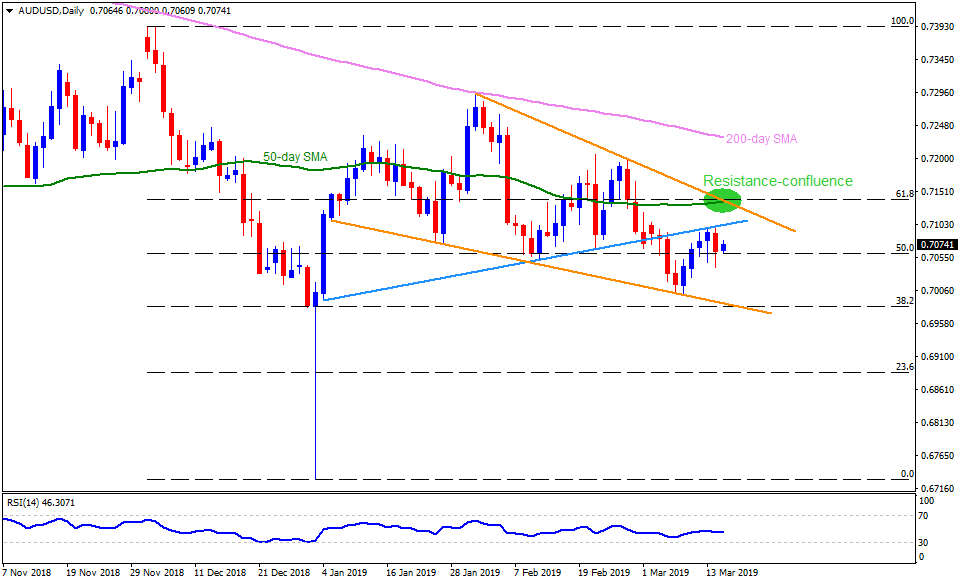

AUD/USD daily chart

- The Australian Dollar (AUD) is presently a little stronger against the US Dollar (USD) around 0.7070 on early Friday.

- Considering descending trend-lines joining highs since late-January and important lows since January 07, a short-term “Falling Wedge” bullish chart pattern is underway on the AUD/USD pair’s daily chart.

- An upward sloping trend-line connecting low of January 04 to February month lows offer immediate resistance at 0.7110.

- However, pair’s upside past-0.7110 has to cross 0.7140 resistance confluence comprising 50-day simple moving average (SMA), 61.8% Fibonacci retracement of December – January decline and falling wedge resistance.

- In case prices rally beyond 0.7140 on a daily closing basis, they validate bullish pattern favoring a rise to 0.7200 and 200-day SMA level of 0.7230.

- Meanwhile, 0.7050, 0.7015 and 0.7000 can act as consecutive nearby supports ahead of highlighting the formation support and 38.2% Fibonacci retracement near 0.6980.

- Should the quote slips under 0.6980, chances of its drop to 0.6950, 0.6910 and 0.6870 can’t be denied.

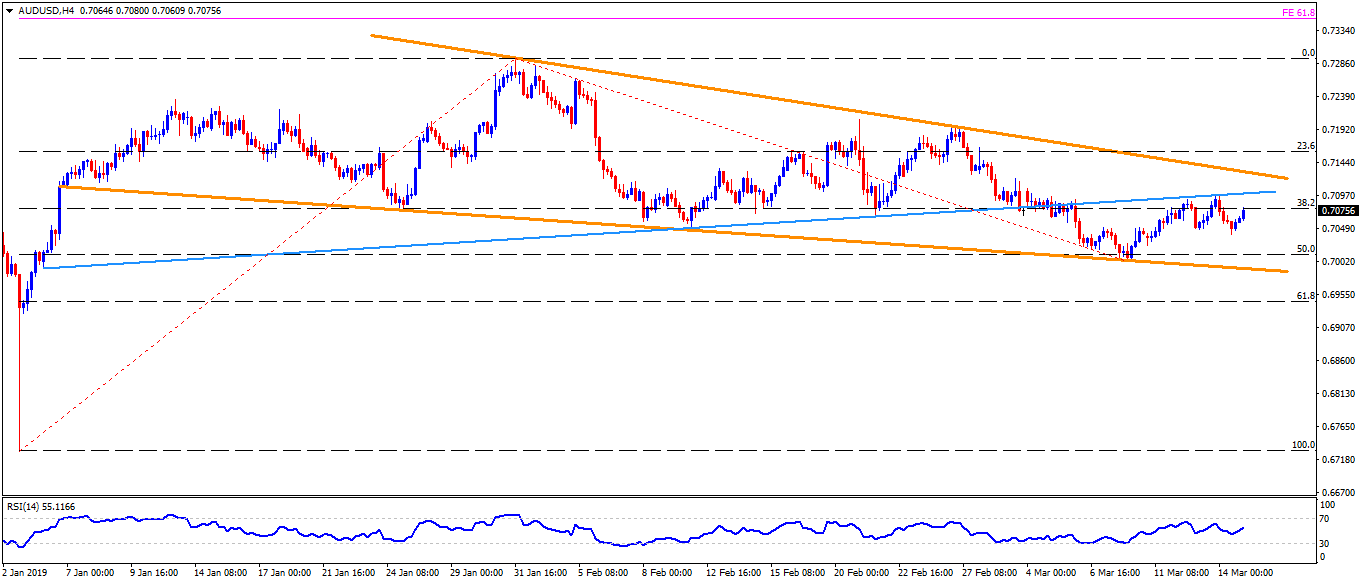

AUD/USD 4-Hour Chart

- January month high near 0.7300 and 61.8% Fibonacci expansion (FE) of January to March moves, at 0.7355, can further please bulls after 0.7230.

- Also, 0.6930 could provide an intermediate stop between 0.6950 and 0.6910.

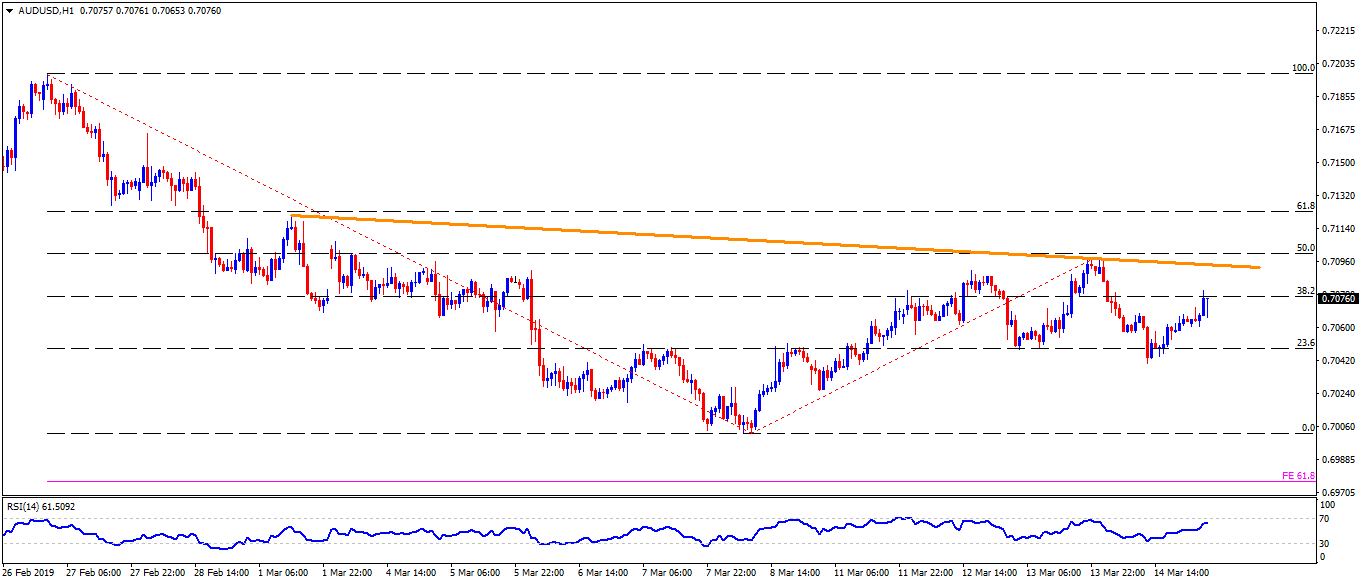

AUD/USD hourly chart

- 61.8% Fibonacci Retracement of February 27 to March 08 decline at 0.7125 could challenge buyers past-0.7110.

- 0.7040 is likely a small stop past-0.7050 but ahead of 0.7015.