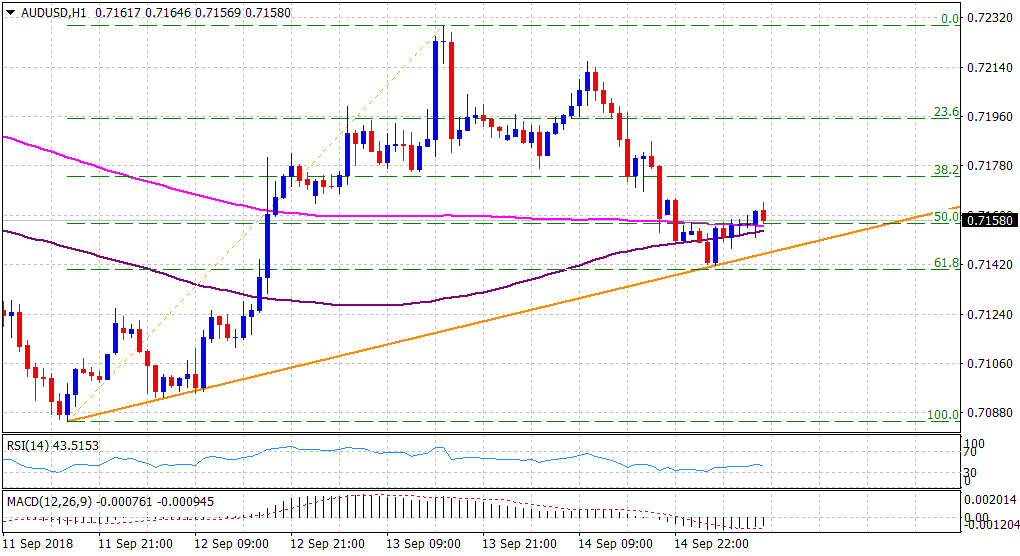

“¢ The pair stalled last week’s retracement slide from over one-week tops and caught some fresh bids near a short-term ascending trend-line support at the start of a new trading week.

“¢ The mentioned support coincides with 61.8% Fibonacci retracement level of the 0.7085-0.7215 last week’s up-move, with traders shrugging off reports that US-China trade tensions may escalate.

“¢ The pair has now recovered to trade back above a confluence region – comprising of the 100/200-hour moving averages and 50% Fibo. level, supporting prospects for additional intraday gains.

“¢ However, the pair’s inability to hold/sustain any move beyond the 0.7200 handle clearly indicates that the near-term selling bias might still be far from over.

Spot Rate: 0.7158

Daily Low: 0.7142

Trend: Intraday bullish

Resistance

R1: 0.7174 (38.2% Fibo. level)

R2: 0.7200 (round figure mark)

R3: 0.7241 (R2 daily pivot-point)

Support

S1: 0.7142 (current day swing low)

S2: 0.7129 (S1 daily pivot-point)

S3: 0.7100 (round figure mark)