- AUD/USD slips from five-week high amid mixed comments from the US and China.

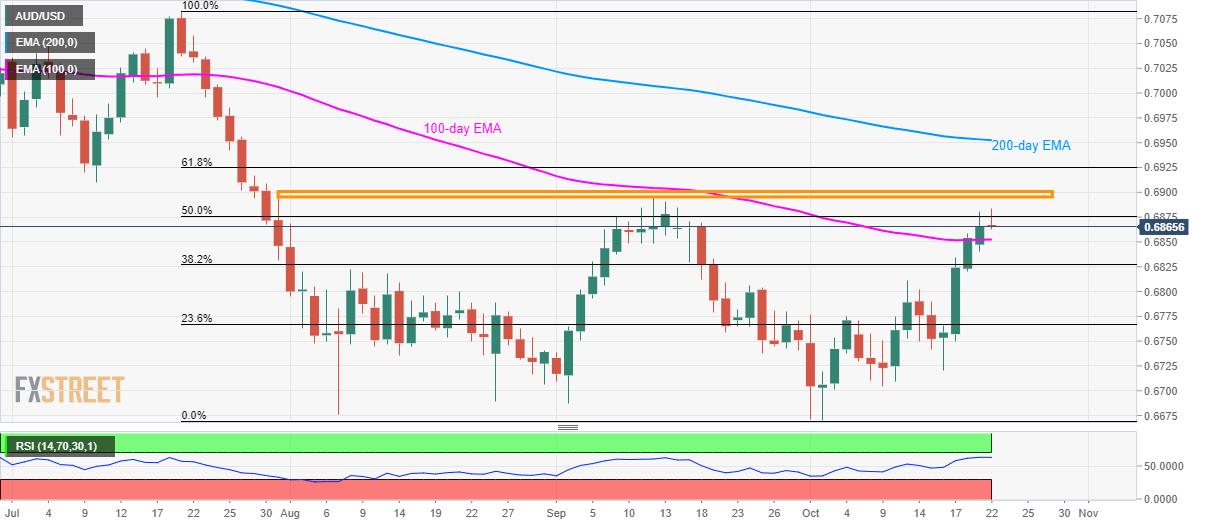

- 100-day EMA acts as immediate key support.

- 0.6895/6900 and 61.8% Fibonacci retracement holds the gate for further upside to 200-day EMA.

With the Aussie buyers struggling to hold upside momentum around a monthly high, AUD/USD takes rounds to 0.6865 amid early Monday.

Despite recent pullbacks, overall sentiment remains bullish and hence even short-term sellers await entry only if the pair drops below 100-day Exponential Moving Average (EMA) level of 0.6853.

In doing so, bears could target 38.2% Fibonacci retracement of July-October downside, at 0.6827, whereas 0.6800 will become preferable for short positions then after.

Meanwhile, an area including highs marked since July-end around 0.6895/6900 and 61.8% Fibonacci retracement level of 0.6925 seems nearby crucial resistances to watch during the pair’s further upside.

Should bulls manage to conquer 0.6925, a 200-day EMA level of 0.6953 and July 17 low close to 0.7000 will be in the spotlight.

AUD/USD daily chart

Trend: pullback expected