- The RBA positively surprised investors. However, it could not avoid the decline at the end of the week.

- The NFP and the Fed’s comments strengthened the Dollar.

- For the following week, investors must pay attention to US CPI and PPI.

The AUD/USD weekly forecast pair maintains its price level despite the midweek uptrend. The pair’s attempts to stay above the 0.7400 level were collapsed by the results of the US labor indicators and by the statements of Fed Vice Chairman Richard Clarida, announcing the possibility of a change in monetary policy.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The Reserve Bank of Australia positively surprised investors by leaving the cash rate at 0.1% and the 3-year bond yield target at the same level.

It was expected a more moderate stance due to the difficult economic situation that Australia is going through.

The US nonfarm payroll report was instrumental in the turnaround at the end of the week. The creation of 943,000 new job positions in July exceeded estimates for the month of 870,000. For its part, the unemployment rate fell to 5.4%, exceeding market expectations. The underemployment rate was also reduced to 9.2%, and the participation rate increased to 61.7%.

COVID fears in Australia

The blockades in the country due to the increase in infections of the Delta variant of Covid-19 have put economic recovery at risk.

However, the Australian authorities acted with optimism, providing peace of mind to the market. Still, the performance of the US economy in July strengthened the US Dollar in a way that the ailing Aussie could not resist.

Upcoming Events

In the United States, the publication of indexes related to inflation is expected. These indexes generate great expectations among all those involved in the market since they will try to confirm whether US inflation has already exceeded its worst moments or if it will continue for some time to come.

In this sense, the consumer price index and the core consumer price index will be released on Wednesday. For the CPI, the forecast is an increase of 0.5%, and for the Core CPI, the expected increase is 0.4%.

Finally, on Thursday, the producer price index will be released. It’s expected that during July, the increase of this index will be 0.6%. The confirmation of the expectations would give very positive signals to the American economy, and with this, there is a downward trend for the AUD/USD pair.

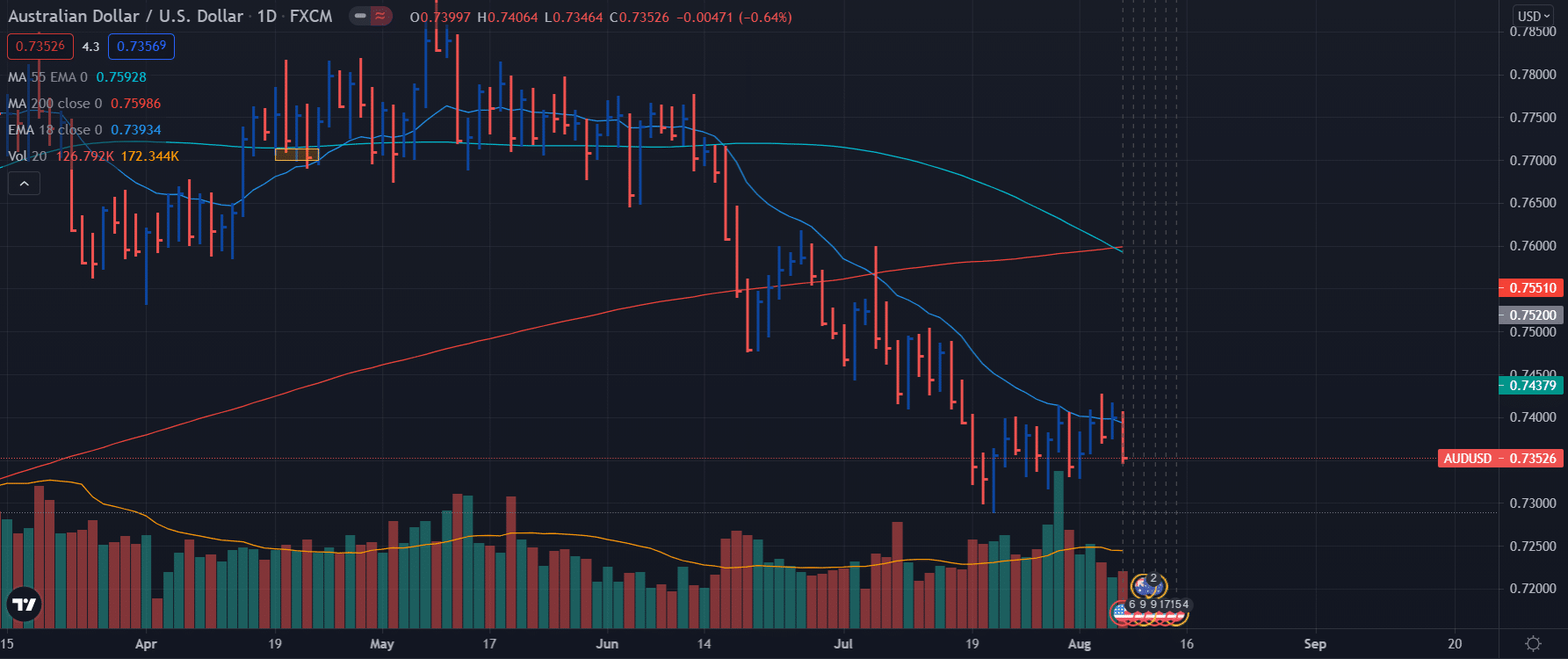

AUD/USD technical analysis: Key MAs pointing downside

The daily chart indicates a slight downtrend corresponding to a price just below the 20-day SMA, while the 50-day and 100-day SMAs also continue to point lower. The death cross of 200 and 50 SMAs indicates that losses can extend deeply.

–Are you interested to learn more about forex signals? Check our detailed guide-

There are solid support lines at 0.7290 and 0.7220. If both support lines are dominated, the price slip could extend to 0.7100.

AUD/USD next week forecast

As long as the pair remains below the 0.7450 level, the bears will remain in control, and in the short term, the pair is expected to extend its decline. The expected average price is around 0.7300. However, should the price break above the 0.7450 level, the rally could extend to 0.7500.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.