- The Reserve Bank of Australia shifted its monetary policy toward hawkishness in a surprise move.

- Australian employment data for March will be the focus next week.

- The AUD/USD must remain above 0.7400 to maintain bullish potential.

The AUD/USD weekly forecast has turned negative despite the hawkish shift in the RBA’s stance. Fed’s aggression keeps the Aussie’s gains limited.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

A new multi-month high of 0.7660 was retreated from, and the AUD/USD pair ended the week with slight losses in the 0.7440 price range. A hawkish Reserve Bank of Australia message surprised the markets and sent the Aussie soaring. The Central Bank maintained the interest rate at 0.1% on a monetary policy decision. Governor Philip Lowe, however, said commodity prices would likely rise as a result of the crisis between Russia and Ukraine.

RBA’s hawkish shift

Lowe cited three main sources of uncertainty: the pace of supply-side resolution, how global energy markets change, and the evolution of overall labor costs. The central bank removed several key proposals from its statement, signaling that it may raise rates at its upcoming meetings. Policymakers have abandoned their patient approach. Moreover, they said that the next decision would be based on inflation rates and labor costs. Speculative interest is looking at a rate hike in June due to the Australian federal election in May.

Overall, Australian economic indicators continue to suggest growth while price pressures continue to rise. For example, the TD Securities March inflation rate increased to 4.0% y/y from 3.5%. It is also worth noting that Australia’s February trade balance was a positive $7.45 billion, far worse than expected.

Fed’s minutes and soaring yields

On the other side of the world, the US Federal Reserve released its latest meeting minutes. In the document, US policymakers “generally agreed” to a balance sheet reduction of $95 billion per month, detailing a maximum of $60 billion in Treasury securities and $35 billion in mortgage-backed securities. Market participants were reminded of the central bank’s aggressiveness as the bank is expected to raise rates by 50 basis points in more than one meeting this year.

AUD/USD weekly data/events ahead

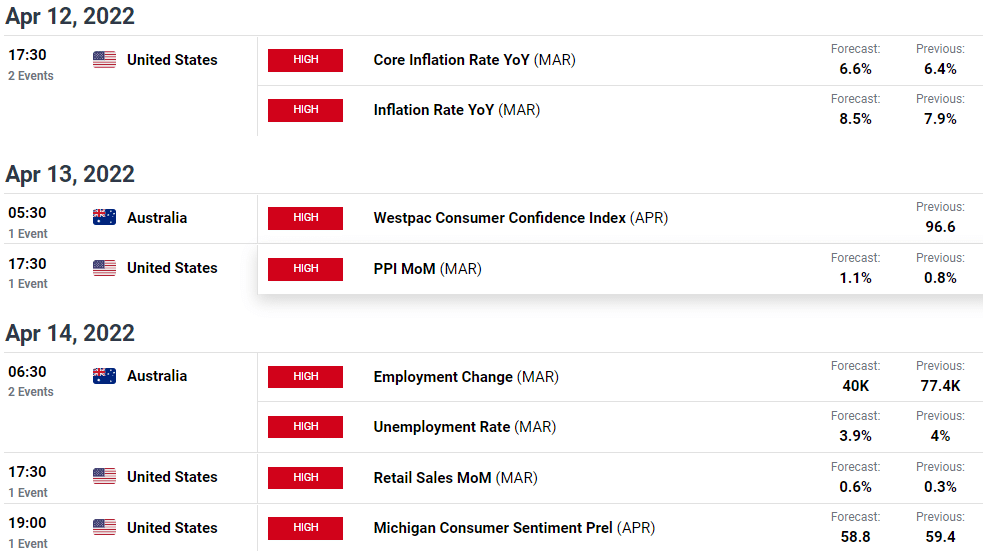

We’ll have a busy week in terms of data. The Westpac Consumer Confidence report and the March NAB Business Confidence report will be published in April. On Thursday, the country will release employment data for March, which is expected to show 40,000 new jobs. Additionally, China will publish its March inflation and February trade balance figures.

On the other hand, the US will release its March CPI, which is expected to be 8.3% y/y. As a result, the base rate will be 6.6%, up from 6.4% previously. In addition, a preliminary estimate for Michigan’s consumer sentiment index for April will also be released.

AUD/USD weekly technical forecast: 20-SMA remains the pivot

The AUD/USD price sharply fell from the multi-month top and continued to fall until it found support near 20-day SMA. If the price closes below the 20-day SMA, the next target will be 0.7400, which may lend some support. Turning below the 0.7400 handle will be considered a strong bearish trend with the least probability of upside potential.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

On the upside, 0.7500 will be the key resistance to watch. Any sustained move above the level may gather traction for further gain to 0.7550.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money