- AUD/USD ended the week in gains despite the last two days closed in negative.

- Bullish gold prices and Wall Street helped the Aussie to gain further.

- US 10-year bond yields dropped, providing no room for the Greenback.

The AUD/USD weekly forecast is neutral to bearish as the last two trading days were negative for the pair despite a bull run and overall weekly close in gains.

-If you are interested in high leveraged brokers, check our detailed guide-

The AUD/USD exchange rate rose for a third straight week, traded near a new three-month high of 0.7545. Although speculative interest ignored the dollar’s usually positive hints, the Australian dollar mimicked Wall Street momentum. The price of gold rose above USD 1,800 a troy ounce on Friday, reaching its highest level in a month, as the rising price of gold supported the market.

Following Friday’s drop in 10-year US Treasury yields, the dollar barely had a chance against commodity rivals. The pair started the week slowly as dismal Chinese data eroded demand for high yield assets in favor of the dollar. The world’s second-largest economy reported a 4.4% increase in retail sales in September, beating expectations, even though industrial production rose a modest 4.9% at the same time. Further, the third quarter saw economic growth of 0.2% after a 1.3% increase in the second quarter.

The Reserve Bank of Australia issued the minutes of its last meeting, but nothing was found. In the document, policymakers voice confidence in the economic recovery but reiterate that a rate hike won’t happen until 2024. The document is largely a copy of the September statement.

Key data/events for the AUD/USD next week

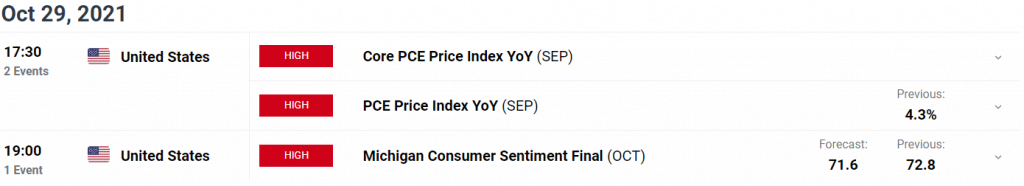

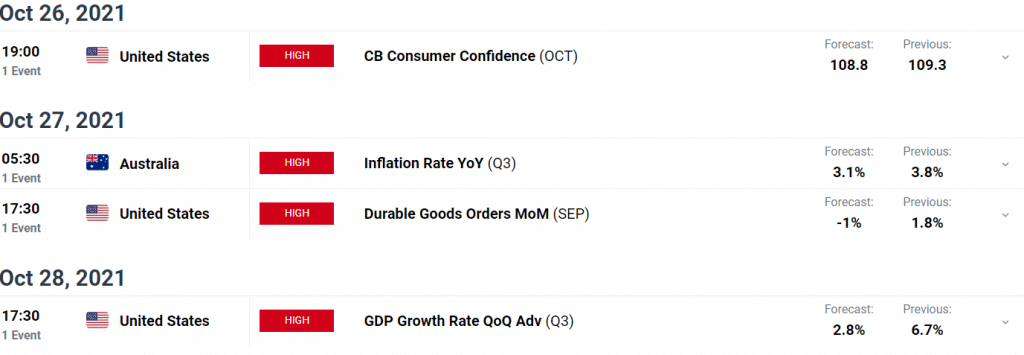

Several top-tier events are scheduled for the coming week. US GDP is due to be released Thursday, which is expected to be 3.2% q/q, roughly half last year’s 6.7%. The country will also release CB Consumer Confidence and Durable Goods Orders ahead of the event.

Australia will focus on the CPI forecast for the third quarter, September retail sales forecast for 0.2%, and third quarter PPI forecast for 3.2%.

-If you are interested in MT5 brokers, check our detailed guide-

AUD/USD weekly technical forecast: Bears emerging with huge strength

The AUD/USD price found a hard rejection near 200-day SMA around the mid-0.7500 area. The two consecutive bars closed near the lows, completing a top reversal pattern. We may see a minor upside move in the next week ahead of resuming a downside trend. The downside targets coincide at 0.7400 (100-day SMA) followed by 0.7350 (20-day SMA). The volume is clearly showing a bullish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.