- The AUD/USD pair should continue to decline in the coming weeks due to central bank imbalances.

- Stocks fell due to the Fed’s hawkish activity and strong US growth.

- There is a chance that the AUD/USD pair will continue to fall towards 0.6770.

The AUD/USD weekly forecast is strongly bearish as the pair has finally broken the 0.7000 psychological level after the hawkish Fed exacerbated USD strength. A drop to 0.6966, its lowest level since July 2020, underscored the pair’s weakness. Furthermore, the pair fell due to renewed demand for the US dollar following the US Federal Reserve’s monetary policy announcement, much more aggressive than expected.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

US policymakers moved back in November after warming inflation, but every meeting has become increasingly hawkish since then. Jerome Powell announced the rate hike early this time, leaving the door open for increases at every upcoming meeting. In 2022, the market expects at least four raises and consequent balance sheet reductions.

A significant economic recovery and a definite improvement in labor market conditions were considered when making the decision. In addition, Powell expressed concern about inflation continuing to rise, but he expressed determination to fight it.

The decision strengthened the dollar and sent stocks into a tailspin, creating an ideal environment for the AUDUSD to depreciate. Wall Street will end in the red for the fourth week in a row as investors fear a sharp rise in borrowing costs.

As gold’s price tumbled, it took a toll on the pair. Gold hit $1,853.83 an ounce midweek and is currently trading at $1,780, its lowest level since mid-December.

A preliminary estimate of US GDP showed the country grew at a pace of 6.9% on an annualized basis in the last quarter of 2021, which provided additional support to the greenback. Despite ongoing inflationary pressures, December’s Personal Consumption Expenditure Index increased by 5.8% year over year, a bit below expectations of 6.1%. The core jumped 4.9% above forecasts of 4.8%. December durable goods orders fell by 0.9%, while the January Markit PMI declined business activity.

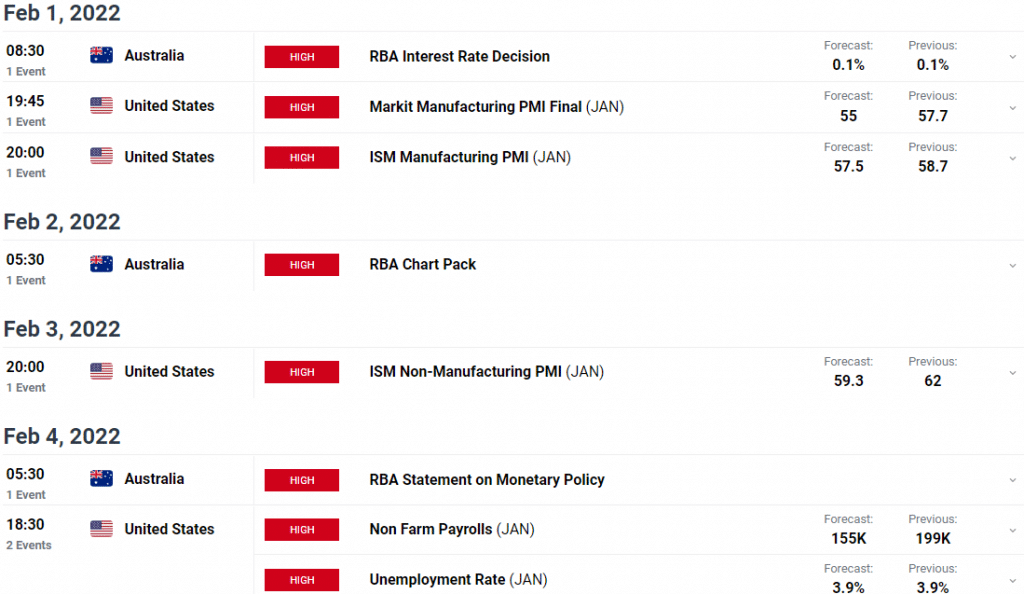

Key data/events for AUD/USD next week

Several economic reports will be released this week, including China’s official PMI data for January and US nonfarm payrolls.

There will be several announcements later this week in Australia, including AIG’s manufacturing productivity index for January, retail sales for December, NAB business confidence for 4Q and retail sales for December. In addition, a monetary policy meeting is due to take place next Tuesday at the Reserve Bank of Australia. Still, it is expected that the central bank will suspend its current policy.

The official January ISM Purchasing Managers Index and the December Jobs Report are in the US macroeconomic calendar, which is expected to show 238,000 new US jobs this month. Unemployment is expected to stay at 3.9%.

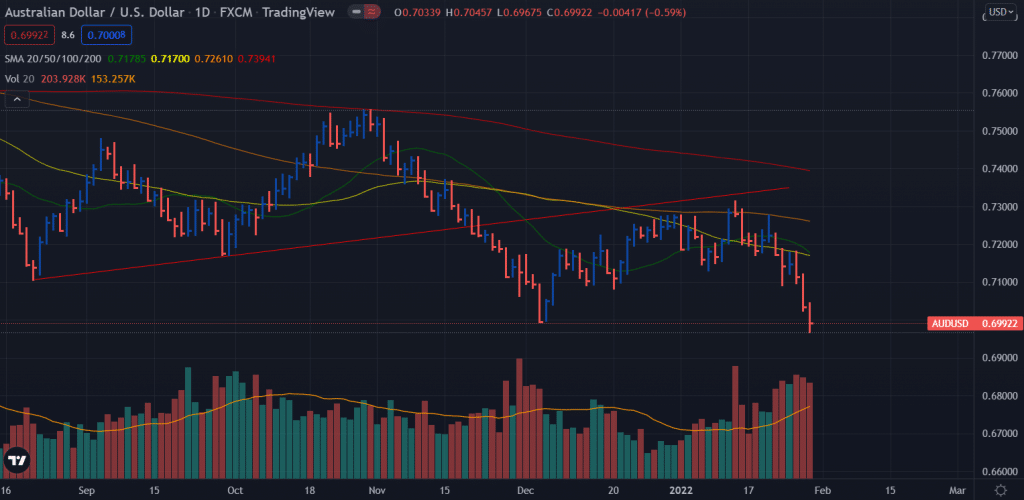

AUD/USD weekly technical forecast: Bears dominating below 0.7000

The AUD/USD weekly forecast is bearish as the price broke below the major support of 0.7000. On the daily chart, the price stays well below the key SMAs. However, the volume is slowly declining. It indicates that the price may correct higher ahead of any further bearish continuation. We can expect a pullback towards 0.7060-80 area.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

On the downside, the AUD/USD price may test the 0.6900 ahead of 0.6820. The path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.