- The Australian employment and inflation data were better than expected in December.

- The focus is now shifting to the upcoming US rate hike by the US Federal Reserve.

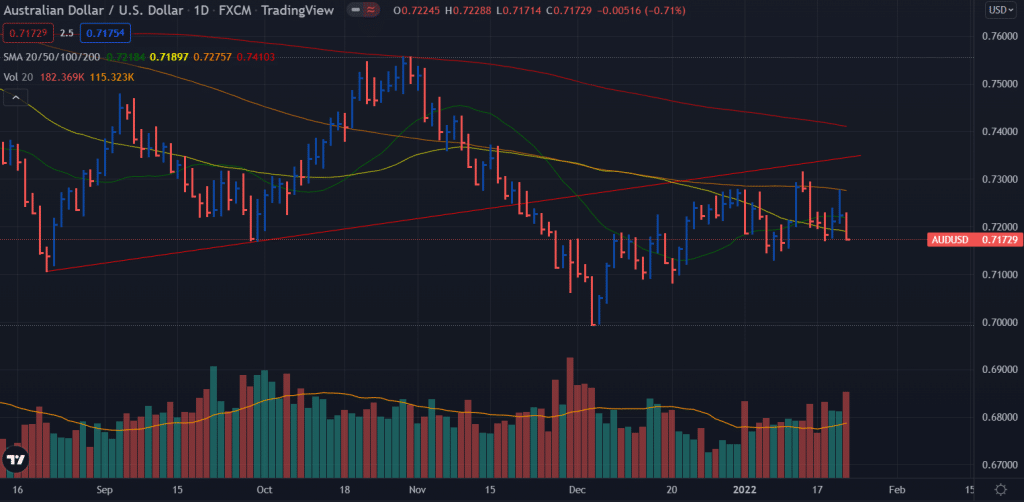

- Technically, the AUD/USD pair may soon resume its long-term decline.

The AUD/USD weekly forecast is bearish as the pair closed below 0.7200 remained almost unchanged for this week. However, the pair reached a high of 0.7276 on Thursday, as encouraging data from Australia did not overshadow a renewed surge in dollar demand.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

As market participants became increasingly concerned about a stagflationary scenario or higher inflation, risk sentiment was negative during the week. A significant loss on Wall Street brought down global indices. At the end of the week, gold prices traded at $1,840 an ounce, near a two-month high.

The yields on government bonds have soared, which is unusual in a risk-averse environment but quite expected since 2021 when stagflation is spreading worldwide. Due to the spread of Omicron, the economic recovery has slowed, and employment figures have become disappointing. Most developed countries experienced their highest inflation levels in several decades as price pressures remained unchanged.

The data released in Australia this week obscure the fact that the country is also headed for stagflation simply because the car has taken longer to launch. During most of 2021, Australia was shut down and did not reopen until the end of the year. Thus, it experiences a job creation boom in November, followed by an optimistic December report later this week. Over the past month, the country added 648,000 jobs, exceeding market expectations. While the unemployment rate fell to 4.2%, well below the expected 4.5%, economic activity remained stable at 66.1%.

Additionally, the good news is that consumer inflation expectations fell from 4.8% in January to 4.4%. However, whether the country will be able to maintain reasonable rates of job creation and inflation remains to be seen.

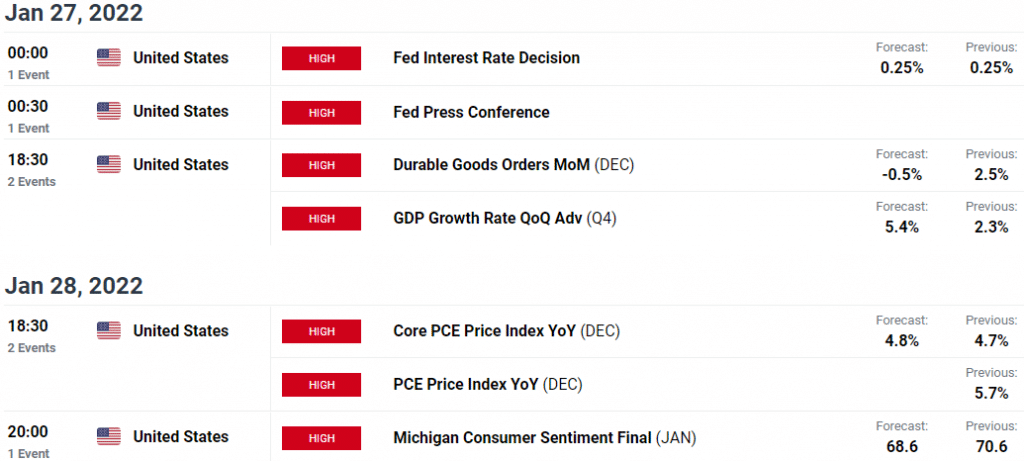

Key data/events for the AUD/USD

This week promises to be a busy one for macro releases, contrary to what has been observed in the past few days. It will be Monday when preliminary PMI estimates for both countries will be published. On Tuesday, Australia will release NAB business confidence for December and CPI for the fourth quarter. The country will release its Westpac Index of Leading Companies for December and its Producer Price Index for the fourth quarter later this week.

On January 26th, the US Federal Reserve will announce its monetary policy decision. At this time, no action is expected, but market participants are looking for more indications of an upcoming rate hike. Investors expect at least three rate hikes in the coming year, beginning with the first one in March 2022. Moreover, the country is expected to release its first estimate of the fourth-quarter gross domestic product, which is expected to be 5.8% q/q, and orders for durable goods in December. The US will release its most popular measure of inflation later this week, the core personal spending price index.

AUD/USD weekly technical forecast: Bears dominating for a breakout of 0.7100

The AUD/USD price attempted another rise last week, finding rejection quite ahead of the broken ascending trendline. The pair bounced back from the 100-day SMA and closed the week below 20-day and 50-day SMAs. It indicates a strongly bearish scenario that may lead the price towards horizontal levels at 0.7100 and 0.6990.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

The daily chart shows an upthrust daily bar on Thursday followed by a hidden upthrust with a very high volume. This is extremely negative for the Aussie, but it also indicates a potential pullback before falling further.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.