- Aussie ended the week higher as the dollar weakened after the Fed minutes.

- Fed officials agreed to slow rate increases as the economy adapts to higher rates.

- Investors will keep an eye on the US jobs report next week.

The AUD/USD weekly forecast is bullish as dollar weakness is set to continue amid optimism for a Fed pivot while eying key US data next week.

Ups and downs of AUD/USD

AUD/USD had a bullish week, with the main catalyst being the FOMC meeting minutes. At the Federal Reserve’s meeting earlier this month, a “substantial majority” of decision-makers agreed that it would “likely soon be appropriate” to halt the rate of interest rate increases.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Officials were mainly confident they could raise rates in smaller, more deliberate steps as the economy adapted to more expensive credit, according to the minutes of the Nov. 1-2 Fed meeting.

“A slower pace … would better allow the (Federal Open Market) Committee to assess progress toward its goals of maximum employment and price stability,” said the minutes released on Wednesday.

Next week’s key events for AUD/USD

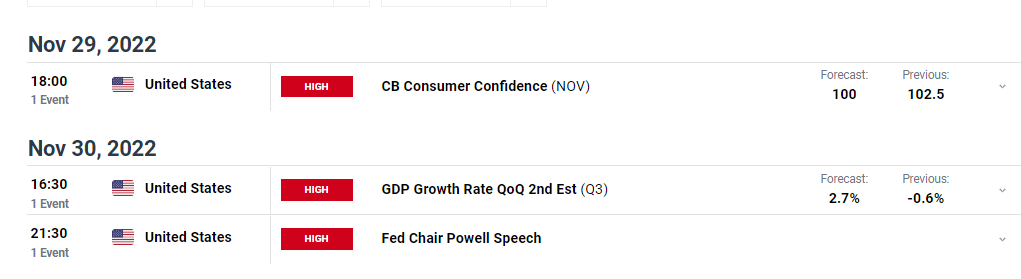

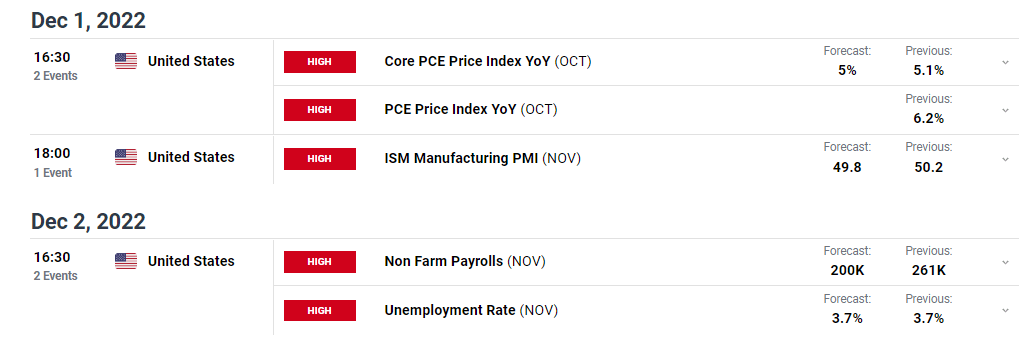

Next week investors will receive important data from the United States, including GDP, consumer confidence, and nonfarm payrolls. These reports will shed light on the US economy, showing whether higher interest rates affect the economy.

An analyst poll by Reuters indicated that the US economy likely added 200,000 new jobs, which would be the smallest gain since December 2020. Five of the last six jobs reports have exceeded expectations, and a sixth positive report could push Aussie lower.

AUD/USD weekly technical outlook: Bulls eying a fresh high at 0.6900

Looking at the daily chart, we see the price trading above the 22-SMA and the RSI above 50, showing that bulls are in charge. Bulls have been in control since the price broke above the SMA. It has since respected the 22-SMA as support, showing a strong bullish trend. The price is currently trading between the 0.6778 resistance and the 0.6600 support. The bulls could not break above 0.6778 the first time, so they are giving it a second try.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

The price is currently paused at this key resistance level, and bulls need just a bit of momentum to push above. If the price goes above this level, the next target will be at the 0.6900 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.