- The Australian government will release its first-quarter inflation data next week, which is expected to increase rapidly.

- As central banks tighten their policy, high-yield assets have become less attractive.

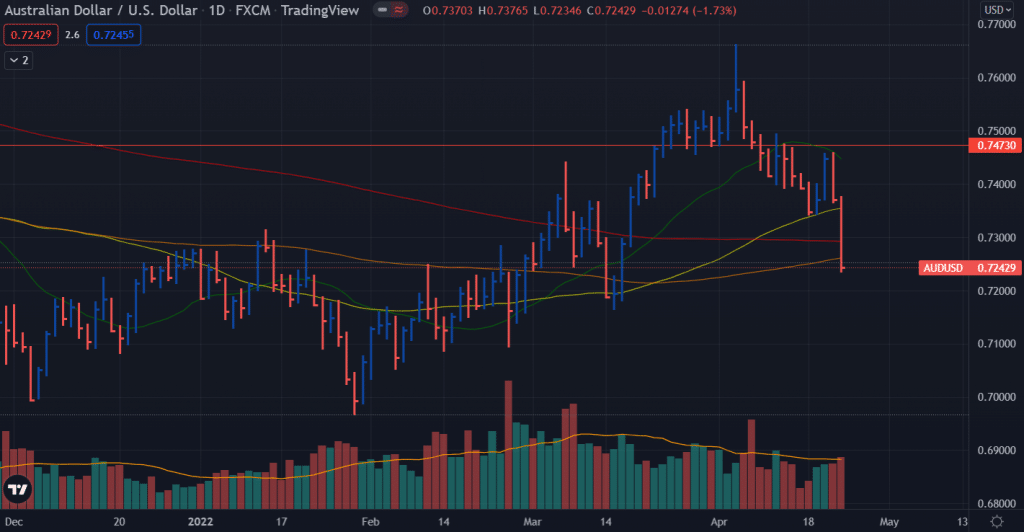

- A break below 0.7233 should increase the bearish momentum in the AUD/USD.

The AUD/USD weekly forecast is bearish as the pair gears up for a breakout of 0.7000 level as the Fed-RBA divergence continues to weigh on Aussie.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

In Friday’s trading session, the AUD/USD pair hit a fresh multi-week low of 0.7248 and ended the week a few pips higher than it started. Equities also fell on Friday as the commodity-pegged currency plunged. However, the pair traded higher during the week as Wall Street’s earnings surprised investors.

Risk-off sentiment

Fears have been associated with slowing economic progress since the pandemic began in March 2020. Almost as soon as the world entered a period of respite, Russia invaded Ukraine, and the Coronavirus returned to China. Supply chain issues re-entered the spotlight in about a month when Shanghai announced a strict lockdown of more than 26 million people.

RBA-Fed policy divergence

In turn, this decision aggravated the pandemic problems, leading to inflation. As a result, policymakers recently opened the door for a rate hike at the Reserve Bank of Australia’s latest monetary policy meeting, joining the tourists. It is now expected that the central bank will raise rates by 40 basis points by June. Meanwhile, the Australian dollar has declined due to the US Federal Reserve’s expected rate hike, which is anticipated to reach 2.75%-3% by year-end.

Commodity prices are on the decline

High commodity prices supported the Australian dollar during the Russian-Ukrainian crisis. Gold and oil prices began to decline as the crisis deepened, and the conflict over market prices raged. After failing to push above $2,000 earlier in the month, the bright metal ended the week around $1,930 an ounce.

Over the past few days, there hasn’t been much on the macroeconomic calendar. Australia published the Westpac benchmark index in March, which gained 0.35%. According to preliminary estimates for April, the S&P Global Manufacturing PMI stood at 57.9, and the S&P Global Services PMI stood at 56.6.

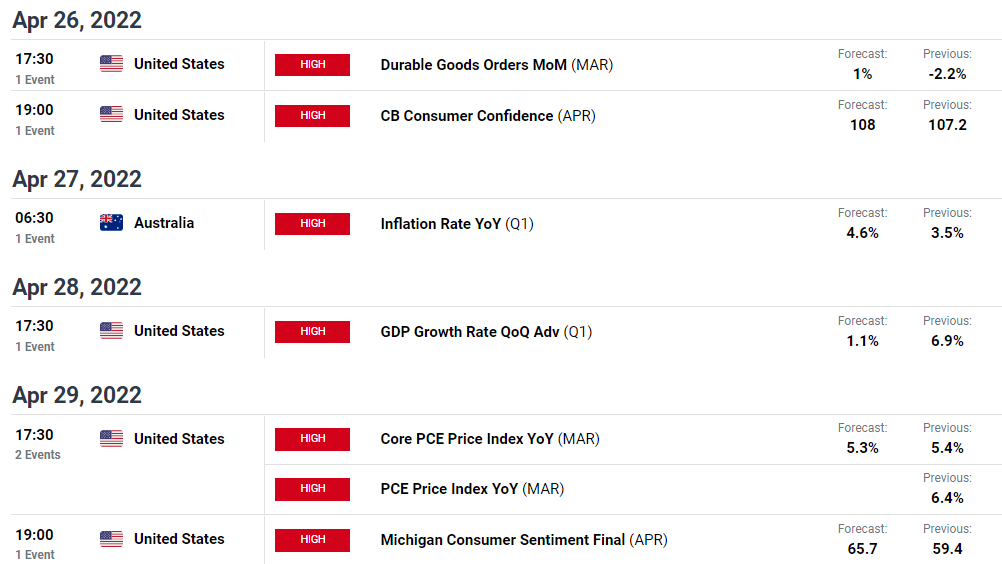

AUD/USD weekly events forecast

The US is scheduled to release a report on durable goods orders for March, which are expected to increase by 1% mom, and a preliminary estimate of first-quarter gross domestic product, which is expected to show a modest 1% increase. Then, the focus will turn to the main PPI, the US Federal Reserve’s preferred measure of inflation, by the end of the week.

CPI is expected to rise by 4.6% y/y in Australia for the first quarter, higher than the previous forecast of 3.5%, potentially prompting RBA rate hikes. PPI for Q1 is expected to come in at 4.2% y/y on Friday.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

AUD/USD weekly technical forecast: Eying 0.7000

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money