- Australian Dollar recovered around 100 pips.

- Australian Reserve Bank compromise to maintain the monetary policy.

- The pair achieves 200 SMA in the mentioned time frame.

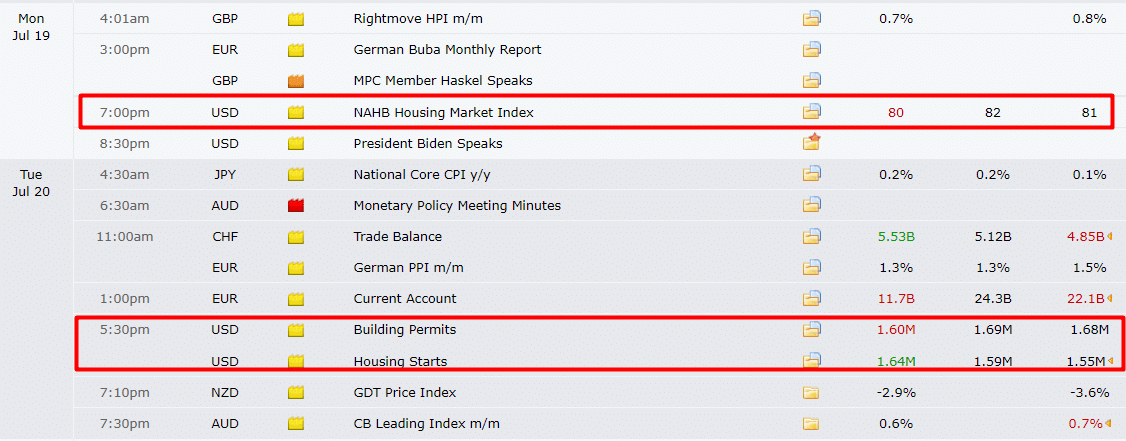

The AUD/USD Weekly forecast is bearish amid fundamental and technical variables despite the recovery of 100 pips in the week. In 2021, the Australian Dollar fell to a low of 0.7288 against the Greenback but managed to recover nearly 100 pips at the weekly close. The recovery was directly related to decreased demand for American currency because investors like to move into high-yielding assets.

–Are you interested to learn about forex robots? Check our detailed guide-

It’s the worst day of the year in 2021 for Wall Street on Monday but leads with record highs on Friday and supports the Aussie. However, in Australia, the upside was limited amid pandemic developments. This week, extending restrictions in the country have put its significant cities under lockdown.

On the other hand, the number of cases is low compared to other countries. Macroeconomic data from June and July show renewed economic difficulty. In this case, the pair will likely depend on the absence of demand for the US Dollar.

The Fed VS RBA

The Reserve Bank of Australia published its latest meeting minutes, which shows that policymakers compromised to maintain supportive monetary conditions and repeated the rates records low until inflation and employment reach the wanted levels. The Australian policymakers remain positive about the latest economic developments but very conscious about the latest lockdowns because it will delay monetary policy normalization.

The US Federal Reserve has a meeting on monetary policy on Wednesday, July 28, and the focus will be on the hints related to the future reduction of current financial support and the first steps towards normalization. No material changes are expected for the meeting. However, officials will likely expect an announcement for September.

–Are you interested to learn more about forex options trading? Check our detailed guide-

What next to watch in AUD/USD?

Data wise, the US macroeconomic calendar will incorporate next week June durable Goods orders, foreseen up 2.1 percent following a 2.3 percent advance in the previous month. In addition, the country will publish on Thursday second-quarter Gross domestic product, foreseen at 7.9 percent from the previous 6.4 percent.

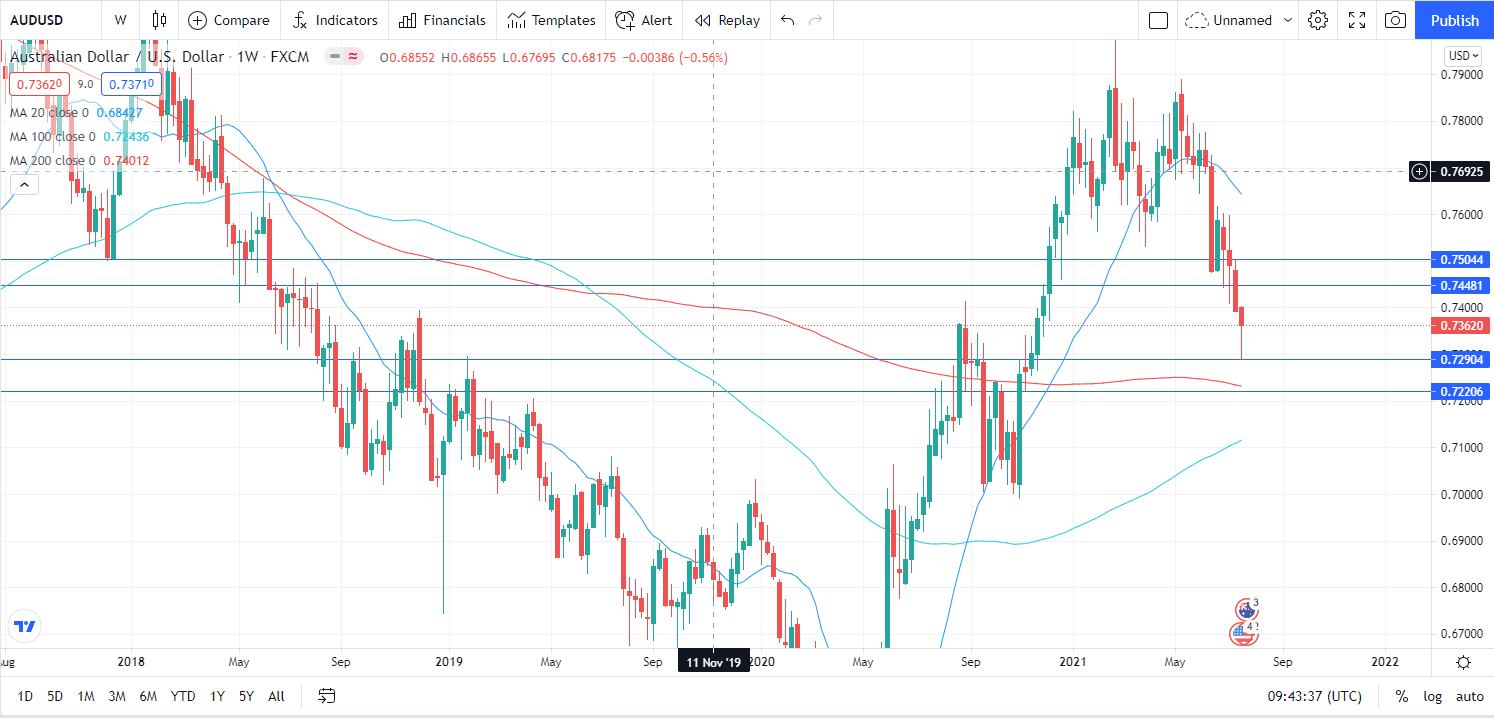

AUD/USD weekly technical forecast: Bears to keep pressing

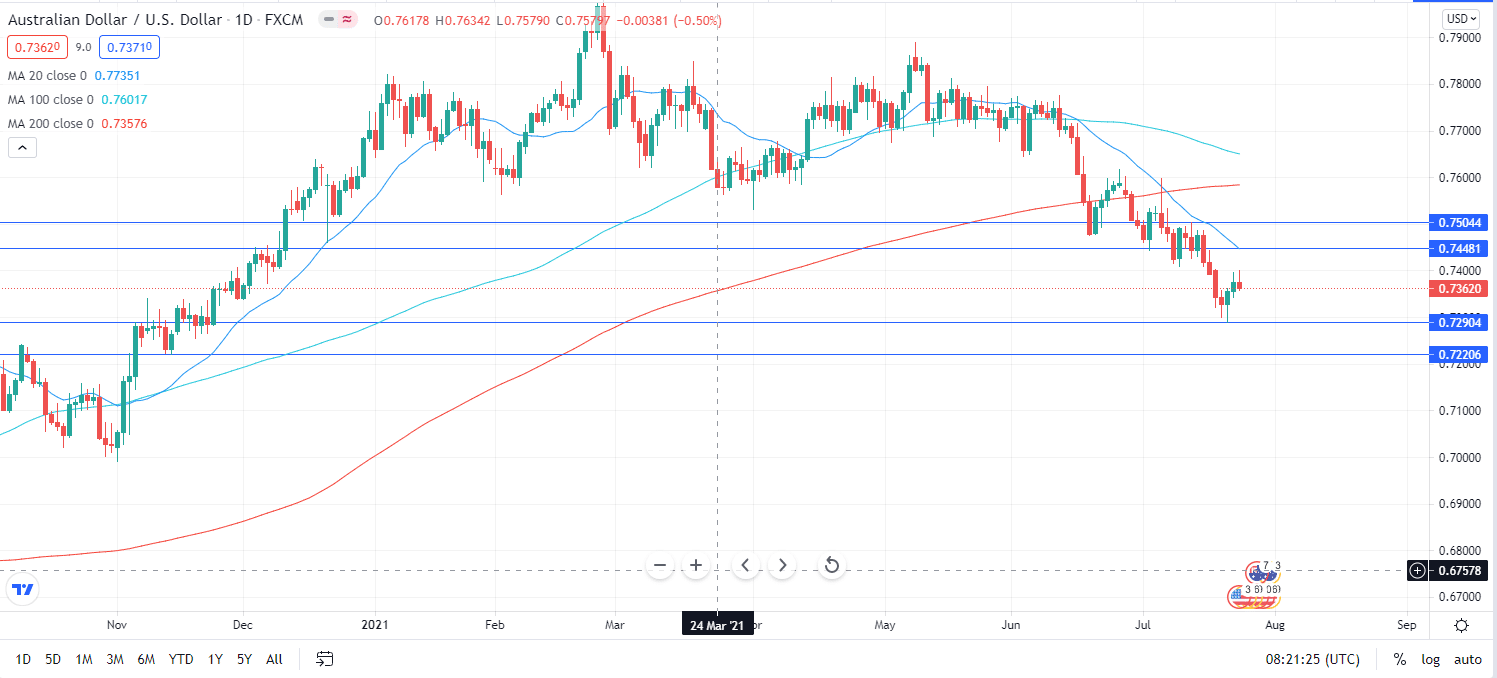

In the weekly chart of AUD/USD, the bearish trend is clear as the pair continues to reach lower lows. The pair achieves its 200-SMA in a given time frame while extending its slide below a bearish 20-SMA area. The longer one provides support at 0.7220. Technical indicators are firmly lower, with negative levels standing low as seen in April. The risk is skewed to the downside in the daily chart.

The 20-SMA heads south at around 0.7440 below longer moving averages. Technical indicators turned lower with the negative levels while holding above weekly lows. Supports are located at 0.7290 and ahead of 0.7220 in the price zone. The buyers’ first hurdle stands at 0.7440 ahead of the 0.7500 marks.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.