- Australian inflation retreated from 33-year highs in the first quarter.

- The Federal Reserve is widely expected to lift interest rates next week.

- Australia’s central bank will likely maintain its interest rate at 3.6% on Tuesday.

The AUD/USD weekly forecast is bearish as markets expect the RBA to hold rates again while the Fed may hike 25-bps again.

Ups and downs of AUD/USD

AUD/USD closed the week lower, with investors reacting to many economic releases from Australia and the US. The major catalysts for last week’s move include Australia’s inflation data, US GDP, and core PCE price index numbers.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Australian inflation retreated from 33-year highs in the first quarter. The cost of living witnessed the smallest increase in more than a year.

The Fed is widely expected to lift interest rates next week because data indicates rising inflation. The GDP report showed that in Q1, core personal consumption expenditure prices increased by 4.9%.

According to figures released Thursday by the Labor Department, initial applications for state unemployment benefits declined. The report reflected a still-tight job market.

The US core PCE figures showed that inflation increased in March, though slower than in February.

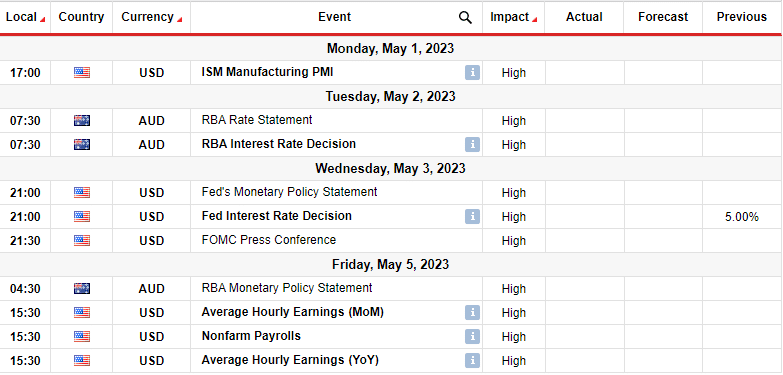

Next week’s key events for AUD/USD

The Fed is expected to hike by 25ps while Australia’s central bank will likely maintain its interest rate at 3.6% on Tuesday. This would be the second time the RBA holds rates.

According to experts, the RBA may be forced to think about hiking rates again in the coming months if high inflation persists.

Investors will also pay attention to the US nonfarm payroll report.

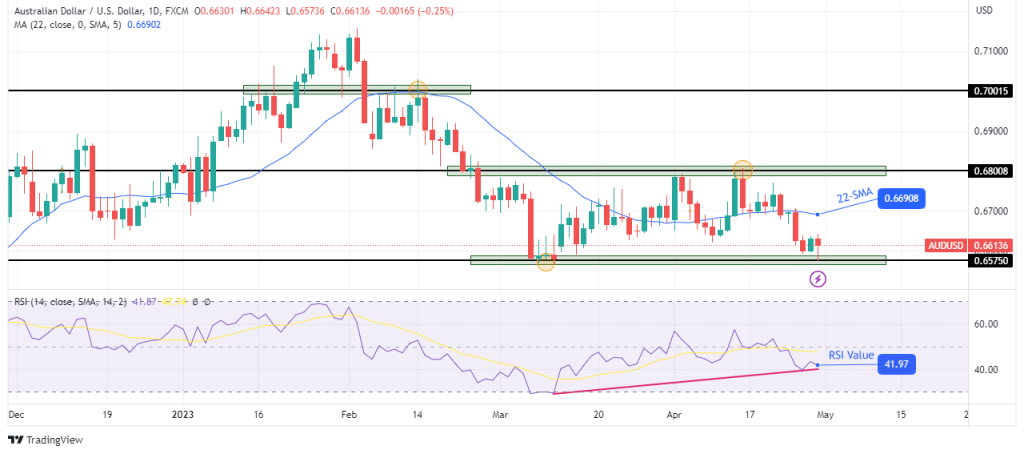

AUD/USD weekly technical forecast: Strong support at 0.6575

The bias for AUD/USD on the daily chart is bearish. This is shown by the SMA, which acts as resistance above the price, and the RSI trading below 50. The bulls attempted to take control by pushing the price above the 22-SMA.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

They, however, failed to go above the 0.6800 resistance level. The bears took this chance to take charge by retesting the 0.6575 support level.

However, this second attempt at the 0.6575 support is weaker. This is seen in the RSI, which has made a higher low. This support level will hold firm again if bears cannot get stronger. This could lead to a consolidation in the 0.6575-0.6800 area. A break below 0.6575 would continue the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.