- US unemployment went up to 3.7% in August.

- The US jobs report gives hope of a soft landing by the FED.

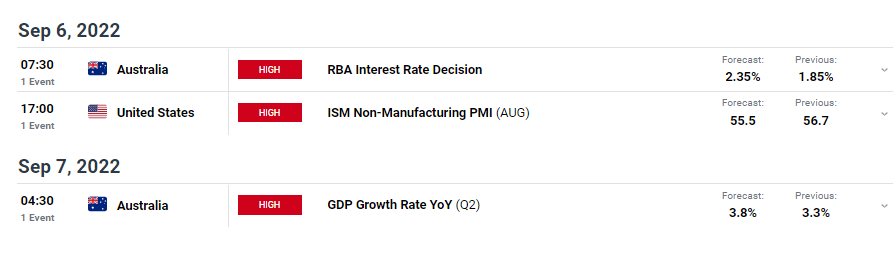

- RBA is expected to hike rates by 50bps.

The AUD/USD weekly forecast is bearish as the US dollar might strengthen further on the August job growth. However, RBA could rescue the Aussie.

–Are you interested in learning more about forex signals? Check our detailed guide-

Ups and downs of AUD/USD

This past week, AUD/USD was mostly moved by the US dollar as there were very few significant news releases from Australia. The US, on the other hand, released a lot of upbeat data. On Tuesday, data showed that consumer confidence in the US rose, and there were a lot of job openings in the US. This boosted the dollar and pushed the pair lower.

The number of jobs added by U.S. employers in August exceeded expectations. Still, modest wage growth and an increase in the unemployment rate to 3.7% suggested that the labor market loosened. This cautious optimism led some to believe that the Federal Reserve could slow the economy without causing a recession.

“The increase in employment offers yet another rebuttal to the idea that the economy is already in recession,” said Michael Feroli, chief U.S. economist at JPMorgan in New York. “The report keeps the hope that a soft landing is still possible.”

Next week’s key events for AUD/USD

According to a Reuters survey of analysts, Australia’s central bank will increase the cash rate by another half-point on Tuesday to combat rising inflation. Still, it will slow the pace of increases for the rest of the year.

One of the later adopters of the global tightening of monetary policy, the Reserve Bank of Australia (RBA) has increased rates by 175 basis points since May, bringing them to 1.85%.

The RBA will be forced to follow its peers and raise rates further if inflation stays over its recent two-decade high of 6.1%.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

AUD/USD weekly technical forecast: Bears set to retest 0.67235

The daily chart shows the price in a downtrend as it trades below the 22-SMA. The RSI, which trades below 50, further confirms the trend, supporting bearish momentum. The price retested the 0.69793 critical level before bears took over.

Looking at the chart, we see no hurdles ahead for bears apart from the 0.67235 support level. The pair will likely fall further if the price breaks below this level in the coming week.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.