- The pullback from 76.80 supports buyers.

- A successful break of 77.45/55 can validate further increase towards 78.20.

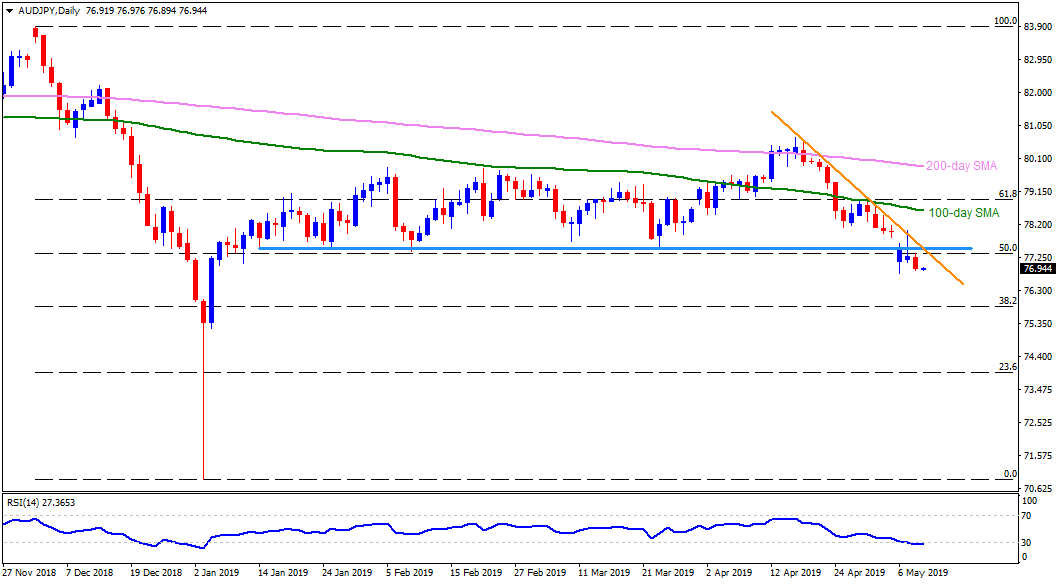

Despite refraining from fresh lows fewer than 76.80, AUD/JPY trades little changed near 77.00 during early Thursday.

The cross recently witnessed pullback but is yet to clear 77.45/55 key resistance area in order to justify its strength. The said region comprises horizontal-line connecting lows since mid-January and a downward sloping trend-line since April 18.

Given the quote’s ability rise past-77.55, 78.20 and 100-day simple moving average (SMA) around 78.65 can entertain short-term buyers.

However, 61.8% Fibonacci retracement of December – January downturn, at 79.00, followed by multiple resistances between 79.50/60 and 200-day SMA level near 80.00, can question bulls’ strength.

On the downside, 76.80 and 76.00 can offer nearby support to the pair prior to fetching it to 75.30.

Should there be increased selling beneath 75.30, 74.50 and June 2016 bottom near 72.40 may gain bears’ attention.

AUD/JPY daily chart

Trend: Pullback expected