When the Reserve Bank of New Zealand released its OCR rate decision statement on 9 June, it began with a note of optimism: “…Global financial market volatility has abated and the outlook for global growth appears to have stabilised after being revised down successively over recent quarters. There has been a modest recovery in commodity prices in recent months…“ However, it remained far short of exuberant by also adding a cautionary caveat: “…However, the global economy remains weak despite very stimulatory monetary policy and significant downside risks remain…”

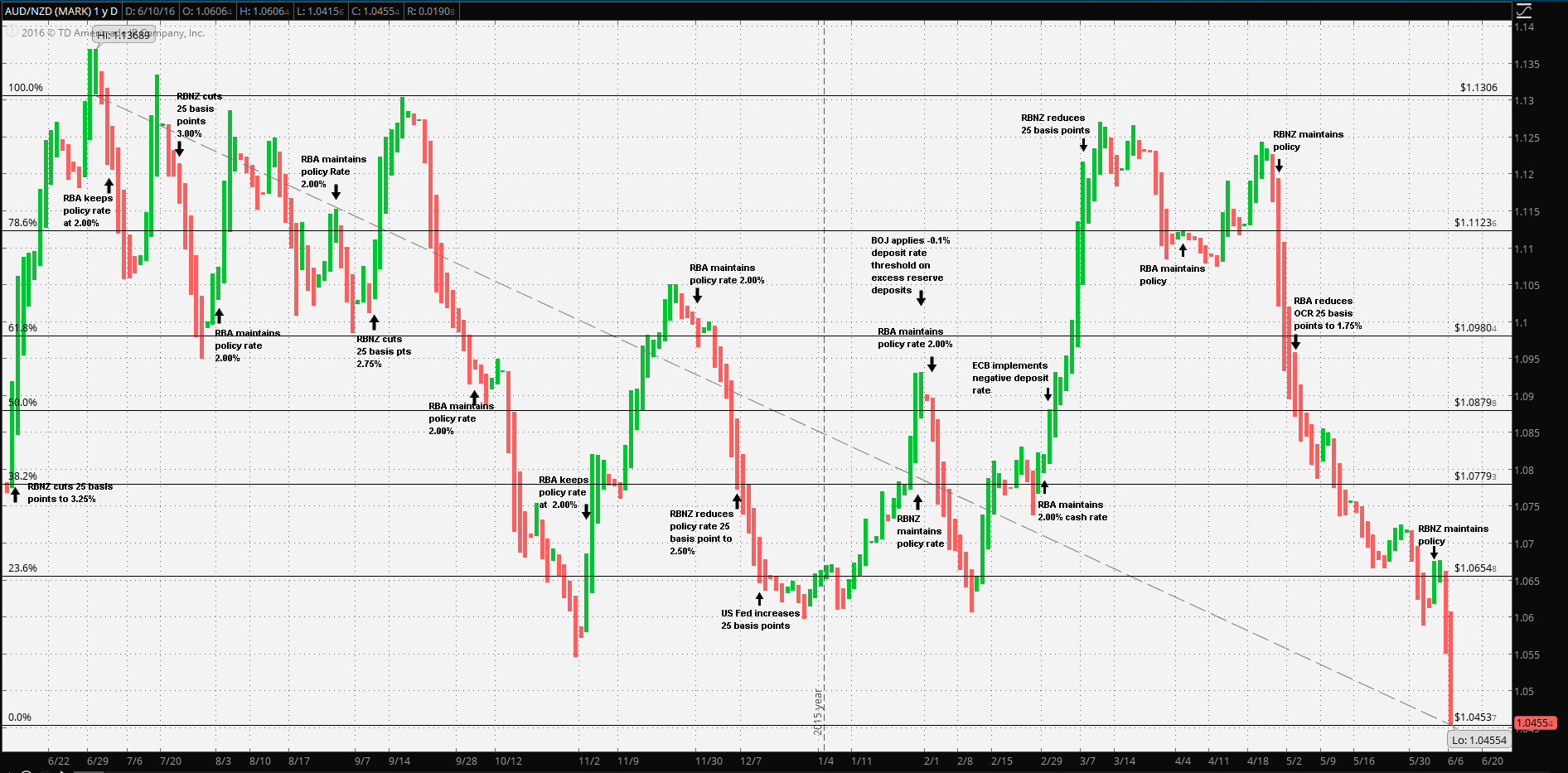

The RBNZ has been fighting slow growth and low inflation for nearly two years. It had reduced the OCR 100 basis points in 2015, in 25 basis point steps and one additional 25 basis point reduction in March of this year. It should be noted that over the previous four weeks the Kiwi has weakened against the Japanese Yen and Swiss Franc but actually strengthened against the Euro, Sterling, the US Dollar, the Chinese Yuan and the Australian Dollar.

Guest post by Mike Scrive of Accendo Markets

In terms of trade, there is a strong bilateral link between New Zealand, China, Japan and Australia. Just over 17.50% of New Zealand’s exports are destined for Australian ports and about 12.20% of New Zealand’s imports originate from Australia. This is second only to the nearly 20% of exports destined for China’s markets and nearly 17% of imports originating from China. Since the largest portion of New Zealand’s bilateral trade is within the Asia-Pacific region, it should be noted that Japan is third among major Asia-Pacific trade partners.

New Zealand is primarily an exporter of agricultural products and chief among those is dairy. However, there’s one notable exception. Australia is mainly an importer of New Zealand’s high quality crude petroleum accounting, for 17% of total New Zealand exports to Australia. This is followed by gold at 7% of total to Australia, after which come agricultural exports. The point is that a stronger Kiwi vs the Aussie is not all that helpful for the NZ economy nor is a stronger Kiwi over the Yuan; China is a major importer of NZ dairy; 36% of total exports to China; 60% of exports to China are other animal or agriculture products.

Since dairy is a major component of the NZ economy, it’s also worth noting that the global dairy overcapacity problem has not yet bottomed. This is especially true in the Asia-Pacific where the Australian government has recently proposed an AUD$ 578 million dollar domestic dairy industry aid package. True, it’s politics, but that doesn’t belie the fact that the Aussie dairy industry is in need of assistance. This is evidenced in aggressive competition for dairy market share within the domestic Aussie economy, including accusations of unfair pricing practices. Lastly, a weaker Aussie plus an indirect subsidy for a major dairy producing regional competitor could be a double hindrance for the NZ dairy industry.

Hence, it all raises some interesting questions. Since agricultural exports are a key component of the NZ economy, particularly dairy exports, wouldn’t the RBNZ want to at least say in sync with the Yuan and Aussie by weakening the Kiwi? True, in many respects, NZ crude petroleum exports have been given a lift by the recent global price recovery, but again, regionally, a stronger Kiwi relative to major trade partners may offset this advantage.

The 9 June statement does take trade into account, noting that “…The dairy sector remains a moderating influence with export prices below break-even levels for most farmers… …The exchange rate is higher than appropriate given New Zealand’s low export commodity prices. Together with weak overseas inflation, this is holding down tradables inflation. A lower New Zealand dollar would raise tradables inflation and assist the tradables sector…“ Hence it’s quite clear.

Although it had seemed that housing prices were being kept in check by new mortgage regulations, the current situation is still a concern: “…House price inflation in Auckland and other regions is adding to financial stability concerns. Auckland house prices in particular are at very high levels, and additional housing supply is needed…“

The statement does conclude by noting that the RBNZ still intends to proceed along an accommodative policy path and with 225 basis points of leverage in an economic zone with major economies implementing increasingly accommodative policies, the RBNZ is holding the best hand.

Similarly, the Reserve Bank of Australia has frugally maintained a positive OCR advantage of 175 basis points. However, from about the end of April to the present time, the Kiwi has gained about 6.25% on the Aussie. Referring again to the bilateral trade relationship between the two, the only real concern might be with Aussie government assistance for its dairy industry. It isn’t the best of news, but it’s well out of the jurisdiction of the RBNZ.

Hence, it’s likely that the pair will remain in a range of near parity support to NZD$ 1.0924 resistance based on a one year Fibonacci retracement chart. This is similar to the trading range of November 2015 through March 2016. Lastly, it’s worth noting that the pair last exchanged at virtual parity in April of 2015.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“