The Australian dollar is on the move to the downside. So is the kiwi, but the latter is moving in a slower manner. The team at Deutsche Bank sees room for the downside, all the way to the very round number.

Here is their view, courtesy of eFXnews:

One of our Blueprint trade ideas is to sell AUD/NZD, targeting parity on diverging rates and terms of trade.

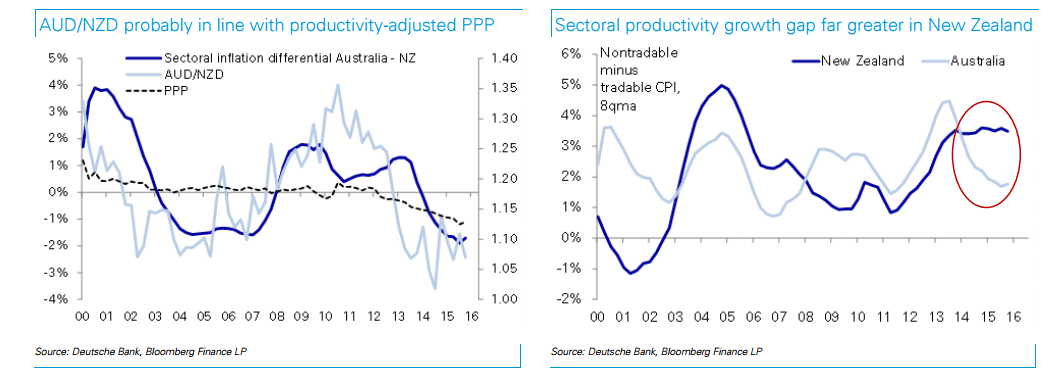

Market sentiment, however, still seems moderately bullish despite the recent reversal. A common argument is that the cross offers value, with CPI-based purchasing power parity sitting somewhere between 1.10 and 1.15 depending on one’s model, but well above spot in any case.

Yet while valuation has generally returned as an important driver in FX, a simple PPP model is misleading in this instance. AUD/NZD looks fairly valued on PPP once we account for differences in sectoral productivity growth and inflation…Stay short.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.