The Reserve Bank of Australia left the interest rate unchanged at 2.50% as widely expected and hardly made any changes to the statement. The mention that the A$ is historically high is not news: we have heard that before.

With other economic indicators balancing each other, AUD/USD was able to rise back up within the range. Can it retake 0.93 and stay there this time?

In the rate statement released by Glenn Stevens and co., the Bank left his line:

The exchange rate remains high by historical standards, particularly given the further decline in commodity prices.

As aforementioned, this isn’t news. In addition, they reiterated that no change is expected anytime soon, with the repeat of this line:

On present indications, the most prudent course is likely to be a period of stability in interest rates

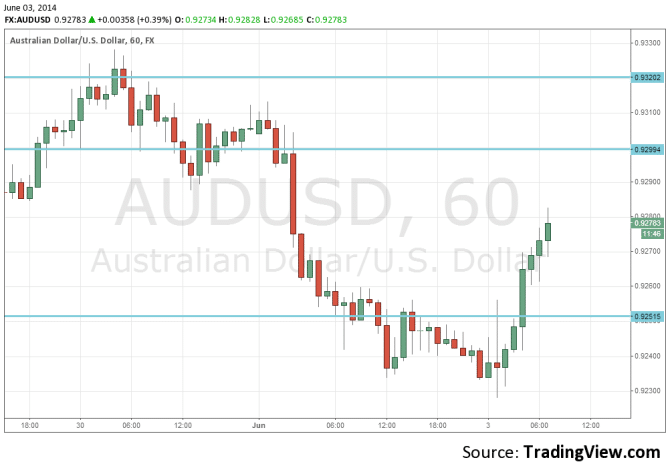

After the recent worrying signs from China as well as the new Australian budget, some had spectated that the RBA would provide a more dovish stance. The Aussie dollar dropped from 0.93 to 0.9220 towards the decision, but now it is trading back up, at 0.9280 at the time of writing.

Despite the break last week, 0.93 remains a strong line. For more, see the AUDUSD prediction.

In addition, to the rate decision, important data were published: retail sales rose by 0.2% in April, withini expectations. Australia’s current account deficit stood at 5.7 billion in Q1, better than 7 billion expected. Not only did these figures stay out of the way, but they also provided some assistance.

Here is how the recovery of the Aussie looks on the chart: