- AUD/USD could not retain the gains despite several attempts.

- Delta variant of COVID-19 is hurting the sentiment.

- RBA’s expected dovish stance is keeping pressure.

The Australian Dollar is making failed attempts to gain momentum and defend its gains. Despite a series of failures, the Aussie does not lose hope of recovery in the medium and long term, remaining a kind of a thorn in the process of long and persistent attempts to rise.

The protracted fall of the Australian Dollar is due to another outbreak of the Delta variant of the coronavirus COVID-19 in the country. Against this background, the Reserve Bank of Australia (RBA) may switch to dovish rhetoric. In addition, fears about further trade relations.

On Wednesday, June 30, the Aussie became the anti-leader among risk-sensitive commodity currencies. This category of currencies suffered significant losses after the Australian and New Zealand Dollar collapse by 0.7%.

Both commodity currencies retained their conquered positions with the last bit of strength, but this did not help them much. As a result, the Aussie slipped to the level of 0.7500. Thus, the beginning of the new month was marked by a further drop in the Aussie against the US Dollar.

On Thursday morning, July 1, the AUD/USD pair was close to 0.7482. Experts fear that new data on macro statistics from the United States may upset the fragile market equilibrium and send the AUD/USD pair into a deep retracement to the level of 0.7000.

RBA’s forecast

The Australian Dollar is under serious pressure as it awaits a decision by the RBA next week. Economists believe that the central bank may surprise the markets with a dovish tone in the current situation. The monetary authorities of the Green Continent will have to deal with the validity of the yield of government bonds due in November 2024, as well as discuss the near future of the quantitative easing (QE) program.

The RBA’s tentative forecast is to maintain its current monetary policy and bond yield target and keep the current QE at AU$ 100 bn.

Technical outlook for AUD/USD

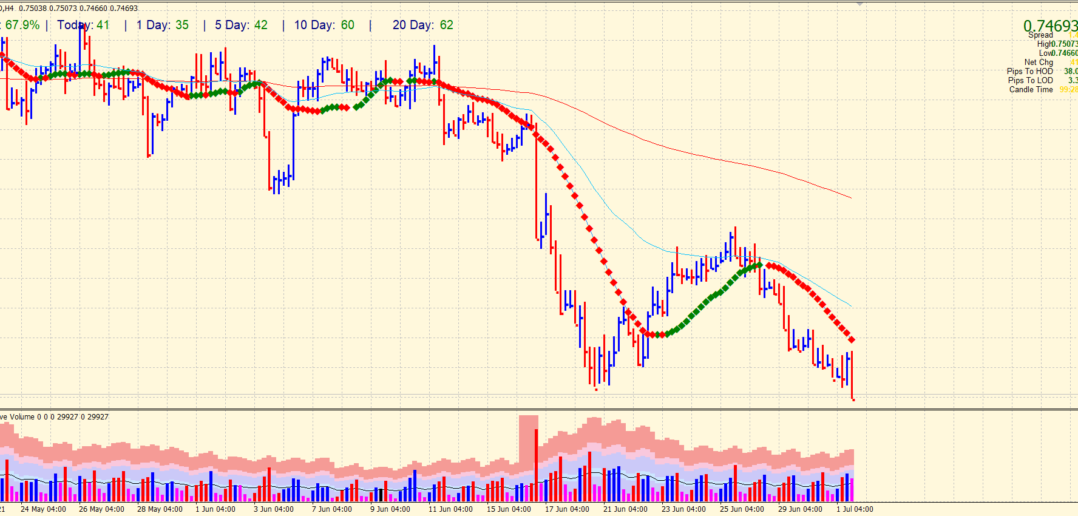

The 4-hour chart of the AUD/USD gives a clear bearish picture. Despite an attempt to rise with the previous 4-hour price bar with high volume, the gains could not stay, and the market collapsed to the support area of 0.7470. The price is well below the 20-period SMA.

The pair can find the next support around 0.7450 ahead of 0.7425 and then 0.7400 handle. On the flip side, if the price closes above 0.7500, the pair will be able to restore to neutral momentum. Further resistance levels are at 0.7530 ahead of 0.7550.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.