After AUD/USD dipped below the double bottom, it managed to stabilize and seems to be looking for a new direction.

The moves in the shorter term may still be unclear, but the bigger picture is clearer according to Deutsche Bank’s forecasts.

Here is their view, courtesy of eFXnews:

In a note to clients today, Deutsche Bank discusses the outlook for AUD/USD into yea-end and going into next year.

“Recent data are not sending a clear signal, reinforcing our neutral view on AUD/USD through year-end,” DB projects.

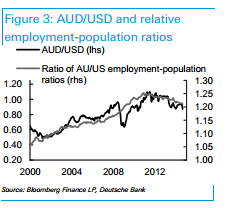

“Recent Australian employment data have been very noisy…In the United States, labour market conditions have improved this year, but recent Fed minutes reveal the FOMC continues to debate the extent of remaining slack,” DB clarifies.

While the short-term picture is unclear, DB thinks that this is set to change going into 2015.

“But divergence next year – our economists see Australian unemployment edging higher to 6.75% by end 2015 while the US labour market tightens to 5.4% – would see the decline in AUD/USD resume,” DB argues.

In line with this view, DB forecasts AUD/USD to trade at 0.90 for end of this year, 0.87 for Q1-2105, 0.85, for Q2-12015, 0.83 for Q3-2015, and 0.80 for end of 2015.

For lots more FX trades from Credit Agricole and other major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.