The Australian dollar, which had showed us some resilience in the not-so-distant past, his looking terrible in the first week of 2016. The gloom and doom just takes over, and it is worse when a significant part of it is related to Australia’s No. 1 trade partner: China.

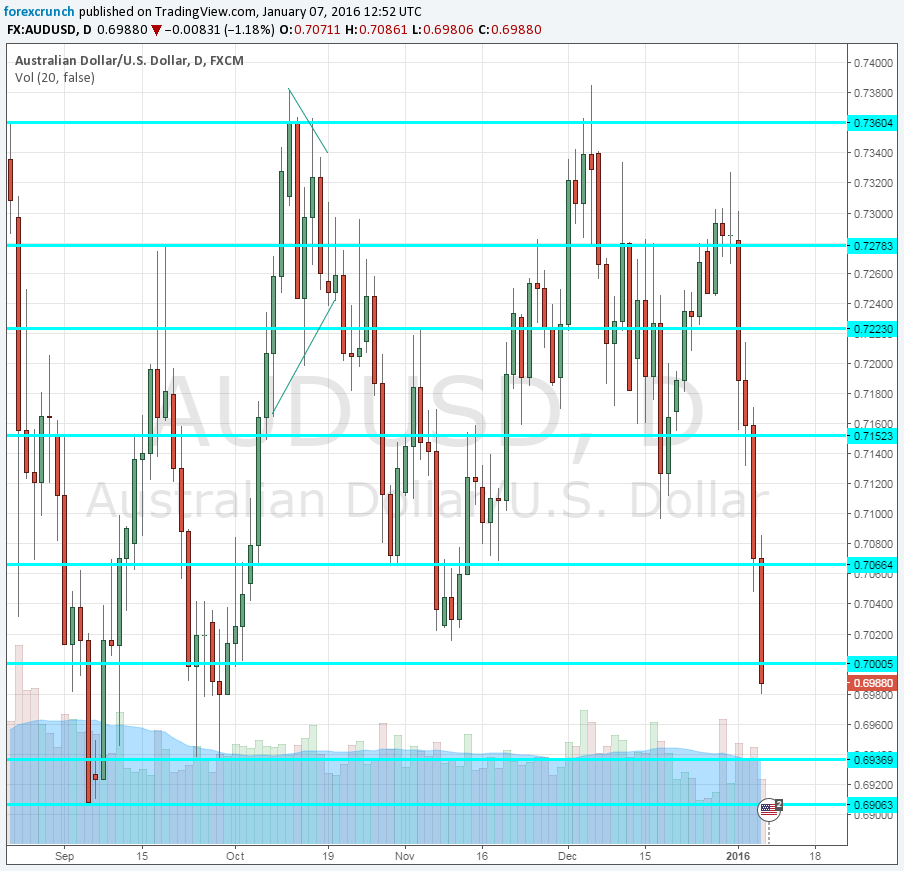

AUD/USD lost several support lines, and the fall below 0.70, albeit shallow at the moment, looks quite serious. The low so far is 0.6980, but we cannot see more than a “dead cat bounce”.

The Chinese stock market in Shaghai was open for only 14 minutes and 17 seconds. The 7%+ fall in shares triggered a closure of markets. This went hand in hand with another devaluation of the Chinese yuan, another sign that markets see as trouble in China. The world’s second largest economy is seen as clinging on to the old export model and not really going into the re-balancing or transition that is touted for years.

The pair is now trading at the lowest levels since October, after taking on its way the 0.7150, 0.7065 and the 0.70 level of course. These all turn into resistance lines now.

On the downside, the next level to watch is the double bottom at 0.6940 see in late September. Further below, the round level of 0.69 provides further support.