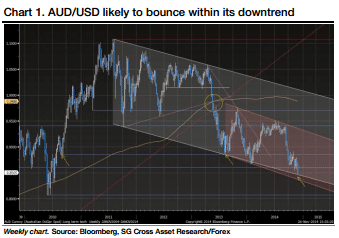

The Australian dollar reached new 4 year lows in November, falling below the 85 cent mark. Can it further fall? If so, how?

The team at SocGen analyzes the downtrend and the so called “dead cat bounces”:

Here is their view, courtesy of eFXnews:

SocGen remains structurally bearish AUD/USD but notes that the technical picture strongly suggests that the pair should see a tactical bounce, before weakness resumes in 2015.

“It has just tested the bottom of its four-year downtrend channel, making upside risk the most likely scenario. Our technical analysts also warn about a reduction in bearish momentum,” SocGen clarifies.

“We would be sellers again on higher levels, but this will not keep us from monetizing a rally,” SocGen advises.

Moreover, SocGen commodity team forecast iron ore prices will stabilize after a massive downtrend, and their copper outlook is marginally bearish (China reaffirms infrastructure projects, supply remains tight and strikes at mines are supporting the market).

“We will sell the AUD again when the copper future clearly breaks 295/300,” SocGen adds.

The trade: “Buy AUD/USD 2M call strike 0.86 double KO 0.8350 & 0.91,” SocGen advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.