The Australian dollar reached new highs against the greenback but stalled and is now retreating. Here are two views about the pair, from ANZ and Credit Agricole:

Here is their view, courtesy of eFXnews:

AUD/USD: Now A Sell – Credit Agricole

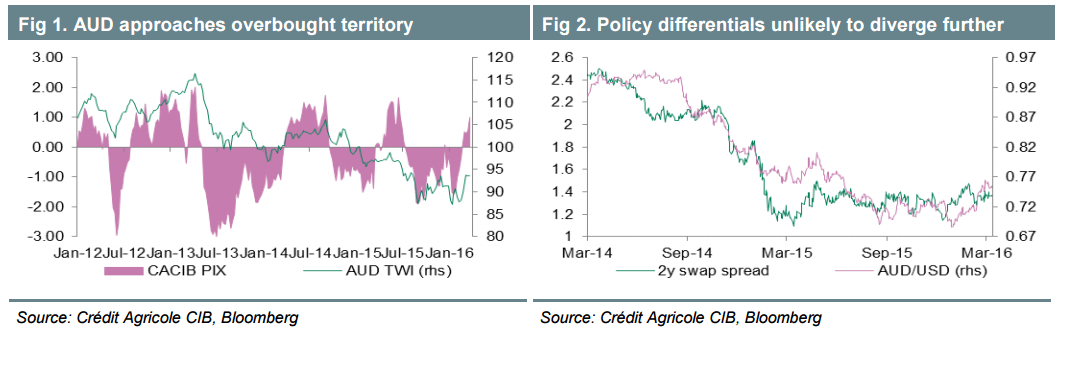

The AUD has been in demand for most of this year. A combination of improving global risk sentiment on the back of several central banks more dovish stance and improving domestic conditions to the benefit of RBA monetary policy expectations have been driving this year’s developments. Stabilising commodity prices have helped too.

With speculative oriented investors now long the currency, there is limited position squaring-related upside risk left. If anything this suggests that fresh buying is needed to drive the AUD sustainably higher. For that purpose further improving commodity price developments, rising risk appetite and/or increasing RBA rate expectations may be required. This is especially true as limited room of further falling Fed monetary policy expectations may reduce USD downside risks from the current levels.

With global growth momentum still capped, major central banks are unlikely to become more aggressive on monetary policy anytime soon, however it cannot be excluded that risk sentiment may turn more unstable in the weeks to come.

Elsewhere, the RBA is unlikely to make a case of a less dovish policy stance. The central bank will meet next week and chances that Stevens may consider a more cautious rhetoric tone cannot be excluded with respect to the currency.

As a result of the above outlined conditions we believe that the AUD faces downside correction risk. In the short-term we forecast a return closer to 0.70.

AUD: It’s Not About Commodities; How To Trade It? – ANZ

The recent rally in the AUD has coincided with a rally in commodities, most notably in the oil and iron ore markets. However, we think that the move in the AUD is more likely reflective of a shift in broader themes, rather than a currency reaction to stronger commodity prices. If the recent rally was just about pricing in a new commodity price paradigm, then the rally in the AUD would have been far more limited. Weightings in the RBA non-rural commodity price index mean that the recent move in iron ore prices – a rally from USD38 to USD60 – shifts the index from 51 to around 56. Our long-term model of the nominal AUD estimates the impact of this scale of move in the commodity price index; it is worth around one cent on the AUD. To date, since the rally in commodities began, the AUD has moved a bit more than six cents higher. Thus, if it was commodity prices alone that had driven the AUD, then the AUD has already moved too far.

SUSTAINABILITY OF AUD STRENGTH? We continue to think that this near-term strength will provide significant opportunities to reset hedges for a sharp decline in the AUD. In particular, we see a number of factors that make this AUD rally self-limiting:

First, growing evidence of a broadening in growth, wage, and inflation pressures in the US will ultimately push the Fed to do more than the market currently expects. A sustained rally in oil, or indeed even a stabilisation at current levels over the northern summer, will start to shift the balance of risks for the Fed, and this would be further exacerbated by a period of lower volatility in financial markets (though the Brexit vote in June may create issues). Should Fed rhetoric or forecasts become more hawkish in response to the better market vibes, then a sharp rise in longer term US yields would push the USD to reassert its strength.

Second, the rally in commodities (iron ore in particular) will be capped by the supply dynamics in the individual markets. Iron ore remains with about 50% excess capacity relative to long-term steel demand expectations.

Third, the tightening in financial conditions (as the AUD rallies and as banks continue to pass on regulatory tightening) in Australia will limit the RBA’s willingness to acknowledge the better global circumstances, and could in fact drive the RBA to ease once again. “¢ Finally, the debt load that already exists in China will mean that any recovery we do see will prove temporary as officials start to tighten up again once recessionary risks have passed. In addition, while current levels for the AUD.

In a trading sense, we still struggle to hold outright long AUD/USD positions given the dislocation from other risk assets. As such, we think that AUD/NZD looks like the best cross to use to benefit from nearterm AUD strength. The cross usually favours the AUD in neutral and positive risk environments, and the RBNZ is actively easing rates while the RBA remains on the sidelines.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.