At least 50 people were killed in an LGBT nightclub in Orlando called Pulse. This is a result of an attack by a man of Afghani origin who may or may not have carried the massacre in relation to jihadist ideology. The FBI is still investigating and a state of emergency has been announced in Orlando to aid the investigation. But markets don’t always wait for the actual facts to emerge but rather react instantly, when they are open of course.

This horrific atrocity is attributed to a Muslim and to immigration. It certainly impacts the presidential elections in the US in November but there is also an election in 11 days: the EU Referendum in the UK.

And while the killings happened across the pond, their impact will be felt also in Britain. The topic of immigration and limiting it has been hot on the agenda, especially due to the efforts by the Leave camp. They want the UK to regain full control of entries in the country and to limit immigration. Such a terror attack can have an impact.

We already know that many Brits are in the “undecided” camp, which is quite large and can be influenced by the non-stop news. And, in recent weeks those campaigning for a Brexit gained some ground in the polls. The most recent poll on Friday showed 55% for Leave and 45% for Remain. While this is an online poll (consistently showing more support for Leave) and also one that does not include the undecideds, it had a dampening impact on the close on Friday.

The “risk-off” sentiment on Friday meant a big plunge for the pound, with the euro following suit. The winners were the US dollar and the ultimate safe haven: the Japanese yen.

More could be in store now: with markets speculating that this attack could push more people towards Brexit a relatively short time ahead of the polls, this could deal another blow to the pound and the euro, pushing the dollar and yen higher.

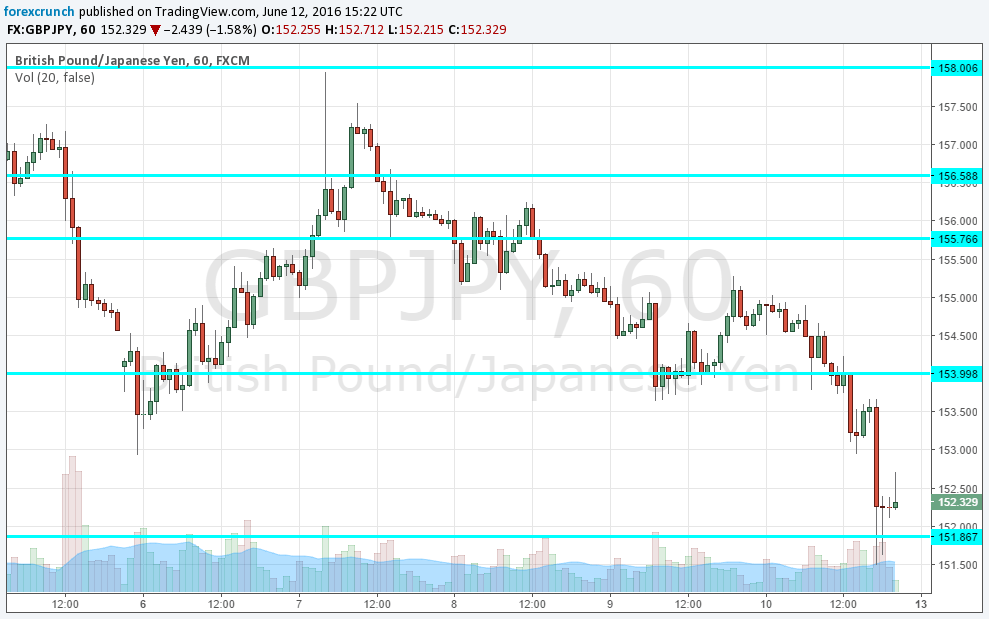

The biggest move could be seen in GBP/JPY, and to the downside.

More: Is your broker Brexit ready?

The pair fell below support at 154 on Friday and the line switches to resistance. The next line of support is the low of 151.80. Further below, we find the round level of 150, followed by 148. The swings in this cross are quite wild. Here is the GBP/JPY hourly chart: