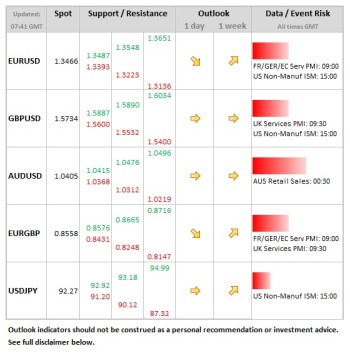

- USD: On the lookout for signs of strength in the non-manufacturing ISM data today, especially given the marginal dip in GDP data in the last quarter of 2012. Last month’s was the second strongest surprise over the past year but only accounted for around 20 pips on EURUSD, so event risk relatively low unless way outside the 55.0 expectation.

- GBP: Given the pervasive negativity towards the British economy at present, today’s services PMI is relatively important. The market hopes to see a minor lift to 49.5, from 48.9 previously. If we get a reading above 50, then we may see some further short-covering. See how to trade the services PMI with GBP/USD.

- EUR: A raft of releases out today, including Italian/French/German/EC services PMIs out from 8:45, followed by Eurozone retail sales and Italian CPI at 10:00. A concern for Europe is how the strength of the currency will impact on external demand for exports – euro-bulls will need to keep a very close eye on this over coming months. Be aware that there is an ECB meeting on Thursday and another EU Summit later this week.

Idea of the Day

There was a distinct feeling of tiredness at the start of the week, which was instigated by a number of factors. The intensity of the moves seen on Friday, together with the much larger than normal volumes, left FX markets feeling distinctly stretched. On top of this, the perception of political instability in Spain dented sentiment, with Spanish stocks down nearly 4% and bond yields up by more than 20 basis points. For some, it may feel that markets have come to their senses after a period during which the Eurozone crisis appeared to be put almost forgotten. But for FX the impression left is that markets are certainly a lot more bold, with investors and traders more confident to push currencies on the basis of their perception of underlying fundamentals, rather than a generalised “risk-on, risk-off” flow of sentiment.

Latest FX News

- EUR: Taking the full force of corrective activity at the start of the week, down 1.5 cents through the day. This takes EURUSD just back below the Feb-12 high of 1.3487.

- JPY: Stronger on the back of the reversal of recent trends, but for what would have previously been called a “risk-off” day, the moves on USDJPY were pretty modest.

- GBP: The dramatic EURGBP move seen on Friday was totally reversed on Monday. On the daily chart, the 14 day RSI has moved below 70 for the first time in 12 days.

- AUD: Rates were kept on hold at 3.00% in the wake of the RBA decision, as broadly expected, but the accompanying statement was indicative of rates cuts on the way, which saw the Aussie slip down to the 1.04 area.