- Bancor’s proposal will vote to increase the co-investment limit to 1 million BNT on the MTA pool.

- If this vote gets ratified, Bancor’s BNT/MTA pool will be two times deeper than the largest MTA market, Uniswap.

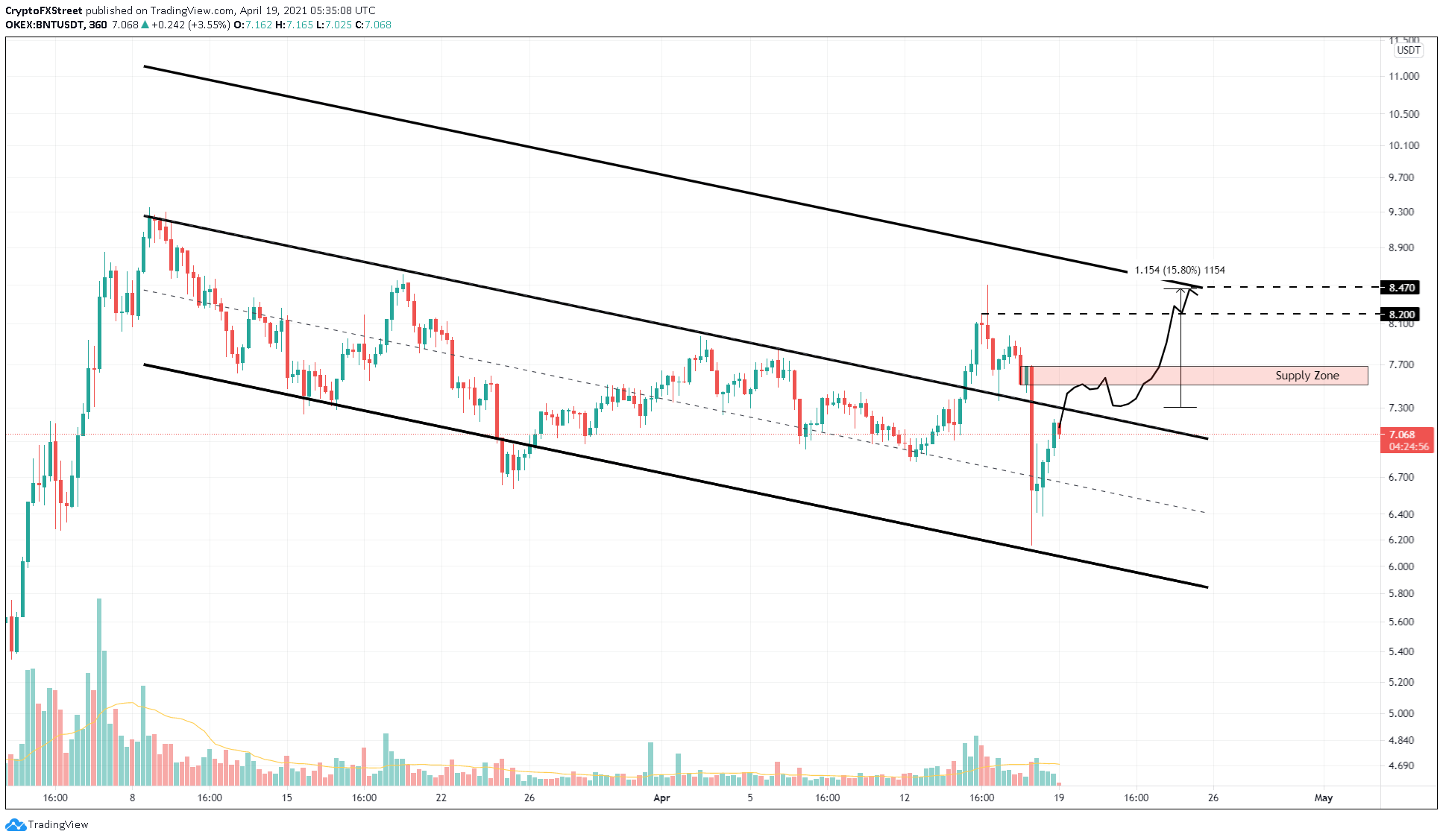

- BNT price is retesting the upper boundary of a descending parallel channel, hinting at a 15% upswing to $8.47.

Bancor protocol stands to gain a lot from the latest collaboration and even compete with one of the popular decentralized exchanges (DEX) in the DeFi space. BNT price eyes a bullish breakout from a technical formation after the recent market crash.

MTA/BNT pool to receive significant boost in liquidity

The latest proposal, which is supposed to go live on Monday at 12:00 UTC, postulates an increase in co-investment to 1 million BNT. If this vote gets ratified, it will add depth to the MTA/BNT liquidity pool on Bancor v2.1.

The primary aim of this move is to attract MTA liquidity providers on Uniswap’s MTA/WETH pool to Bancor. Considering Bancor’s unique impermanent loss protection, this proposal is an outstanding move to onboard users by providing single-sided liquidity.

Currently, Uniswap’s MTA/WETH pool boasts liquidity of $6.2 billion, with its volume ranging from $1 million to $4 million.

According to mStable’s founder, James Simpson,

Bancor’s co-investment would make its market at least 2x deeper than the current largest $MTA market (Uniswap)… This proposal leverages the collective synergies of two DeFi builders with a partnership that scales both with potentially deeper collaboration down the line.

If the proposal comes to fruition, it would naturally attract more trades from aggregators, professional market makers, which ultimately increases adoption and fees.

BNT price eyes higher high

Bancor price has been producing lower highs and lower lows since March 8. A descending paralle channel is formed when these swing points are connected using trend lines. This setup forecasts a 15% upswing, determined by adding the channel’s height to the breakout point at $7.30.

Hence, BNT price is targeting the $8.47 level.

The market-wide sell-off in Sunday’s trading session caused a drop that tapped the lower boundary. However, BNT price has nearly recovered to pre-crash levels.

Although a move above the upper trend line signifies a breakout, BNT price must shatter the supply zone ranging from $7.50 to $7.63 to show the bulls’ commitment. In such a scenario, investors can expect BNT to rally to $8.2, another significant resistance level, before hitting the target at $8.47.

BNT/USDT 6-hour chart

Regardless of the bullish outlook from a technical perspective, investors should note that a rejection that leads to reentry inside the channel will signal weakening buying pressure. If BNT price produces a decisive close below $6.7 on the 6-hour chart, it will signal the start of a new downtrend.

Under these bearish conditions, market participants can expect BNT to slide 6% to $6.27