Data/Event Risks

- ALL: Google and Microsoft shares fell hard overnight after earnings misses and commodity prices dropped, a warning that risk assets may have run too far in the short term. Otherwise little of interest today. Note – 25th anniversary of Black Monday, the stockmarket crash of 1987.

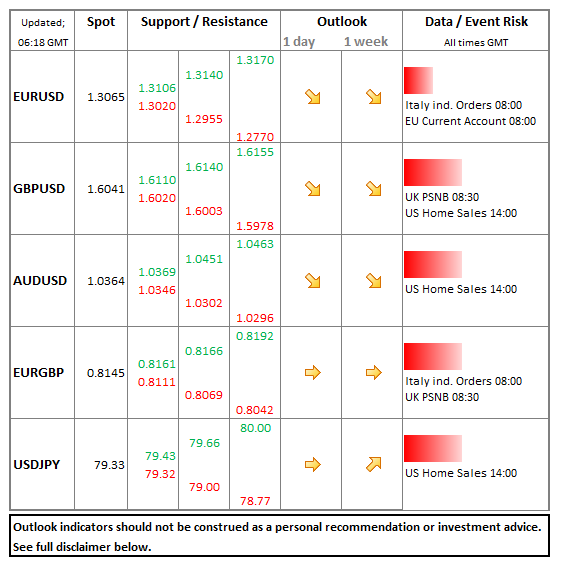

- USD: Existing home sales out at 14:00 (see how trade with USD/JPY) but unlikely to move the dial as housing recovery already priced in. Of more interest are corporate earnings, with GE and McDonalds reporting later. Weak corporate profits could assist the dollar in the near term.

- EUR: Italian industrial orders and EC current account (both at 08:00) are unlikely to change the euro’s course. Might see some profit-taking in the EUR today after an unconvincing EU summit.

Idea of the Day

Safe-haven currencies have struggled recently, with the yen down for seven straight days and gold under USD 1,740. Both still look suspect. However, risk assets and currencies are looking toppy near term, and traders may look to take profits near term. Euro is looking tired, as is cable.

Latest FX News

- EUR: Lots of unresolved issues at the latest EU summit such as banking reform and fiscal union. Euro finding it difficult to penetrate 1.31. A test of the downside likely near term.

- USD: Yesterday’s jobless claims and Google/Microsoft earnings warned that the economy is still struggling. The dollar index might be forming a base at these lower levels.

- GBP: It appears that buoyant employment is flowing through to consumer spending. Retail sales jumped 0.6% last month, up nearly 3% YoY (ex-fuel). As a result, Q3 GDP growth should be positive. Sterling unmoved by the news.

- AUD: Aussie traded through 1.04 yesterday and is still attracting plenty of foreign buyers. The local ASX 200 reached a 14mth high overnight. AUD back above key moving averages and in the middle of the 1.02-1.06 range. In the very short term may drift lower.

- JPY: Continues to struggle. Improvement in global risk appetite is hurting the yen, as is prospect of yet more BoJ asset purchases and political uncertainty regarding both a further fiscal injection and LDP call for fresh elections. MoF will be very pleased with yen demise.