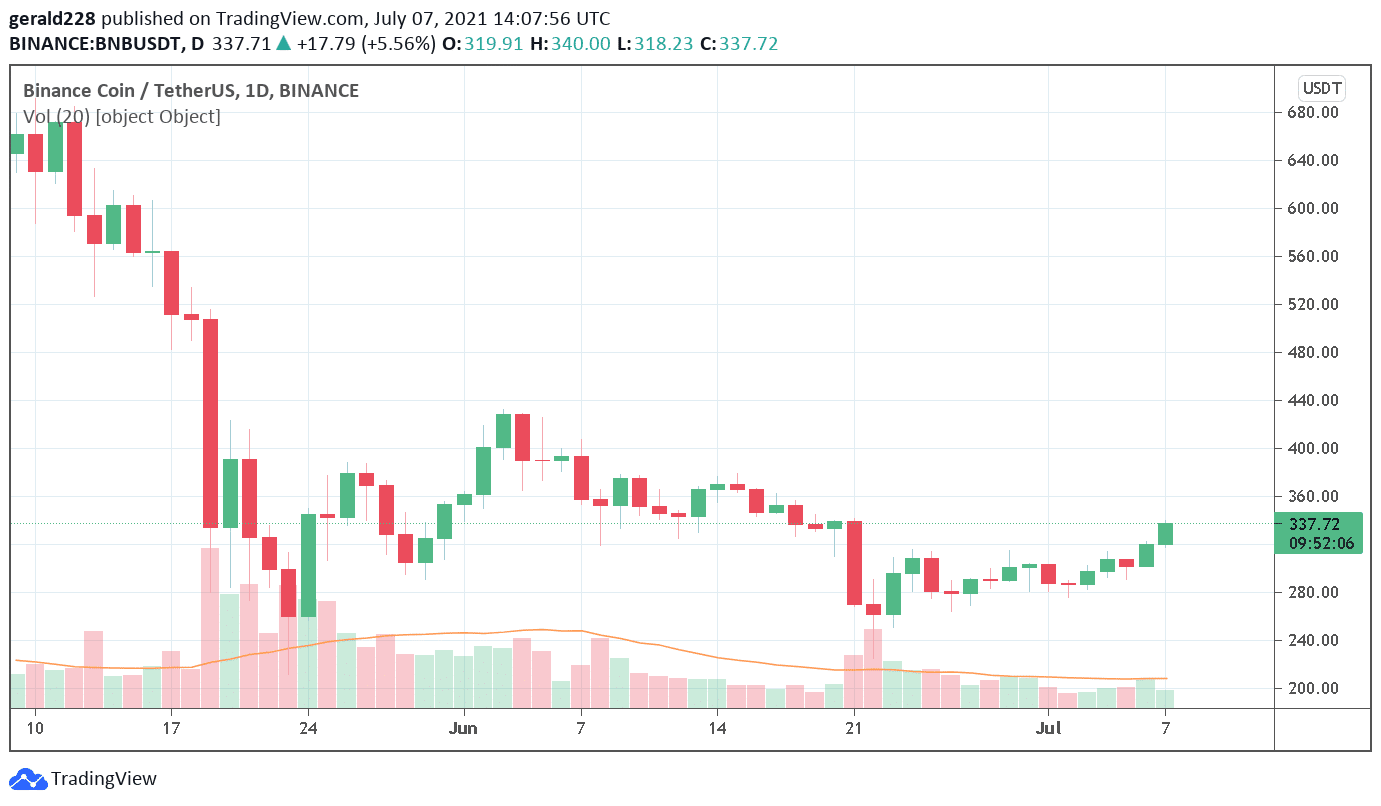

The Binance Coin price is once again on a roll with the $300 level well superseded at present. After falling from its high of $650 in early May to a low of $261 on 23rd May, the price has been playing around between that low level and the $300 mark. July has seen a bullish tendency for BNB however and it is currently trading at the $334 mark which is a 4.7% increase over a 24-hour period.

After having reached similar levels on 21 June, the Binance Coin price crashed and lost around 25% in a day to reach the $261 level. It has been on a steady rise since then as more buyers seem to be coming into the market. What is remarkable however is that both the Chinese and UK crackdown on Binance operations have had next to no effect on the price which continues to rise substantially.

Binance Coin Price Short Term Forecast: A Race to $400

The bulls have once again taken control of the Binance Coin price, at least for the moment. BNB is currently trading between the $330 and $340 level and is well poised to make a considerable breakthrough to the $350 mark after which a rally to $400 would be a distinct possibility.

The $321 retracement level has been well superseded so the next move would theoretically be a leg up to the $345 level followed by the $365 mark. That would certainly indicate bullish momentum and the possibility that the Binance Coin price would be gaining another leg up to the $400 level.

This bullish thesis would be invalidated if the Binance Coin price would eventually lose support and sink below the $321 mark. This could signify a 10% retreat to just under the $300 mark at $298.50 or even a further collapse to the support level of $271 which be a 20% decline from its current price. Having said that, this bearish thesis does not seem very likely, and the bulls are expected to prevail short term.

FUD, BNB and All That

This is perhaps the first case where FUD on a coin has had an opposite effect on price. Binance Coin has shrugged off all sorts of threats from the UK regulatory agencies as well as banks to continue on its recovery road. The latest financial institution to join the fray was Barclays Bank who on Monday issued a statement where it banned its customers from transferring any money to the Binance cryptocurrency exchange.

The bank said that they would be stopping payments that were made through credit or debit cards to Binance. This is being done – according to the bank – to keep its clients’ funds safe. The move fuelled derision on social media with many Barclay’s clients telling them in no uncertain terms that they’ll be taking their money elsewhere. And again there was no effect on the price of Binance Coin other than pushing it upwards.