- Binance Coin price tags all-time high but fails to gain traction.

- Symmetrical triangle breakout estimates a measured move of 35%.

- Daily active addresses plummet during latest rebound.

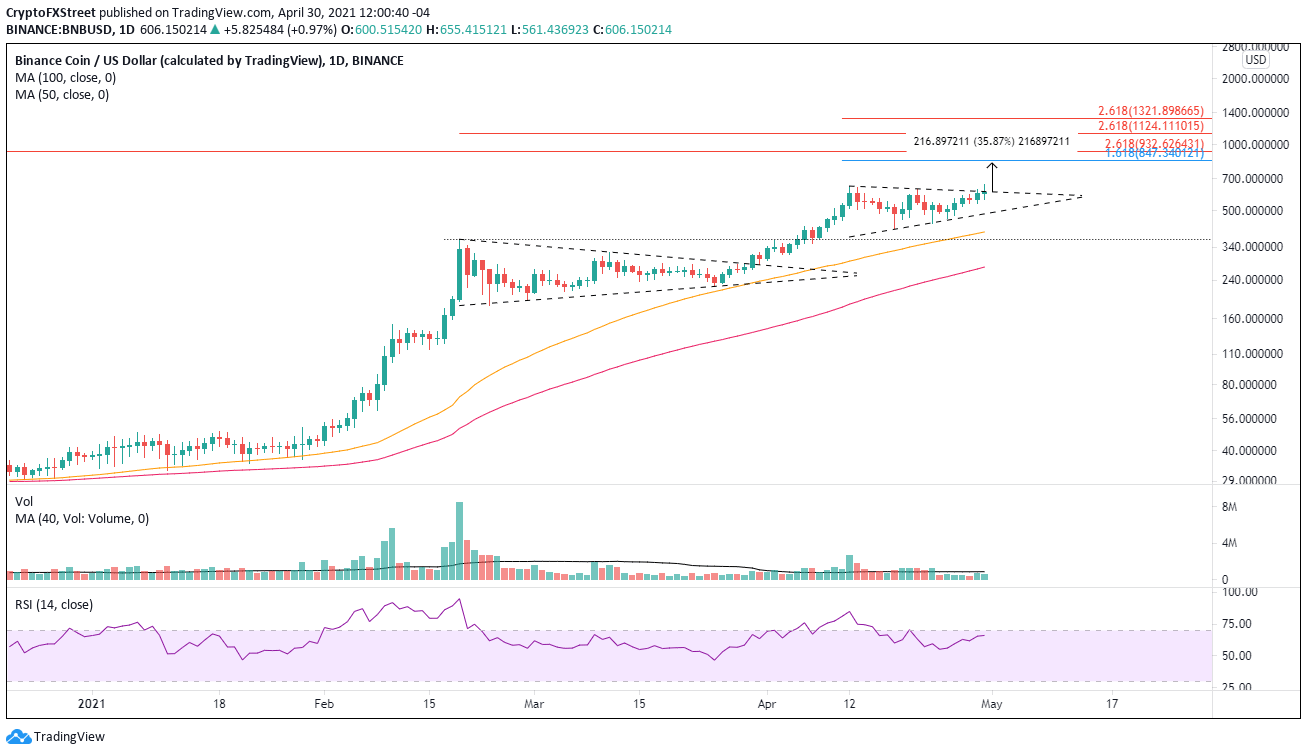

Binance Coin price projects a measured move of 35% from the symmetrical triangle trigger price. Today’s first breakout attempt proved to be indecisive, leaving BNB to drift back into the pattern.

Binance Coin price on pace for the fourth-best month since 2017

April was an exciting month for the cryptocurrency market, highlighted by several 50% declines. BNB also fell with the collective sell-off, but its performance on a relative basis was striking and paved the way for today’s breakout.

Binance Coin price is currently up 99.71% for April, making it the fourth-best monthly return since July 2017 and the sixth consecutive positive month. The altcoin is also on pace to close the week up 20%. The numbers reflect tremendous relative strength and position BNB as a leader if the broad rebound continues in the cryptocurrency market.

At the moment, CoinMarketCap shows a BNB market capitalization of $92 billion, the third-largest cryptocurrency, suggesting it would be in the spotlight, but that is not the case. The digital token has quietly outlined a symmetrical triangle pattern with a measured move target of just over 35%, targeting a price of $847.25 from the current position of the triangle’s upper trendline. The target correlates closely with the 161.8% Fibonacci extension of the April decline at $827.48.

The April 12 high at $643.37 offered some stubborn resistance earlier today and remains the critical barrier to Binance Coin price reaching the measured move target. Beyond $827.48, speculators need to consider the 261.8% extension of the 2019-2020 bear market at $932.62.

Big game hunters can target the 261.8% extension of the February crash at $1,124.11.

BNB/USD daily chart

In February and April, the crypto space has reminded market operators of the need for sound risk management preparations. A failure of the breakout would flip attention to support. Critical support begins at the triangle’s lower trend line at $484.68, followed by the 50-day simple moving average at $399.35 and the February high at $368.17.

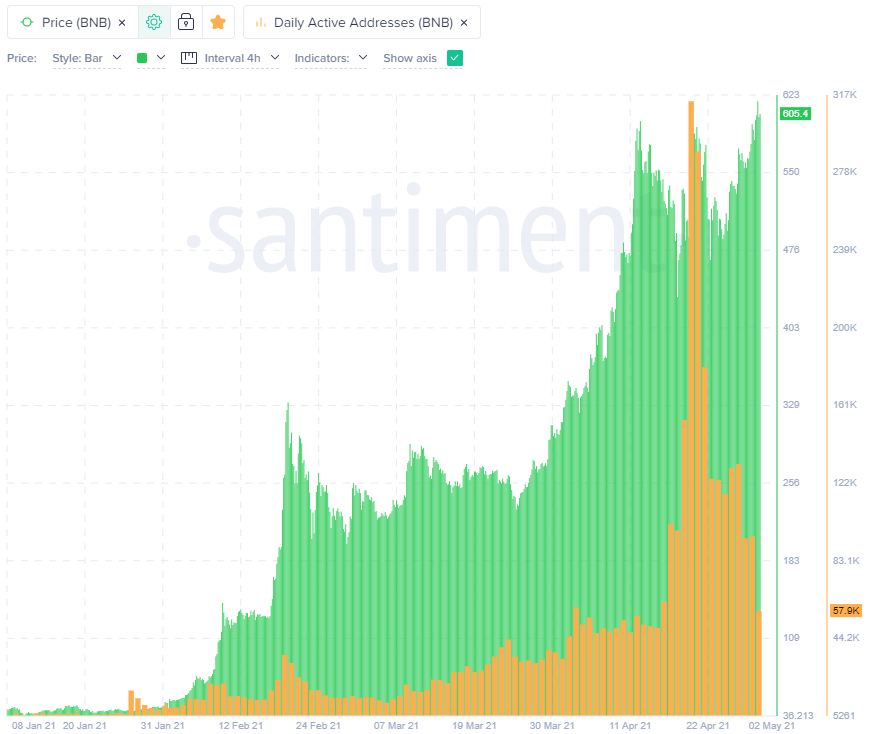

To corroborate the importance of solid risk management in any investment methodology, the number of daily active addresses has fallen from a high of 313.4K on April 20 to 57.9K as of today, representing an 80% decline. A bearish development considering that BNB was on the doorstep of an all-time high.

The sharp decline in addresses connecting to the BNB network illustrates a general exodus of speculators based on profit-taking or a simple reallocation of funds. Moreover, it implies that Binance Coin price may need to reset inside the triangle before achieving a sustainable breakout.

BNB daily active addresses

The technical evidence reinforces a bullish BNB outlook, but the on-chain metric of daily active addresses does raise caution regarding the altcoin’s intentions in the immediate future.