- Bitcoin price had a sell-off down to $28,850 but bulls quickly bought the dip pushing it above $32,000.

- Several major indicators show that the crypto market has reached a local bottom.

On January 21, 2021, the entire crypto market lost close to $200 billion in market capitalization in less than 24 hours. Bitcoin has actually lost even more dominance over the market and stands at only 64% compared to the yearly high of 72.7%.

On-chain metrics suggest crypto market reached local bottom

One of the best indicators of potential buying opportunities is the number of long vs short positions. According to recent statistics from Santiment, the ratio between BitMEX longs and shorts has been neutralized.

BTC and ETH funding rates

This metric shows that long positions no longer dominate shorts and the funding rates have become neutral or even negative. The funding rate is essentially a payment that traders that are long or short have to pay based on the difference between spot and futures prices. A neutral rate allows traders to initiate long positions without having to pay a premium, which means it’s just cheaper.

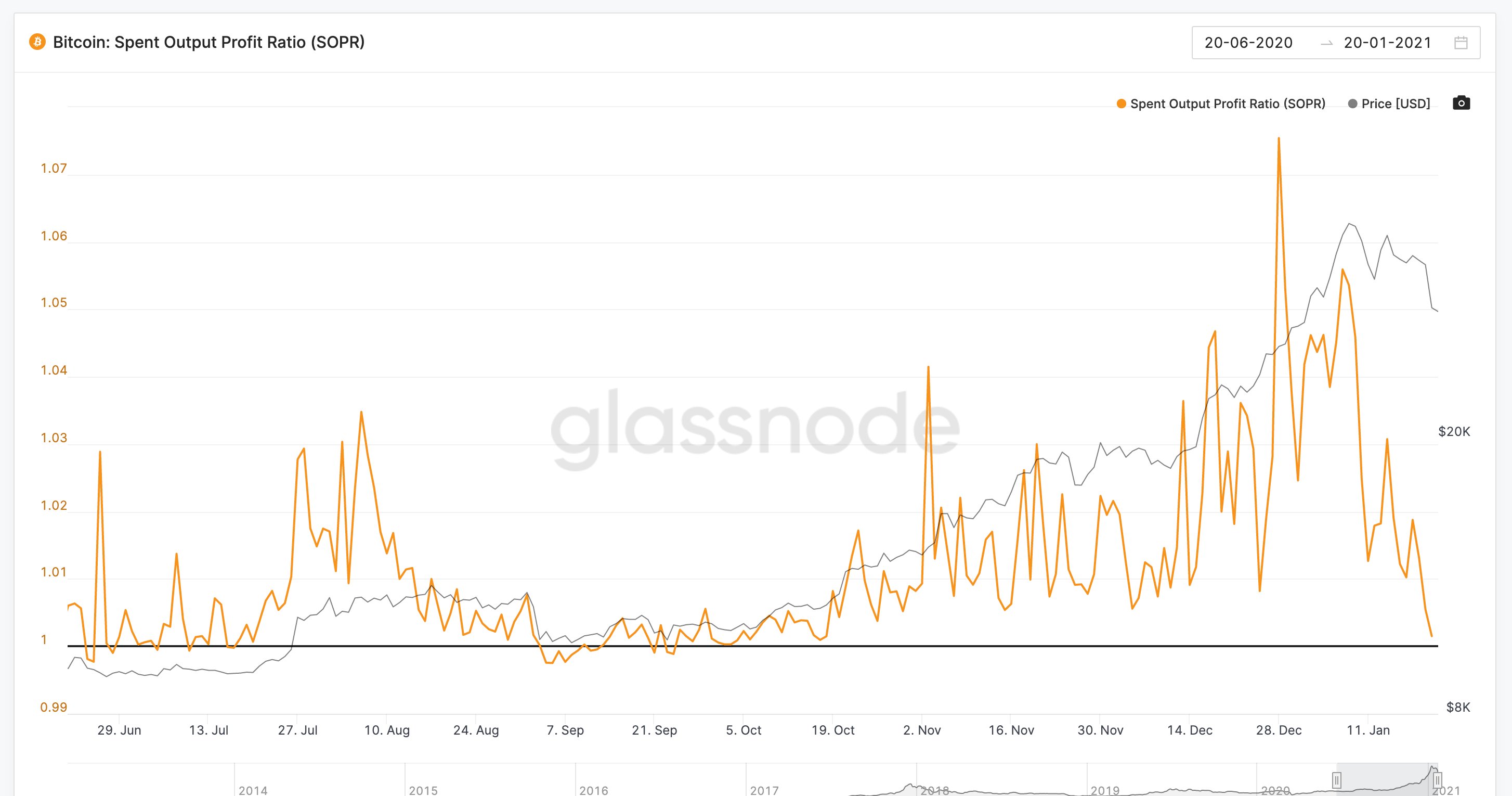

Another crucial indicator of the recent local bottom was the SOPR (Spent Output Profit Ratio) indicator. It basically represents the profit ratio of coins, which is the difference between the purchase price and sale price. A SOPR value higher than one, means investors are selling at a profit on average, below one implies they would sell at a loss.

SOPR Indicator

For the first time since October 2020, the SOPR has cooled off and touched one again, which implies most traders wouldn’t profit from selling anymore.

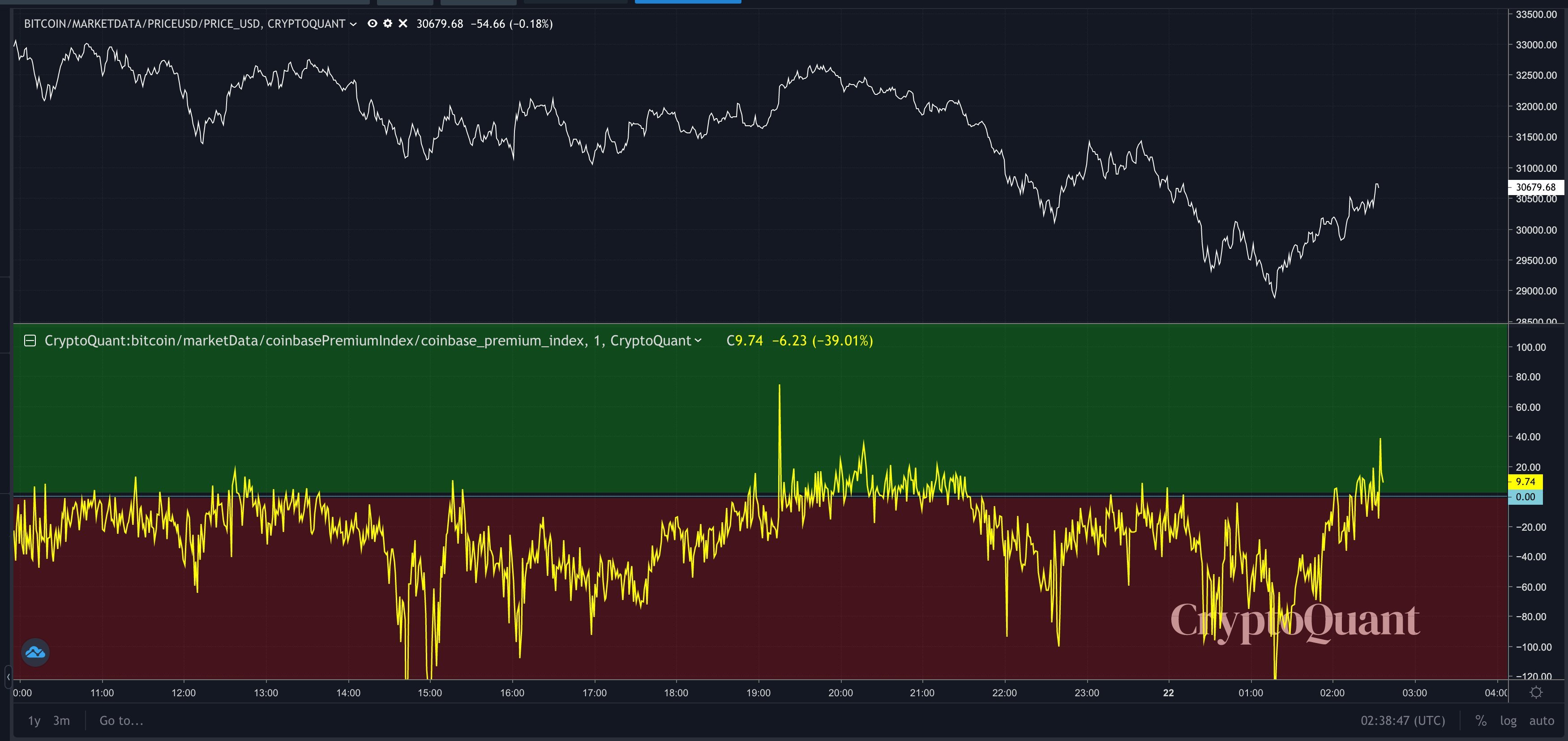

Coinbase Premium Index

Additionally, the Coinbase Premium Index is notably positive again, which indicates that spot buying pressure from Coinbase is stronger. This premium index measured by CryptoQuant is the gap between Bitcoin price on Coinbase and Bitcoin price on Binance.

Meanwhile, veteran trader, Peter Brandt, indicated that the recent dip was healthy and expected. According to Brandt, BHLD (Bump, Hump, Lump, Dump) analog pattern, Bitcoin price was poised for a dump after the ‘Lump’ spike to $40,100.

%20%5B16.57.32,%2022%20Jan,%202021%5D-637469284645955373.png)