- Experts agree that the incoming Bitcoin rally is different from previous cycles.

- Onchain metrics confirm $19,000 as a significant resistance for Bitcoin.

The cryptocurrency market has anticipated Bitcoin’s current price level as it sits a few thousand dollars away from the previous high. Peter Brandt, Mati Greenspan, and Tones Bays are thought leaders in the industry who have expressed their views on this bull run.

Peter sees it as nothing beyond a solid confirmation that the Bitcoin bull run has begun.

The importance of Bitcoin seeing new highs

The momentum in the price action has seen a lot of deliberations amongst various market participants lately. In a panelist session, experts in the cryptocurrency industry expressed their views on the market’s current state.

The CEO of Factor LLC, Peter Brandt, stated in the conversation that this price level only serves as strong verification that Bitcoin has most likely re-emerged into a significant bull trend.

“I think it’s remarkable that we’ve started up there. That’s just the verification that we have started a bull market, looking at all kinds of markets, the nature of the bull market is that you go up and challenge previous all-time highs and manage to find your way through it.” He said.

The founder of Quantum economics, Mati Greenspan, felt differently, saying that he is excited about a $20,000 Bitcoin price.

Mati stated that it depends on how Bitcoin breaks that $20,000 level. He said that merely touching the price level might not be a good sign because it might slow things down slightly with this sign of exhaustion.

But an effortless break out through this point will have a more significant impact on Bitcoin as it would be a pointer to the market’s level of confidence at this point. This is because this is a significant psychological resistance level for the digital asset, instead of a false or shy breakout.

Blockchain consultant and researcher Tone Vays agreed with Matis, stating that taking the trade of a para swing high breakout is a lot safer than trying to time the high. He added that unlike previous bull runs, the media hype around the digital asset is more justifiable with events such as halving, Bitcoin birthday, and imminent break out from all-time high.

Tone stressed that without a proper correction of at least 30%, between $10,000 and $20,000, Bitcoin price would remain at risk of losing steam in recurring the cup and handle patterns as it attempts to breakout.

The growing media hype around Bitcoin is different this time

Many mainstream media are now commenting on the latest Bitcoin performance, causing it to skyrocket further. Peter Brandt said that the media effect is yet to fully take effect as we are not seeing a rush of new buyers yet.

“As prices go up, we get more coverage, which will also increase awareness and ultimately have increased network effect.” He also added that “We have seen some interest obviously from people googling Bitcoin, I’ve got calls about Bitcoin, but I don’t think at this point we’ve seen the kind of mass hysteria which we saw Dec of 2017.”

A look at what Onchain data shows

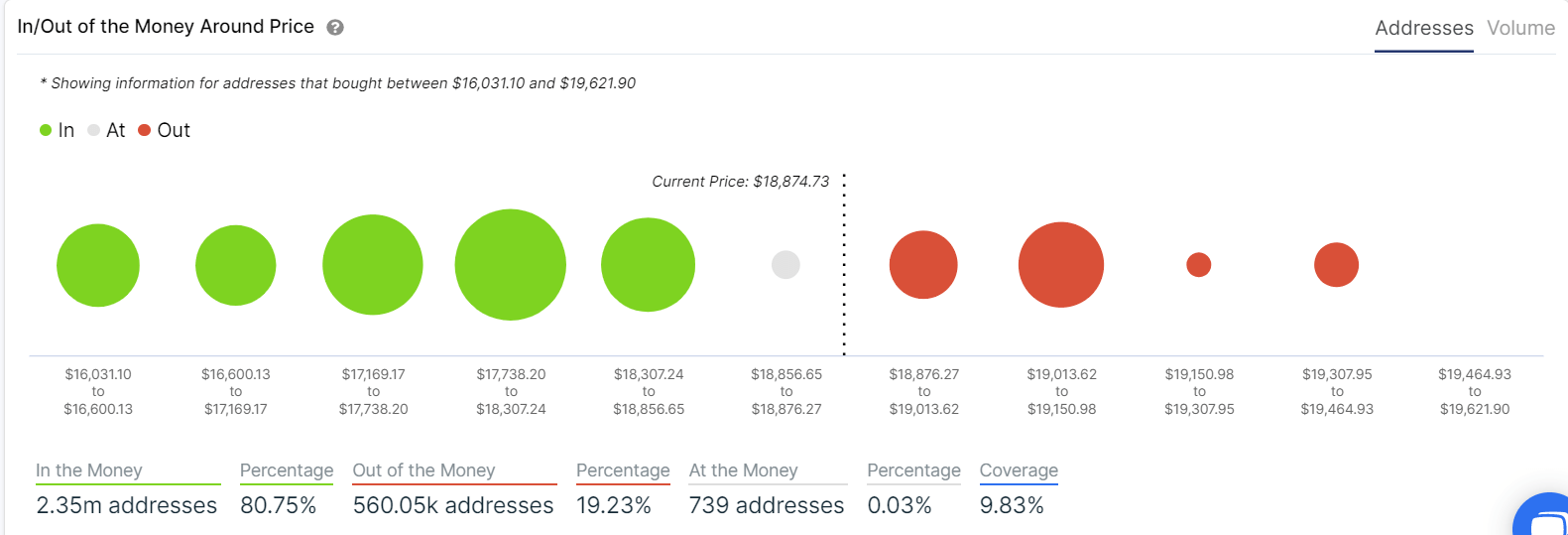

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that $18,500 plays a key role in Bitcoin trend after the retracement. Transaction history shows that this is the largest support level holding the pioneer cryptocurrency from a further dip. Here, over 460,000 addresses had previously bought up more than 257,000 BTC.

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model

Given these numbers, the odds currently favor a pessimistic short-term outlook on Bitcoin price. The IOMAP cohorts model shows some mild resistance ahead if there is a major upwards movement. Roughly 175,000 addresses hold 69,000 BTC at the $19,000 region. However, the major resistance sits at $19,100, where 349,000 wallets hold over 320,000 BTC, meaning that it would require an enormous amount of buying pressure to send prices higher.