- Bitcoin recovered strongly into the end of the week.

- There are several factors that might have caused the stellar growth.

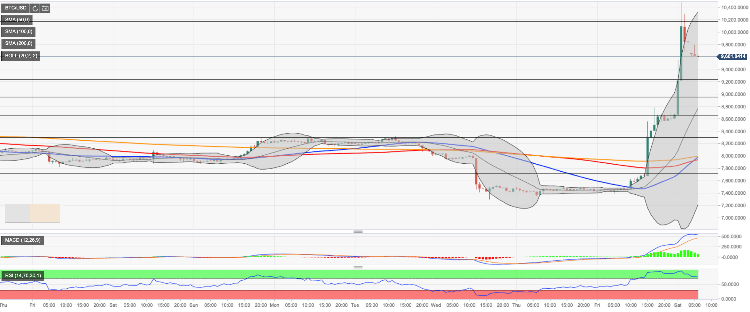

Once again, bitcoin demonstrated its unpredictable nature by growing above $8,600 handle in a matter of hours and eventually topped at $10,484 during early Asian hours on Saturday. The digital coin had been passing time in a tight range above $7,400 during early Friday hours. However, the market situation started to change when the European players joined the game and turned into a snowball ahead of the US hours.

The charts show that the sharp upside movement was accompanied by a strong growth of trading volumes, which is often considered as a signal of a trend reversal.

While the true fundamental reasons behind the stratospheric growth are buried in mystery, there are some factors that might have created a favorable situation for Friday developments.

It is all about BitMEX

The trading platform for leveraged cryptocurrency instruments BitMEX registered a massive short squeeze. The positions worth of $200 million were liquidated within the recent day and set the bull’s ball rolling.

Notably, the recent price collapse might have also been caused by BitMEX positioning as a huge long position was liquidated on the platform right before the sell-off.

Read more about this.

Bakkt inspired some volatility

Bakkt Volume Bot reported that the trading volumes on the platform reached a new all-time high at 770 contracts, which is 42% higher from the previous day. While the correlation between Bakkt volumes and Bitcoin price is vague, the signs of growing institutional interest might have supported the upside momentum.

Read also: Bakkt trading volumes hit all-time high as Bitcoin collapsed

Tether is involved

Notably, Tether Treasury has recently minted new coins worth of $16 million on the TRON blockchain. Traders believe that a large number of new coins injected in the system tp be converted into other cryptocurrencies, which is a clear bullish signal.

A large number of new USDT being minted is often taken as a bullish sign by traders and market analysts since it can be assumed that these tethers will enter the market to be exchanged for cryptocurrencies.

At the time of writing, BTC/USD is changing hands at $9,600, up 27% on a day-to-day basis. The coin hit $10,484 high on Saturday before retreating to the current levels.