- A critical resistance of $10,000 is still out of reach.

- A massive long position liquidated on BitMEX, might have caused the strong bearish move on the spot market.

Bitcoin (BTC) managed to recover from the recent low of $9,112 touched during a sharp sell-off on Sunday. BTC/USD is changing hands at $9,643, having gained about 1.6% on a day-on-day basis. Despite the recovery, the first digital coin is still significantly lower on a week-on-week basis (-9%).

Meanwhile, some experts believe that BitMEX might be behind Bitcoin’s Sunday collapse. As the stats data shows, the sell-off coincided with the liquidation of a massive long position worth of $100 million on BitMEX. As BitMEX supports trading with 1X100 leverage, the effect of the sell-off was multiplied accordingly.

The industry experts have already noticed that the trading platform developments influence Bitcoin price movements.

“Bitcoin down as @BitMEXResearch unwinds highly leveraged positions. When I interviewed CryptoHayes he said the avg. leverage (on a scale of 0-100x) was 20. Extrapolating that number, adding recent outflow data, and you get a (temporary) inferred BTC price of $8,800 – $9,300,” Max Keiser noted recently in his Twitter.

Bitcoin’s technical picture

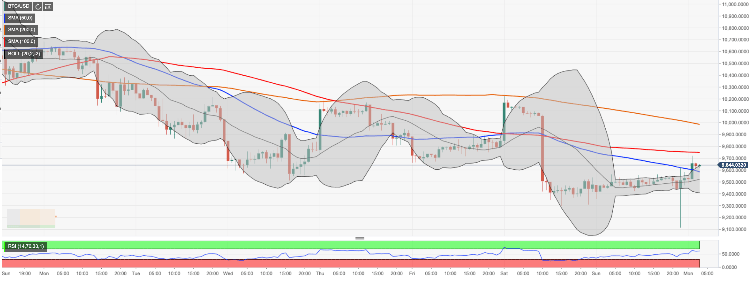

Meanwhile, BTC/USD recovery is capped by $9,750. This barrier is strengthened by SMA100 (Simple Moving Average) 1-hour. Once it is out of the way, the upside is likely to gain traction with the next focus on psychological $10,000 with SMA200 1-hour located on approach.

On the downside, a sustainable move below $9,500 (SMA50 1-hour, the middle line of 1-hour Bollinger Band will push the price towards the initial support of $9,400(the lower edge of 1-hour Bollinger Band) and towards the recent low of $9,112.