- Bitcoin Cash bulls awoken ahead of the hard fork scheduled for November 15.

- BCH/USD recovered from the lows around $410 to test the resistance at $600.

- The bull rally is expected to progress as speculators take their positions in the market.

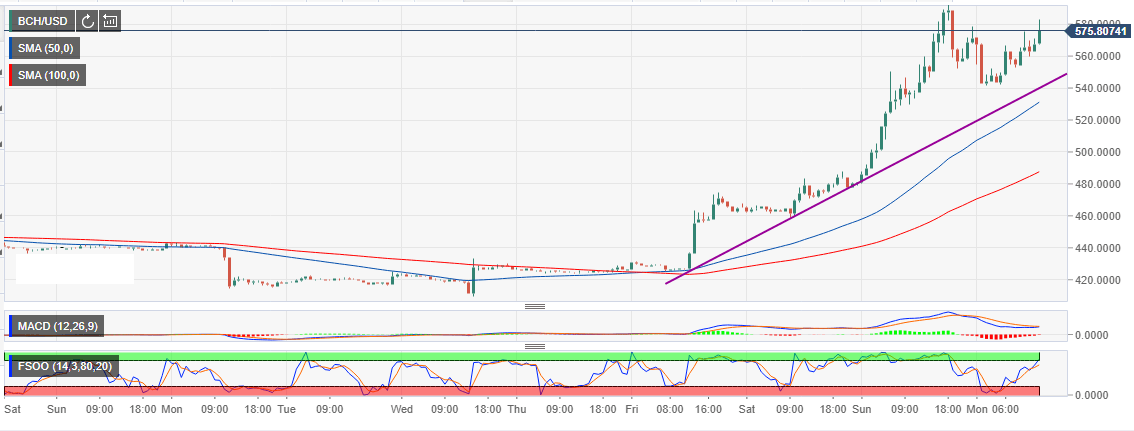

The entire market recovery faintly yesterday, although Bitcoin Cash led the recovery with an incredible upswing. In the past few weeks that price has been locked below $440 while the declines suffered on the previous Tuesday saw drop below the support at $410 and formed a low around $408 before the bulls battled for a pullback. The resistance at $440 hindered growth, fortunately the moving average support was strong enough to keep the price above $420.

The brief rally commenced on Saturday this week as Bitcoin Cash zoomed past $440 and $460 respectively. More gains on Sunday blasted above $500, likewise, the unstoppable bulls tested the resistance at $600 but the price formed a high at $493. Corrections from the monthly high have been protected at $540.

At press time, BCH/USD is trading at $577.52. There are strong buy signals from the indicators applied to the 1-hour chart. For instance, the fast stochastic oscillator is entering the overbought signals, to show that bulls can increase their entries. A mixed signal from the MACD shows that the bears are present in the market, although their influence cannot match that of the bulls.

The above bull ran is mainly fueled by the incoming hard fork scheduled for November 15. This hard for will see the Bitcoin Cash network give birth a new coin. It is believed that investors in the market are taking their positions in order to benefit from the surge ahead of the hard fork. Holders of Bitcoin Cash are expected to receive an equal number of the new coins in comparison to the BCH they hold. One thing that is clear is that speculators in the market are trying to reap from the hard fork ignited surge.

BCH/USD 1-hour chart