- Bitcoin Cash miners may be obliged to transfer some of their returns to a dedicated fund.

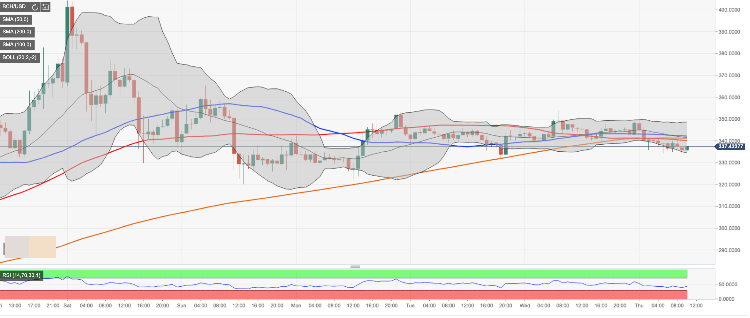

- BCH/USD stuck in a tight range moving with a bearish bias.

Bitcoin Cash, the fourth largest digital asset with the current market value of $6.1 billion has lost 2.5% in the recent 24 hours amid global correction on the cryptocurrency market. At the time of writing, BCH/USD is changing hands at $335, off the recent high registered at $404.

Over 90% of Bitcoin Cash holders are making money now, according to the cryptocurrency data service Intotheblock. It means that at this stage it is one of the most profitable assets for long-term investors. Notably, about 92% of BCH addresses have a weighted average holding period over a year as compared to 63% registered for Bitcoin.

Bitcoin Cash moves to a centralized totalitarizm

However, the Bitcoin Cash community is now discussing the idea of miners donating part of their profits to the ecosystem development. The idea was introduced by Jiang Zhuoer, the CEO of the largest BCH mining pool, BTC.TOP. He suggested that all miners should voluntarily transfer 12.5% of their block rewards to a dedicated fund that will finance the infrastructure development of the project.

Other large mining pools, including Antpool, BTC.com, ViaBTC и Bitcoin.com, supported the idea. Their aggregated computing power amounts to two-thirds of the total network.

Notably, the community was not so happy about the suggestion. Many industry players pointed out that this move would lead to the network centralization, while a popular crypto twitter influencer Whale Panda called it “a centralized totalitarian regime with a 51% attack threat.”

The feature may be implemented in May, together with the scheduled network update. The participation in the initiative is promoted as a voluntary, however, those who will choose to opt-out will be orphaned from the network.

To ensure participation and include subsidization from the whole pool of SHA-256 mining, miners will orphan BCH blocks that do not follow the plan. This is needed to avoid a tragedy of the commons.

BCH/USD: technical picture

BCH/USD stays close to the local support created by the lower line of 1-hour Bollinger Band at $335. Once it is broken, the upside is likely to gain traction with the next focus on $320 (January 20 low) and psychological $300.

On the upside, a formidable resistance is created by a confluence of 1-hour SMA levels on approach to $350. We will need to see a sustainable move above this area for the upside to gain traction with the next focus on $400 reinforced by the upper line of the daily Bollinger Band.