- Attempts to break $470 resistance fail the sellers find an entry.

- The critical resistance is at $470 while the ultimate intraday resistance is the $500.

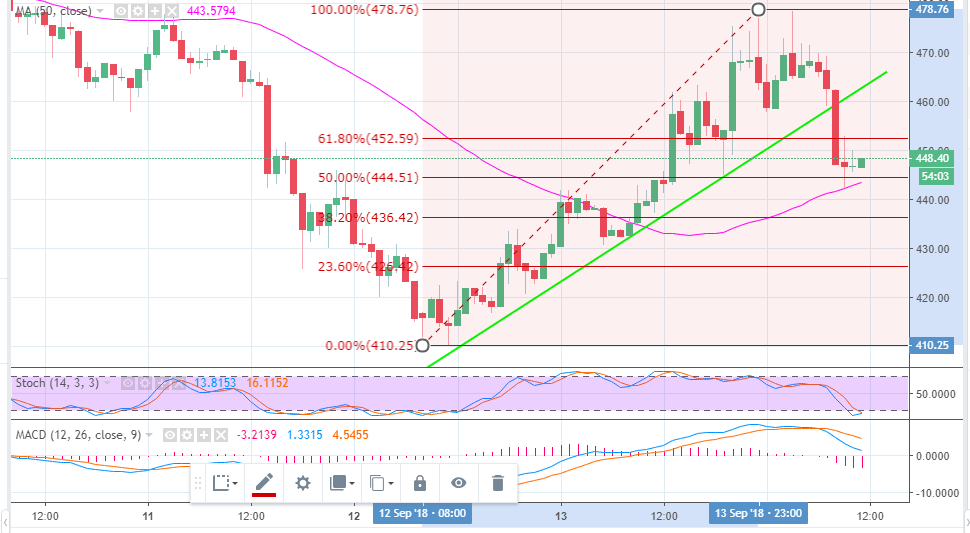

Bitcoin Cash graceful ascent has come to a sudden halt at $470. The bulls regained control of the price on Wednesday after defending the lifeline support at $410. Bitcoin Cash continued trading higher highs and higher lows on Thursday. After the bullish trend stepped above $460, attempts to break above $470 were rendered unsuccessful.

Bitcoin Cash is a $7 billion cryptocurrency currently ranked 4th on CoinMarketCap. It has a trading volume of $408 million. The bears are increasing their grip at the moment, besides it has corrected lower 3.19% on Friday. In the last 24 hours, the majority of Bitcoin Cash trading volume went through BitForex (61.07%) in BCH/USDT pair.

There was a sharp decline from the upper limit at $470 below the trendline support at $460. Bitcoin Cash is on its feet after finding support at the 50% Fib level of the last upward swing of $478.43 and a downward swing of $410.25. Likewise, the hourly 50 simple moving average highlighted at $442.85 will offer support at $442. If declines progress $430 and $410 are in line to offer additional support.

Looking at the chart, there is a weak bullish trend forming above $445 towards $450 (immediate resistance). The critical resistance is at $470 while the ultimate intraday resistance is the $500. The sellers are showing signs of exhaustion and this is a perfect time for the buyers to entry and push for higher corrections.

BCH/USD 1-hour chart