- 2018 was the year of correction in the crypto market.

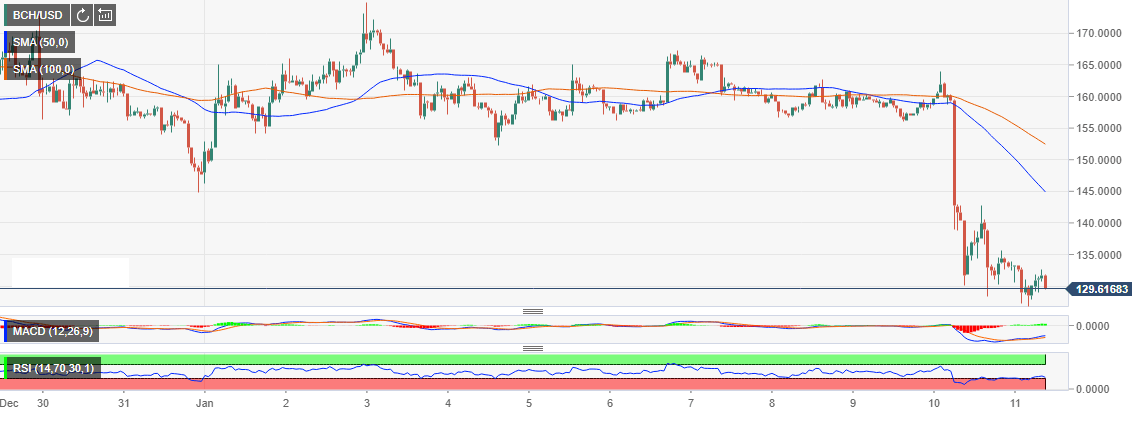

- Bitcoin Cash corrected lower breaking below the short-term support at $160.

Bitcoin Cash price is still quite volatile following the hard fork split that took place in November last year. The asset is yet to find balance in a market that still heading south. Last year was called the year of correction for the cryptocurrency market. According to the expert analysis at Finder.com, Bitcoin is expected to close the month of January trading at $3,494. Other assets alike, will record losses except for Stellar and Cardano.

Find the full prediction story here: Stellar (XLM) Cardano (ADA) to see highest growth in January – Finder.com predictions

Mid through this week, there was a sudden break that saw Bitcoin Cash corrected lower breaking below the short-term support at $160. The larger market dumped $16 billion in less than 24 hours. However, in the last 24 hours, the same market is recording slight gains of $2 billion from $121 billion to the current $123 billion.

On the other hand, after Bitcoin Cash tail-spin below the hourly Simple Moving Averages (SMA), the bulls have taken solace in the support at $130. Attempts to reverse the trend have been thwarted by the seller concentration at $135. In fact, at press time, the aforementioned support is being tested.

Taking a broader look at the chart, we see that the bulls have begun preparing for a comeback. The Moving Average Divergence Convergence (MACD) is recovering from the low formed at -6.03 to the -3.3. The same recovery is seen in the Relative Strength Index (RSI) on the same chart. The RSI is currently holding ground above the oversold region.

BCH/USD 1-hour chart