- The body has reason to believe that regulations are beneficial to customers in the industry.

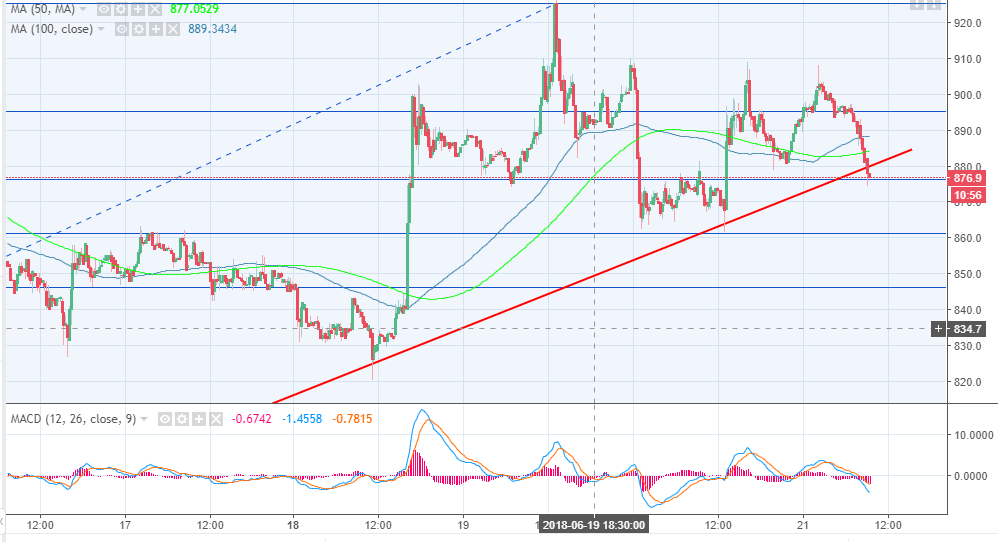

- Bitcoin Cash price is supported by the 38.2% Fibo, but further downside correction expected in the short-term.

Bitcoin Cash price has been restricted below $930 for over a week now owing to the extended selling pressure that commenced two weeks ago. Moreover, the support provided by the 23.6% Fib retracement level with the previous swing high of $925 and a low of $801 around $895 failed to hold during the declines on Thursday.

CryptoUK, the self-regulatory body in the United Kingdom has been reported have warned the members of Parliament regulate the crypto industry. Failure to which, the government is going risk being left out “on the biggest technology since the internet.” Iqbal V. Gandham, chair of CryptoUK which is made up of CEX.IO, BlockEx, Coinshares, CommerceBlock, eToro, CryptoCompare and Coinbase. The body has reason to believe that regulations are beneficial to customers in the industry. While on call with the Treasury Select Committee and UK government, Iqbal V. Gandham said:

“Regulating the point where cash is converted to crypto and vice versa is a simple solution to the serious concerns currently tarnishing this technology.” He added, “It offers a clear means to tackling illegal activity and protecting consumers, whilst enabling the best of this industry to flourish. We made this mistake to our cost 25 years ago with the rise of the internet – the UK economy cannot afford to do so again. Regulatory certainty is crucial to promoting innovation for the future.”

Bitcoin Cash technical picture

At the time of writing, Bitcoin cash has broken below the bullish trendline and is trading at $878. The buyers are battling to find a support at the 38.2% Fibonacci retracement level. Further downside corrections are expected in the short-term. Besides, the gap between the 50 SMA and the longer term 100 SMA is increasing. The MACD momentum indicator is moving further in the negative region to show that the Bears have the influence in the medium -term.