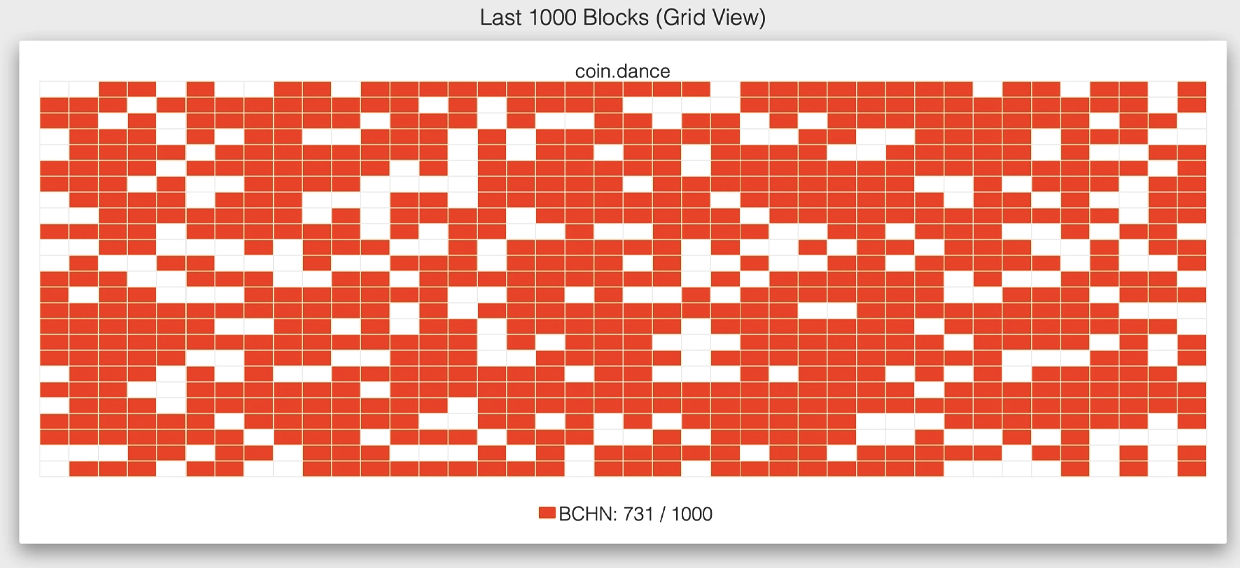

- 731 of the last 1,000 Bitcoin Cash blocks were mined using BCHN.

- The 3-day chart for BCH has flashed the sell signal.

As previously reported by FXStreet, Bitcoin Cash is on the verge of a hard fork as the protocol readies itself to split between BCH ABC and BCHN. As per Coin Dance, it looks like the majority of the miners are heavily favoring the BCHN protocol. It seems like 73% or 731 blocks out of the last 1,000 was mined using BCHN.

The price outlook

Bitcoin Cash found support at $240 and rose to $276 between October 21 and October 24. Since then, the price experienced a severe downturn as BCH plummeted to $260, as of press time. Further downward movement will probably be inhibited by the 100-day SMA ($256.25), 200-day SMA ($247) and 50-day SMA ($236).

BCH/USD daily chart

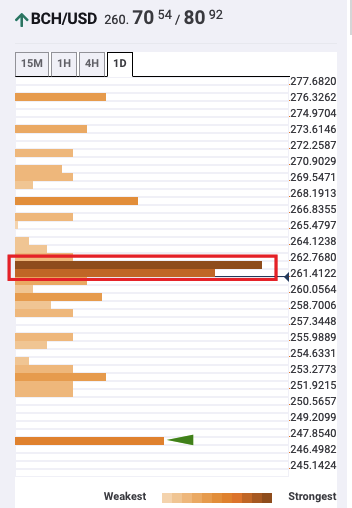

The daily confluence detector shows that the price faces an immediate resistance stack between $261 and $262, which stops any further movement. The strongest support lies at the 200-day SMA ($247). So, even if the price breaks below the 100-day SMA, the downside is capped at $247.

BCH daily confluence detector

The 3-day chart adds further credence to our bearish outlook. As you can see, the price has flashed the sell signal in the TD sequential indicator. In this time frame, the downside seems to be at the 50-bar SMA ($250).

BCH/USD 3-day chart

The Flipside: Do the bulls have any hope?

The encouraging sign for BCH investors should be the fact that the whales seem to be religiously buying the dump. The number of addresses holding 10,000-100,000 tokens rose from 164 on October 25 to 168 on October 27. While this jump may not seem that significant, keep in mind that these addresses are holding hundreds of thousands to millions of dollars worth of BCH.

BCH holders distribution

Key price levels to watch

The bears will attempt to push BCH down to the 200-day SMA ($247), which provides strong enough support to prevent any further downturn.

For the buyers, they will need to flip the $261-$262 resistance barrier to support. Following that, they will be able to take the price up to $275.

-637393648719875193.png)

-637393649423684422.png)

%20%5B07.24.11,%2027%20Oct,%202020%5D-637393650077815124.png)