- The surge in the flow of Bitcoin from miners into exchanges after newly created blocks may threaten its bullish outlook.

- Meanwhile, the rate at which investors troop into Bitcoin keeps increasing even after crossing $20,000, leaving little or no room for a negative effect on the price.

- Several on-chain metrics continue to reinforce the case of an upward movement for the pioneer cryptocurrency.

As Bitcoin fundamentals continue to look brighter, several indicators are also giving signals pointing to the possible direction of the market in the future. However, none of these metrics change the bullish thesis of the digital asset.

Bitcoin price reflects mixed perspective

Data from on-chain analytics firm CryptoQuant reveals that Bitcoin’s movement from miners to exchanges has seen a steep increase recently, creating a possible streak of sell-off. While this conclusion may not be absolute, it increases the odds of adverse price action as miners seek to take profit.

-637437567170474982.png)

It could be surmised from historical records that these miner’s liquidations haven’t always been consistent with Bitcoin price dips, as they have also preceded some positive market movements. A similar scenario may play out this time as there is a long queue of investors waiting to exploit the slightest retracement, with more new corporate institutions now seeking to catch a piece of the action.

Ruffer investment company recently made its way to the growing list of firms diversifying into digital assets. In a memo to its shareholders, the management stated that 2.5% of its multi-strategy fund worth about $15 million had been allocated to purchase Bitcoin.

As financial institutions continue to add Bitcoin to their portfolio, another on-chain statistic from Santiment has also revealed two contrasting views at once. It reflected a significant decline in the number of addresses holding between 10,000- 100,000 BTC since November 19. In this same period, the holdings of smaller wallets revealed a different behavior as there was an increase in owners who possessed 0.001- 100 BTC.

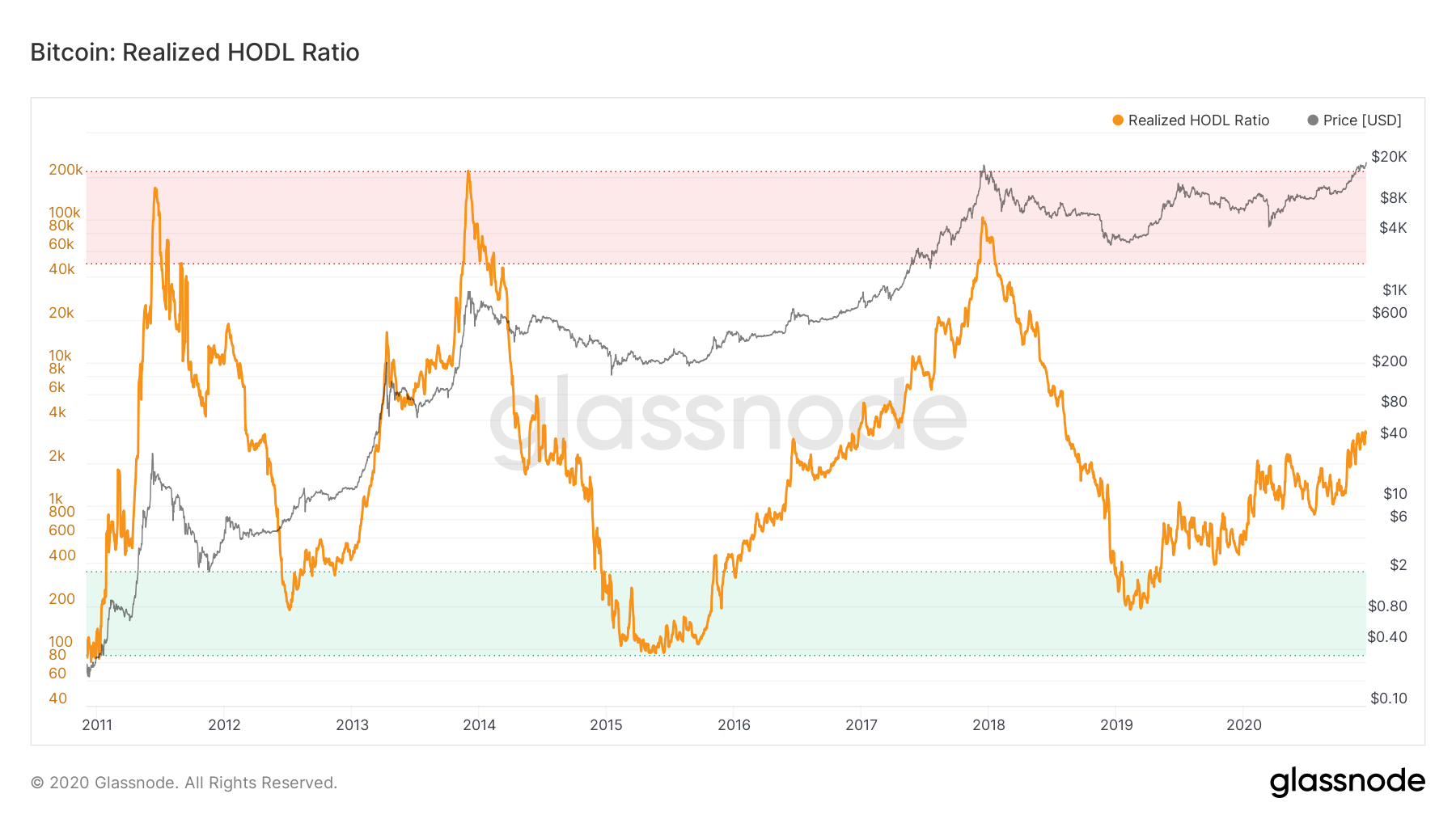

These opposing scenarios might mean a redistribution from huge buyers to smaller market participants such as retail investors. A peek into on-chain metrics aggregator, Glassnode indicates the fourth build-up of Bitcoin’s realized HODL ratio, also known as the RHODL Ratio. This indicator can be used to time cycle tops as the peaks of the last three bull runs have always corresponded with their all-time highs. Currently, this ratio is barely 3% of the 2017 mania, indicating a lot of room for growth left.

Bitcoin HODL ratio

Sentiments from Bitcoin investors shows that the significant price action is yet to kick in fully. More of this may begin to play out following the $20,000 line that was breached recently. In the meantime, long term parabolic moves of the flagship cryptocurrency continue to point north.