- Bitcoin is mature as an asset, but volatility hampers price forecasting.

- The pioneer cryptocurrency needs more money from the financial world to stabilize.

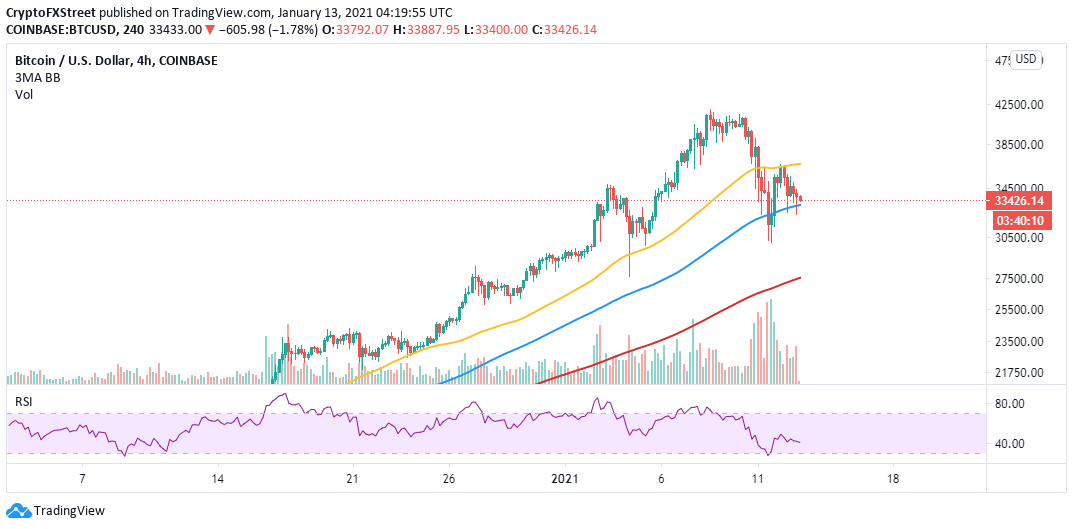

- BTC/USD struggles to hold above $33,000 as losses to $30,000 beckon.

According to Goldman Sach’s Jeff Currie, Bitcoin is showing signs of maturity despite the volatility that is being experienced. However, funds streaming in from the institutional investment sector are still minor compared to BTC’s gains accrued in the current bullish cycle.

Bitcoin needs more money from institutions to stabilize

Currie heads Goldman Sach’s commodities research and believes that the flagship cryptocurrency requires more funds from the financial world to stabilize. His comments come after Bitcoin, and the rest of the cryptocurrency market suffered a significant selloff on Monday, where more than $200 billion was wiped off the market value in less than 24 hours. Currie was talking to CNBC’s Steve Sedgwick in an interview on Monday, where he said:

I think the market is beginning to become more mature.

I think in any nascent market, you get that volatility and those risks that are associated with it.

He continued:

The key to creating some type of stability in the market is to see an increase in the participation of institutional investors, and right now they’re small… roughly 1% of it (the $600 billion invested in BTC at the moment) is institutional money.

Bitcoin’s value has also grown massively over the last few months topping out at an all-time high close to $42,000. The pioneer cryptocurrency is exchanging hands at $33,650 and is still up 17% since the beginning of the year. Ethereum, the largest altcoin, is trading at $1,045 and is up 42% from the start of the year.

Bitcoin’s store of value narrative gains traction

Globally, investors are starting to relate to Bitcoin as a store of value, just like gold. The pandemic being battled across the world has seen governments take drastic measures to cushion economies from tumbling. The devaluation of fiat currencies is worrisome to many investors looking for alternative investments like Bitcoin and other digital assets.

Renowned investors like Paul Tudor Jones and Stanley Druckenmiller have recently backed Bitcoin. At the same time, fund managers have also started to allocate a portion of their portfolios to the cryptocurrency sector, perhaps to take advantage of the spike in prices.

Large investment banks like JP Morgan are giving Bitcoin a lot more attention than before. Strategists at the bank recently predicted that Bitcoin could surge to $146,000. However, they caution that BTC must reduce the volatility to hit this price level.

The volatility in the Bitcoin market is making it difficult to forecast the price. Meanwhile, bulls have their attention channeled to holding the price above $33,000. Losses toward $30,000 are likely to come into the picture; especially now Bitcoin is trading below the 50 Simple Moving Average on the 4-hour chart.’

BTC/USD 4-hour chart

A break below the 100 SMA would call for more buy orders, thus increasing the overhead pressure. Support at $30,000 was recently confirmed, but if push comes to shove, Bitcoin may stretch to the primary support at $27,500.