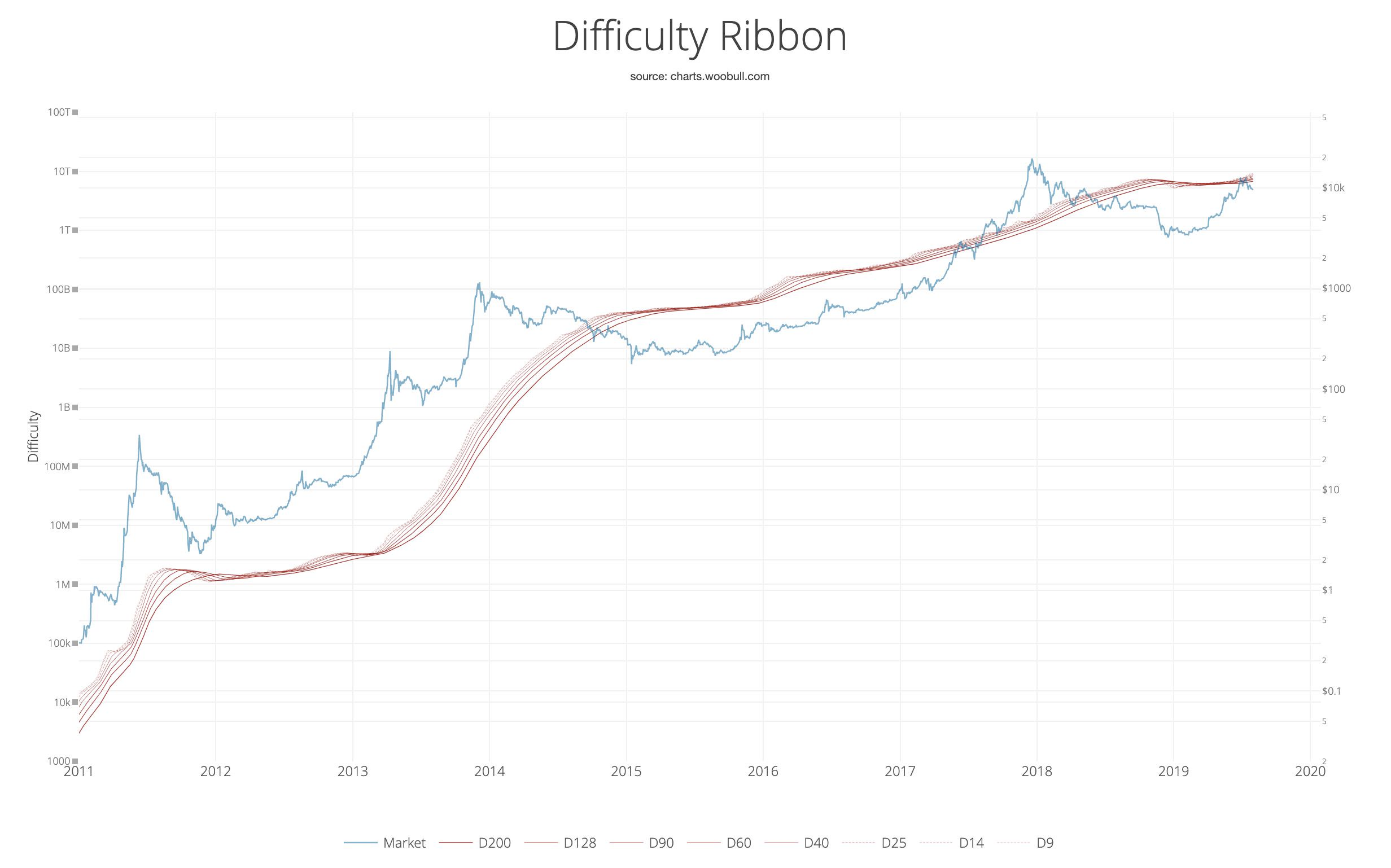

- Glassnode’s difficulty ribbon compressions metric is derived from Willy Woo’s difficulty ribbon.

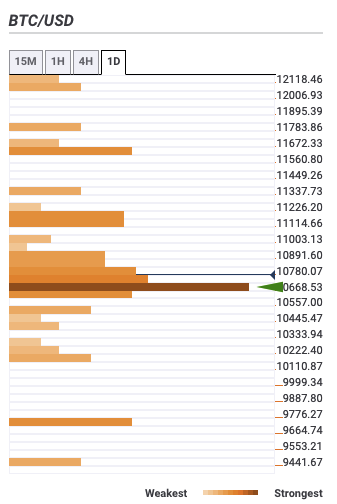

- BTC confluence detector shows a lack of strong resistance to $12,000.

Glassnode, a cryptocurrency analytics firm, tweeted the following this Monday, which has had the entire bitcoin community in a frenzy:

So, what exactly is this difficulty ribbon and how can it help us with our price prediction? Let’s take a look.

Bitcoin difficulty ribbon

As Glassnode notes, their difficulty compressions metric is derived from Willy Woo’s difficulty ribbon. Periods of high ribbon compression historically signal good buying opportunities. The ribbon has simple moving averages on mining difficulty, enabling us to understand and detect the rate of change in difficulty.

Difficulty is a hardcoded feature in the Bitcoin protocol that controls the ease of mining. Mining becomes more challenging when the difficulty metric increases. By visualizing network mining difficulty, one can see the impact of mining of BTC’s price.

How difficulty affects BTC’s price?

When miners mine new coins, they sell some of their holdings to stay in business. However, this usually generates selling pressure. Weaker miners tend to sell off a vast majority of their coins to remain in operation. This drastically reduces the price, making the whole mining operation non-profitable, forcing the majority of the miners to close down shop.

MIners are a vital component of the Bitcoin ecosystem. Mining activity is directly related to the hashrate of the system. For the uninitiated, hashrate is the computational power of the network. More the network hashrate, more the speed and overall security of the whole system. When miners leave the ecosystem, the network’s difficulty goes down, which prompts the overall difficulty to fall as well, causing the difficulty ribbon to compress. The strong miners, who have remained in the ecosystem, will no longer have to sell off a vast portion of their holdings to stay in business. This leads to an increase in bullish price action.

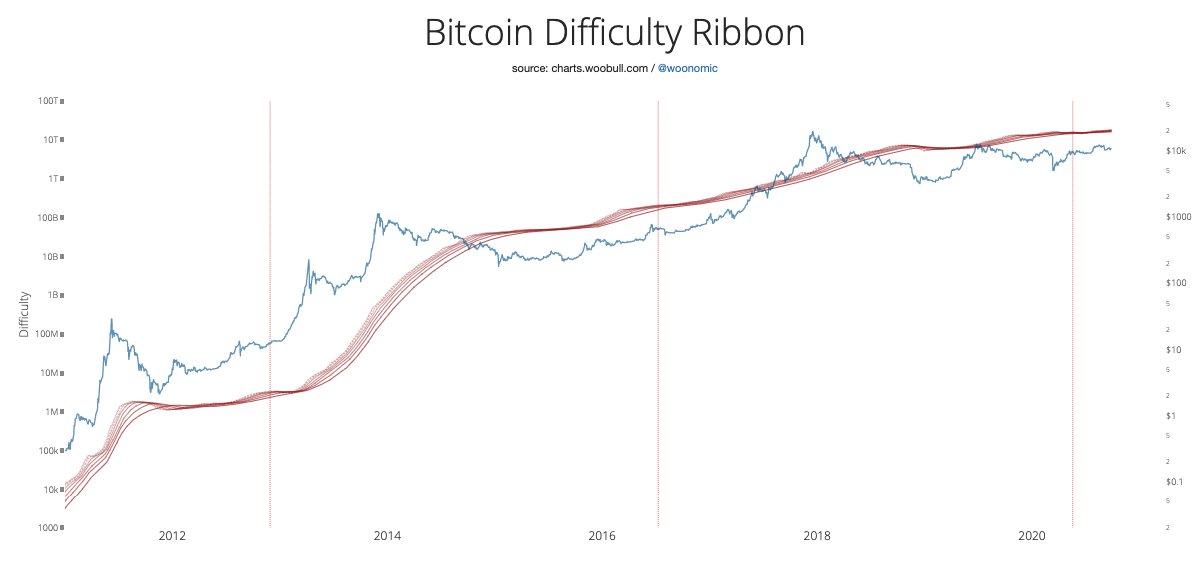

Difficulty ribbon and halving

So, how does the difficulty ribbon react to halvening events? In the chart above, the three vertical lines signify the three events. As you can see, during this time, the ribbon compressed after each event, showing that the miners left the protocol as mining became increasingly unsustainable. However, this eventually led to a rise in BTC’s price.

The situation as it stands right now

With the difficulty ribbon compression flashing a bullish signal, the time is now for the bulls to take action and exert complete control over the bears. Let’s look at the daily confluence detector to understand the upside, as it stands right now.

BTC daily confluence detector

As of now, BTC is trading around $10,715 and sitting on top of the $10,700 support level. The buyers need to do everything that they possibly can to defend this level. If the sellers break below this level, the price can plummet to $9,700 before it meets another healthy support.

However, on the positive side, the upside potential looks pretty terrific. There is a lack of strong resistance levels to $12,000. If the bulls take control, they can make some significant gains.