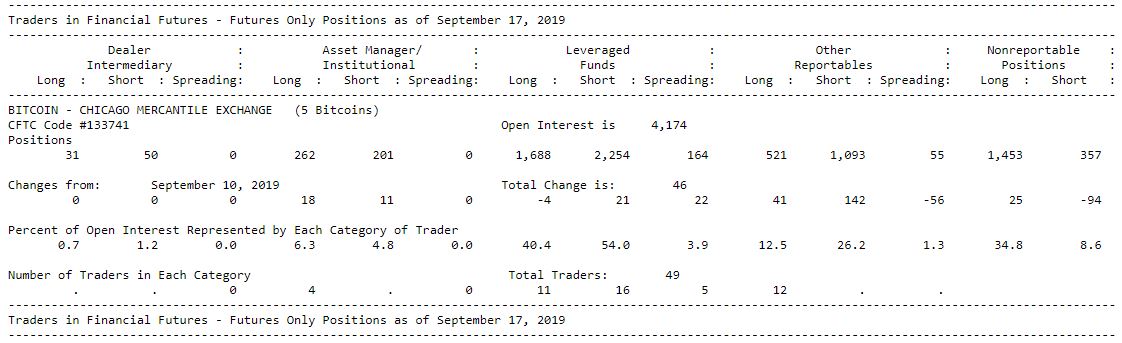

- Asset managers move to 262 vs 201 on the long side with an 18 vs 11 contract change.

- Leveraged funds move to the sell-side as shorts outweigh longs 2,254 vs 1,688.

- Leveraged funds trimmed long positions by 4 contracts and shorts added 21 contracts.

As Bitcoin hovers around 10k it seems that asset managers and leverage funds are just as confused as the rest of us.

The BTC futures contract is showing some bullish signs but cannot seem to gather any momentum once 10k holds.

Yesterday there was a strong rejection of the downside and today you would have been forgiven if you thought the momentum would continue.

Over the past few weeks, the volume has been drying up until the support seen yesterday. Next week could be key as the Bakkt futures contract is due to start trading (23rd Sept) so let’s hope things pick up then.