- Bitcoin Gold is trading in the green in spite of the market turning bearish on Wednesday.

- A short-term support is established at $20.60, although $20.20 is positioned to stop declines heading to $20.00.

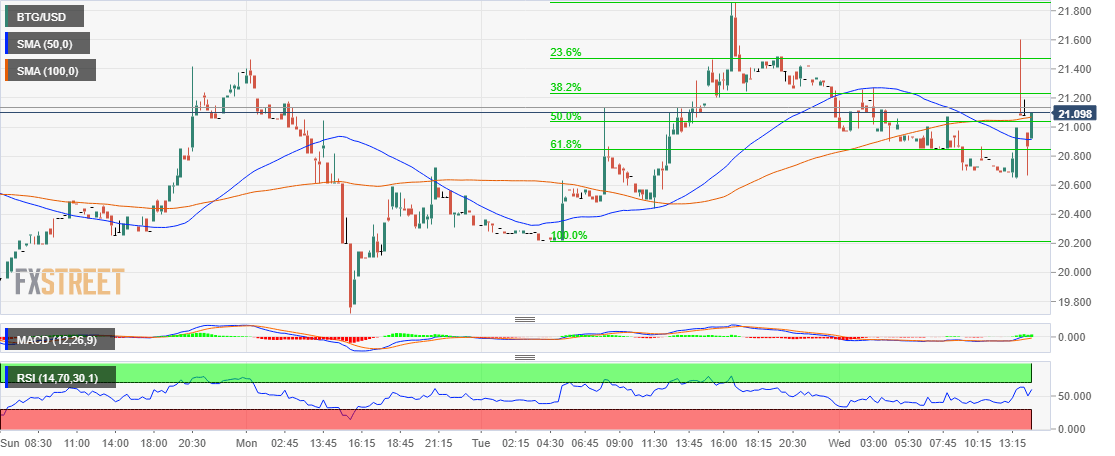

The market is bleeding again in the wake of the bullish spike on Wednesday. Bitcoin Gold resumed the uptrend from the lows traded on Monday this week at $19.7. While there was a break above $20.00, the price remained in a range with the upper limit at $20.8 until yesterday. There was also a slight bearish correction to the swing low at $20.21 before the buyers found their bearing and pushed for upside correction above the moving averages.

Bitcoin Gold retraced even higher above $21.00 and stepped slightly beyond $21.8 before making an about-turn move. The declines continued during both the Asian and European trading hours. Importantly, the buyers have defended the short-term support at $20.60 prevent any swings towards $20.00.

In the interim, BTG/USD is exchanging at $20.98 after making a comeback from the support at $20.60. The hourly 50 simple moving average is providing anchorage but the price has just crossed above the 100SMA resistance. The immediate resistance now lies at $21.0, similarly, there will be significant resistance at the upper supply zone at $21.8.

Looking at BTG/USD chart, upside correction towards $22 are imminent. The technical signals are positive which means that buyers should continue to increase their entries. However, it is essential to note that huge bullish swings are unlikely. A higher support preferably at $21.40 is needed for recoil towards $22.00 to become a reality.

BTG/USD 15-minutes chart