- Bitcoin Gold rebounds 8.17% on Friday after the sudden widespread crypto selloff.

- BTG is the strongest daily gainer following a formidable rebound from the intraday low.

The cryptocurrency market is dealing with the aftermath of the allegations facing Tether (USDT) and Bitfinex following a new filing by the New York Attorney General’s office. The two entities are accused of covering up a shortfall of $850 million in funds to pay for customer withdraws. More on that story:

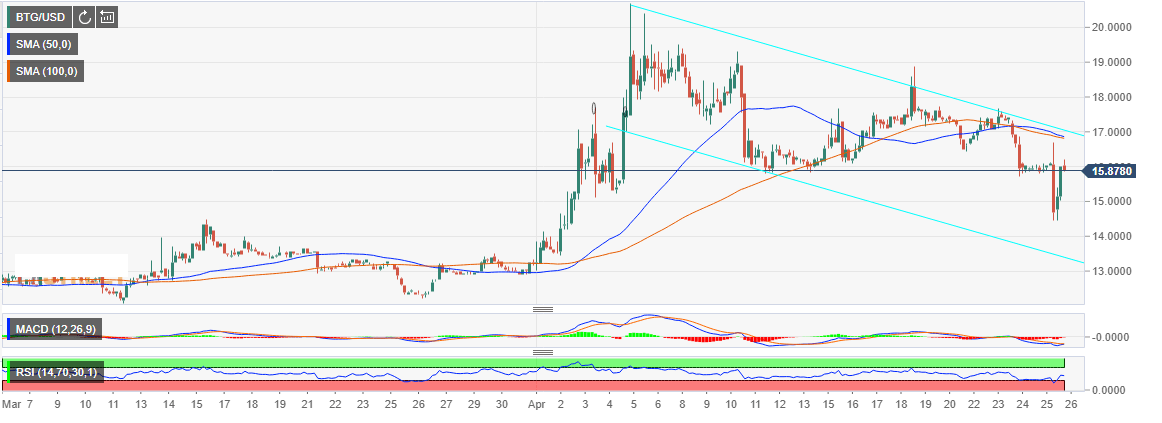

Bitcoin Gold alongside other cryptocurrencies tumbled for the second time this week to record significant losses. BTG/USD was trading below both the 50 simple moving average (SMA) and the 100 SMA, at the time, it was keeping the new balance it had found at $16.00. The widespread declines on Friday pushed Bitcoin Gold below the support, in turn, igniting losses below $15.00 to form a low at $14.48.

In spite of the fall, BTG is the strongest daily gainer following a formidable rebound from the intraday low. The price is battling the resistance at $16.00 while trading at $15.90. The crypto will encounter more hurdles at both the 50 SMA and the 100 SMA. Moreover, for almost three weeks BTG has been trending lower within the descending channel, see chart below. A correction above the channel resistance will pave the way for more retracement to the upside and eventually touch $20.00.

BTG/USD 240 chart